Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

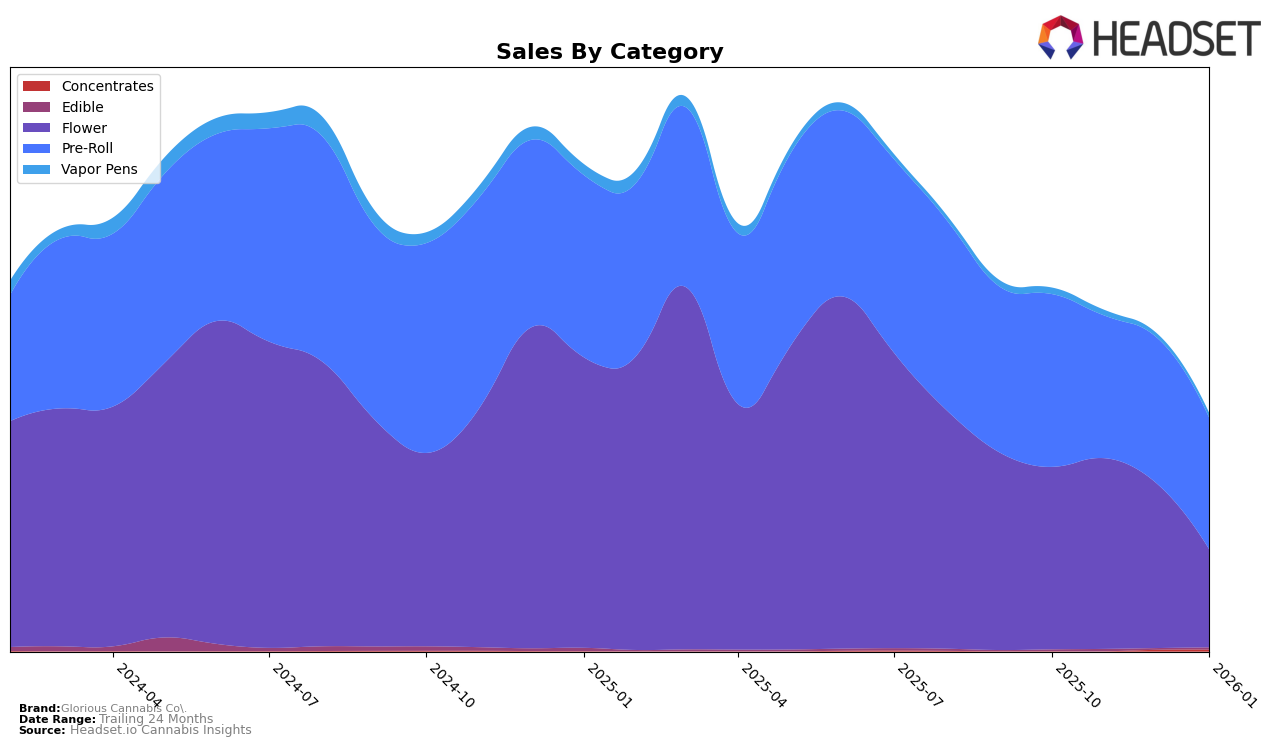

Glorious Cannabis Co. has shown varied performance across different categories and states, with notable movements in their rankings. In the Massachusetts market, the brand's presence in the Flower category has seen a decline, dropping from a rank of 29 in October 2025 to 60 by January 2026, indicating a significant fall out of the top 30, which could be a cause for concern. Conversely, their Pre-Roll category maintained a relatively stable position, consistently ranking within the top 30, ending at rank 21 in January 2026. This suggests a stronger foothold in the Pre-Roll category, despite a slight drop from the previous months.

