Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

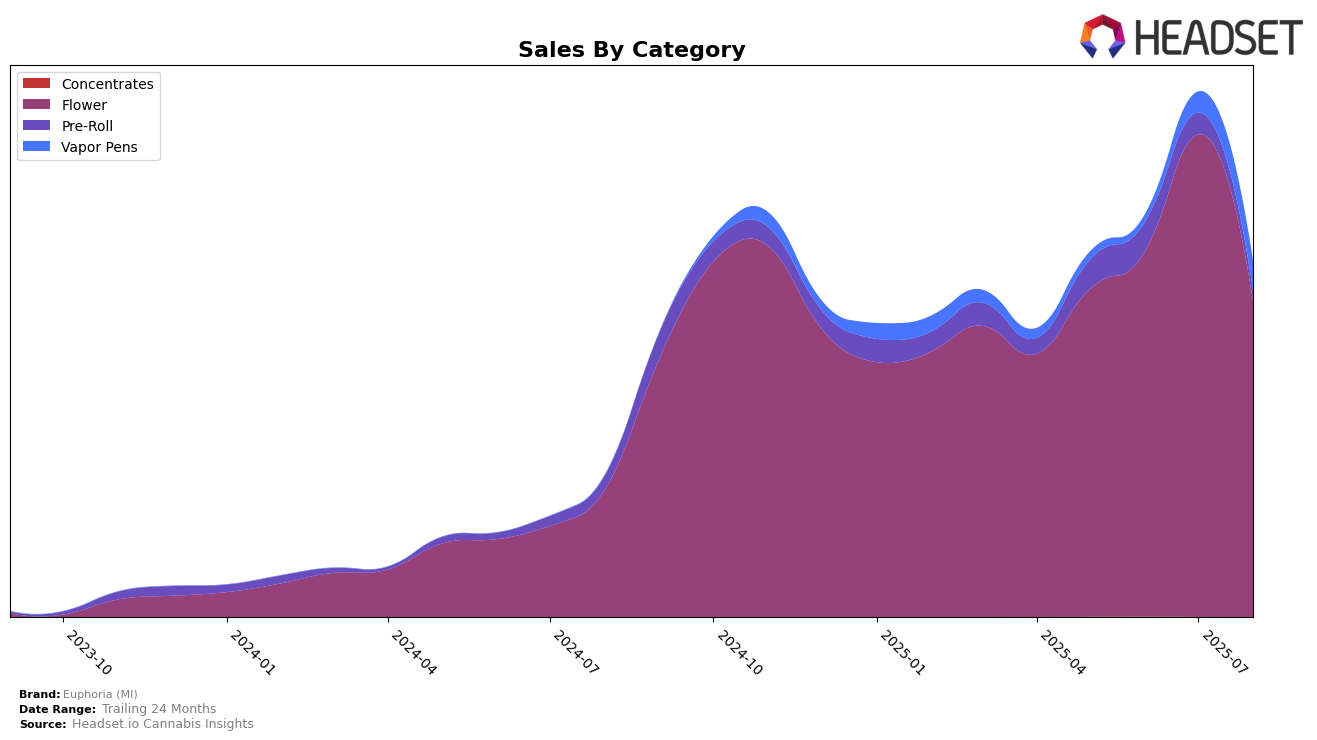

Euphoria (MI) has demonstrated a dynamic performance across various product categories in the state of Michigan. In the Flower category, Euphoria (MI) showed a promising upward trend from May to July 2025, climbing from the 22nd to the 11th position. However, August saw a decline as the brand dropped back to the 23rd rank. This fluctuation suggests a competitive market environment and the need for strategic adjustments to maintain a top-tier position. In the Pre-Roll category, Euphoria (MI) did not manage to break into the top 30 rankings for July and August, indicating potential challenges or shifts in consumer preferences that the brand might need to address.

In the Vapor Pens category, Euphoria (MI) made a notable entry into the top 100 in July 2025, securing the 84th position and improving to 79th in August. This positive movement indicates a growing consumer interest in their vapor pen products, suggesting an opportunity for the brand to capitalize on this upward trajectory. Despite these gains, the absence of top 30 rankings in the Vapor Pens category highlights the competitive nature of the market and the potential for further improvement. The brand's ability to adapt and innovate will be crucial in sustaining and enhancing its market presence across these categories in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Euphoria (MI) has experienced notable fluctuations in its ranking and sales performance over the summer of 2025. In May, Euphoria (MI) was positioned at rank 22, but saw a significant improvement in June, climbing to rank 18. This upward trend continued into July, reaching an impressive rank of 11, indicating a strong competitive stance during this period. However, by August, Euphoria (MI) experienced a decline, dropping to rank 23, which suggests increased competition or market challenges. Notably, Glorious Cannabis Co. maintained a strong presence, consistently ranking in the top 10 for May through July, before also seeing a drop in August. Meanwhile, High Supply / Supply showed a similar pattern to Euphoria (MI), with fluctuating ranks but generally lower sales figures. The emergence of The Fresh Canna in August, jumping from rank 53 to 21, highlights the dynamic nature of the market and the potential for shifts in consumer preferences. These insights suggest that while Euphoria (MI) has demonstrated the ability to capture market share effectively, it faces stiff competition and must strategize to maintain its competitive edge in the Michigan flower market.

Notable Products

In August 2025, the top-performing product for Euphoria (MI) was Georgia Pie (3.5g) in the Flower category, securing the number 1 rank with sales of 4290.0. The 10K Jack Pre-Roll (1g), which had consistently held the top position from May through July, slipped to the second rank. Apples & Bananas (3.5g) climbed to the third position from fifth in July, showing improved sales performance. Bullet Breath (3.5g) entered the rankings in August at the fourth position, while Apricot Scone (3.5g) rounded out the top five. This shift indicates a dynamic change in consumer preferences towards Flower products in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.