Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

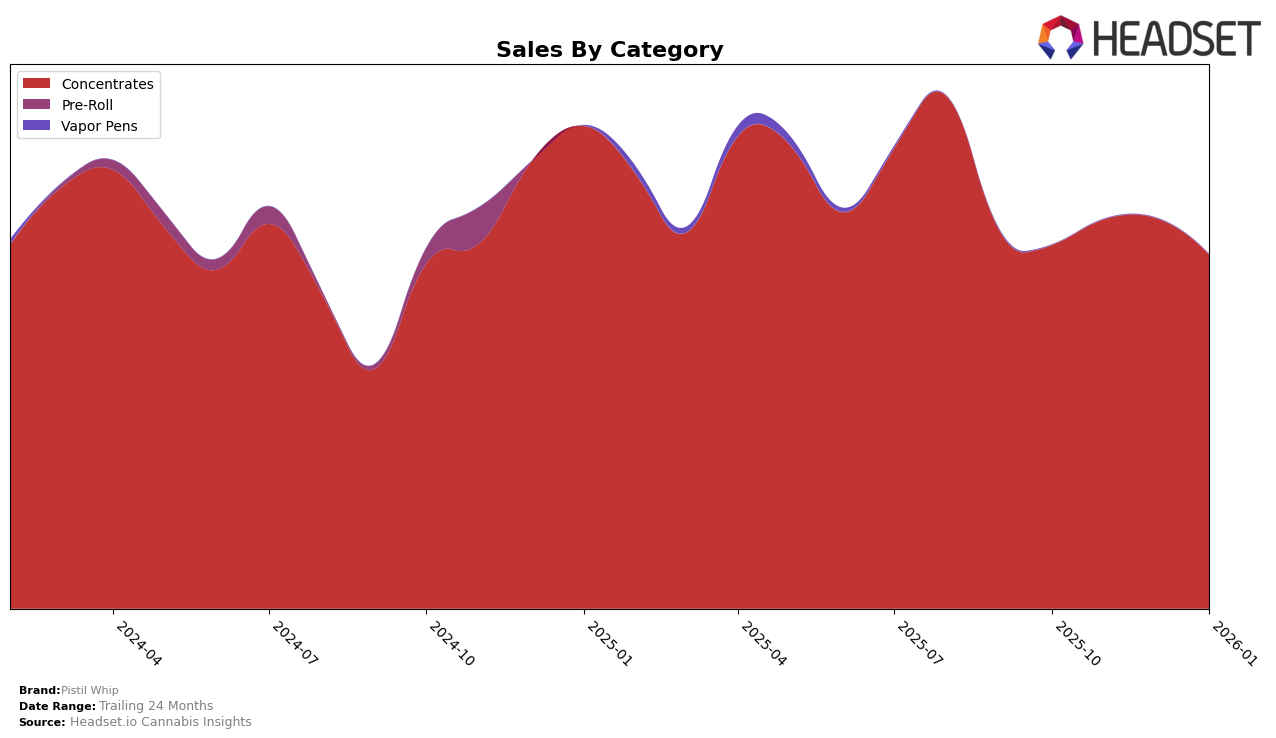

Pistil Whip has demonstrated a dynamic performance in the California concentrates market over the analyzed period. Starting in October 2025, the brand held the 20th position, improving slightly to 18th in November before slipping to 21st and 22nd in December 2025 and January 2026, respectively. Despite the fluctuations in ranking, the brand maintained a relatively stable sales trajectory, with a notable peak in November 2025. This period saw an increase in sales from $162,860 in October to $174,555 in November, indicating a positive reception of their products during this time frame.

While Pistil Whip's presence in the California concentrates category is evident, the brand's absence from the top 30 in other categories and states suggests areas for potential growth and market penetration. The lack of rankings in additional markets could be seen as a limitation in their current distribution or product line diversity, which might be an opportunity for strategic expansion. By focusing efforts on these untapped markets, Pistil Whip could enhance its overall brand visibility and capture a larger share of the cannabis market. This nuanced understanding of their performance provides a foundation for evaluating future strategic directions.

Competitive Landscape

In the competitive landscape of California's concentrates category, Pistil Whip has experienced a dynamic shift in its market positioning from October 2025 to January 2026. Initially ranked 20th in October, Pistil Whip improved to 18th in November, but then experienced a slight decline to 21st in December and 22nd in January. This fluctuation in rank suggests a competitive pressure from brands like Clsics, which consistently maintained a presence within the top 25, peaking at 20th in December before dropping to 24th in January. Meanwhile, Casual Cannabis and Emerald Bay Extracts showed a positive trend by climbing from outside the top 20 to reach 20th and 21st respectively by January, indicating a potential threat to Pistil Whip's market share. Despite these challenges, Pistil Whip's sales figures remained robust, suggesting a loyal customer base that could be leveraged for future growth amidst the competitive pressures.

Notable Products

In January 2026, Pistil Whip's top-performing product was Golden Papaya Live Rosin Badder (1g), leading the sales with a notable figure of 398 units. Following closely was GMO Live Rosin Badder (1g) in the second position. The Papaya x Strawguava #6 Live Rosin Badder (1g) secured the third spot, showing a slight decline from its second place in December 2025. Original Z Live Rosin Badder (1g) ranked fourth, while Sour Garlic Cookies BX #1 Live Rosin Badder (1g) dropped to fifth from its previous top position in December. These changes highlight a dynamic shift in consumer preferences within Pistil Whip's Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.