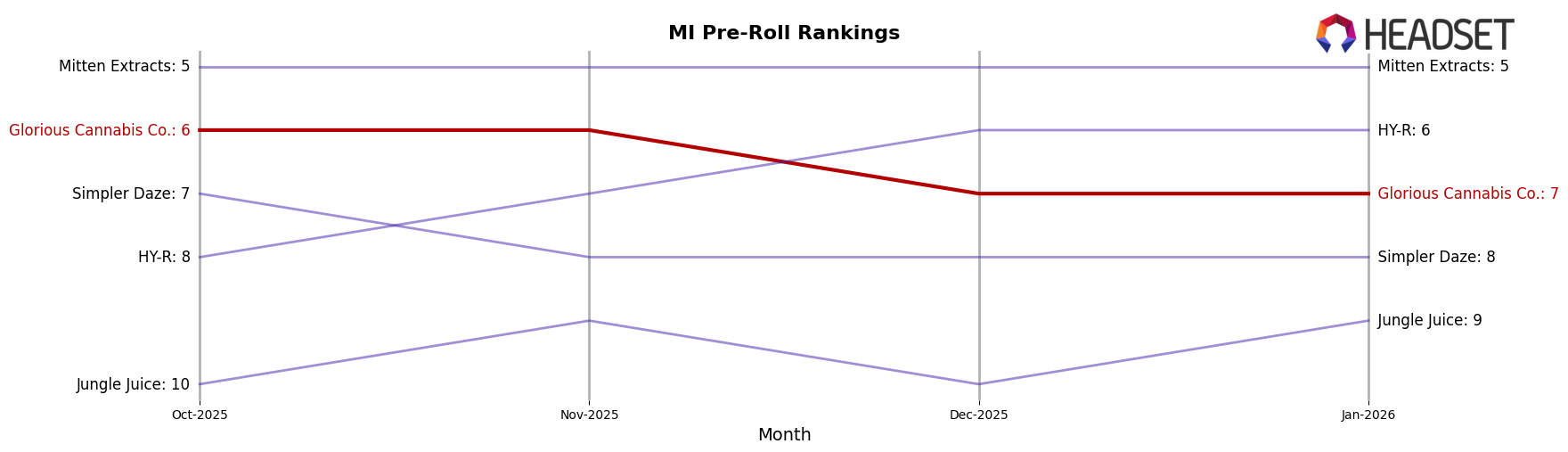

In Michigan, Glorious Cannabis Co. has demonstrated more resilience, particularly in the Pre-Roll category, where they held steady in the top 10, maintaining a rank of 6 in October and November 2025, and only slightly dropping to 7 by January 2026. This stability in Michigan's Pre-Roll market contrasts with their performance in the Flower category, where they experienced a decline from rank 13 in October 2025 to 25 in January 2026. Such a drop indicates a potential shift in consumer preferences or increased competition in the Flower category within Michigan. These movements suggest that while Glorious Cannabis Co. has a strong presence in certain areas, there are fluctuations that could impact their overall market strategy.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll market, Glorious Cannabis Co. has maintained a steady position, ranking 6th in October and November 2025, before slipping to 7th in December 2025 and January 2026. This slight decline in rank coincides with a decrease in sales, suggesting potential challenges in maintaining market share. Notably, Mitten Extracts consistently held the 5th position throughout the same period, indicating a stable and possibly stronger market presence. Meanwhile, HY-R showed a positive trajectory, climbing from 8th in October 2025 to 6th by December 2025, surpassing Glorious Cannabis Co. This upward trend for HY-R could signify increased consumer preference or successful marketing strategies. On the other hand, Simpler Daze and Jungle Juice remained in the lower ranks, with Simpler Daze consistently trailing Glorious Cannabis Co., potentially indicating a less aggressive competitive threat. These dynamics underscore the importance for Glorious Cannabis Co. to innovate and strategize effectively to regain and enhance its market position.

Notable Products

In January 2026, the top-performing product for Glorious Cannabis Co. was Fire Styxx - Unicorn Tears THCA Infused Pre-Roll (1g), which climbed to the first rank with sales of 26,138. Fire Styxx - Grape Escape Infused Pre-Roll (1g) maintained a strong position, ranking second after previously being first in October 2025. New to the top ranks, Fire Styxx - Tigers Breath Infused Pre-Roll (1g) debuted in January 2026 at the third position. Fire Styxx - Blazing Star THCA Infused Pre-Roll (1g) saw a slight drop to fourth after leading in December 2025. Fire Styxx - Rose Rush THCA Infused Pre-Roll (1g) consistently held the fifth position, showing stability in its sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.