Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

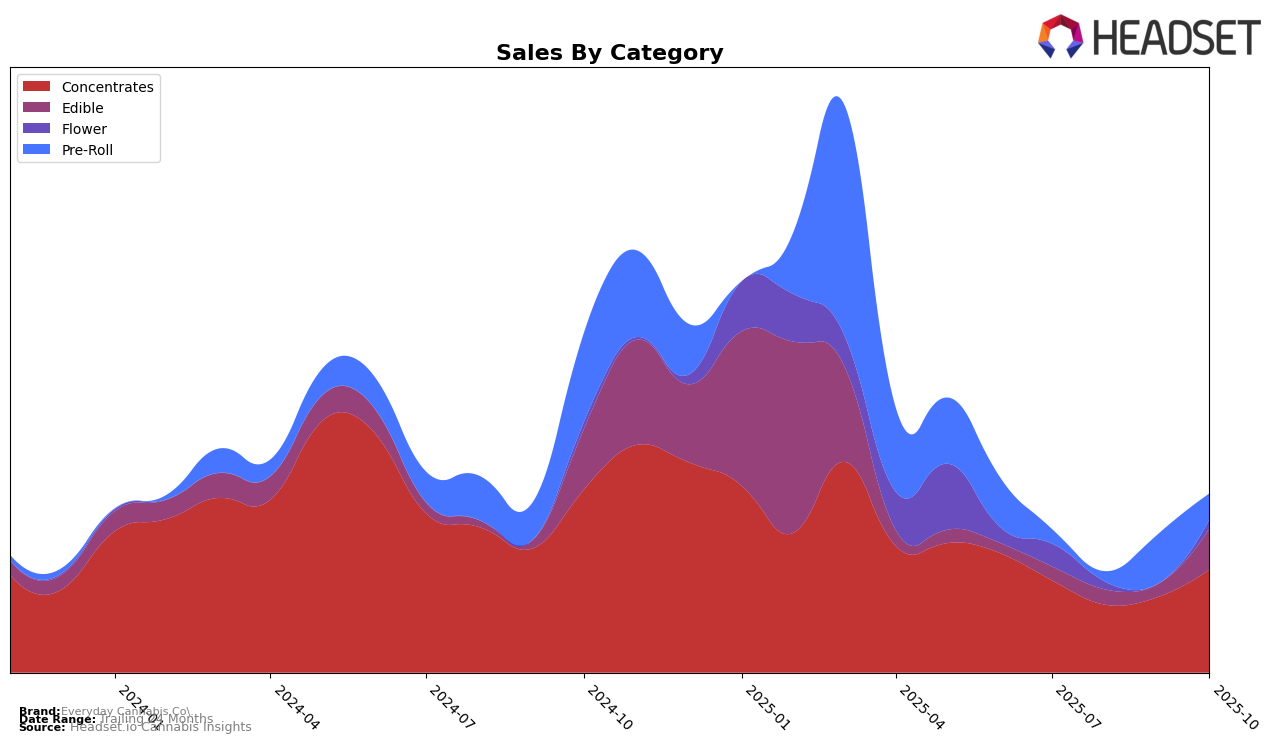

Everyday Cannabis Co. has shown notable performance across different categories and states, particularly in California. In the Concentrates category, the brand was not ranked in the top 30 in July 2025 but managed to climb to the 26th position by October 2025. This upward trend suggests a strengthening presence and possibly an increase in consumer demand or effective marketing strategies. The sales figures for October 2025, which reached $116,430, indicate a significant recovery from the previous months, highlighting a positive trajectory for the brand in this category.

In the Edibles category within California, Everyday Cannabis Co. also improved its standing, jumping from the 65th position in July 2025 to 42nd by October 2025. This improvement suggests that the brand is gaining traction in a competitive market, even though it has not yet broken into the top 30. The October sales figure of $46,541 is particularly noteworthy, reflecting a substantial increase compared to previous months. While the brand is still working to establish a stronger foothold in this category, its progress indicates potential for further growth and increased market share in the near future.

Competitive Landscape

In the competitive landscape of California's concentrates category, Everyday Cannabis Co. has shown a notable upward trend in its ranking, moving from 31st in July 2025 to 26th by October 2025. This improvement in rank is indicative of a positive trajectory in sales performance, particularly when compared to competitors like Cream Of The Crop (COTC), which experienced a decline in sales from August to October 2025. Meanwhile, UP! has also been climbing the ranks, closely trailing Everyday Cannabis Co. by reaching 27th position in October 2025. Despite the competitive pressure from brands like Pistil Whip, which saw a drop from 17th to 25th, Everyday Cannabis Co.'s strategic positioning and sales growth have allowed it to surpass several competitors, indicating a strengthening market presence in California.

Notable Products

In October 2025, Everyday Cannabis Co. saw remarkable sales performance with their Everyday Hitter Sour Blue Raspberry Live Resin Gummy topping the charts as the number one product, achieving sales of 2,301 units. This product ascended from a rank of 5 in July and 3 in August, showing a clear upward trend. The Sour Watermelon Live Resin Gummy also demonstrated impressive growth, climbing to the second position from fourth in September, with significant sales figures. Meanwhile, the Sour Green Apple Live Resin Gummy maintained a steady presence at the third spot, indicating consistent consumer demand. Among concentrates, Everyday Dabs Gastro Pop Sugar Wax debuted at fourth place, showcasing potential for growth in future months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.