Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

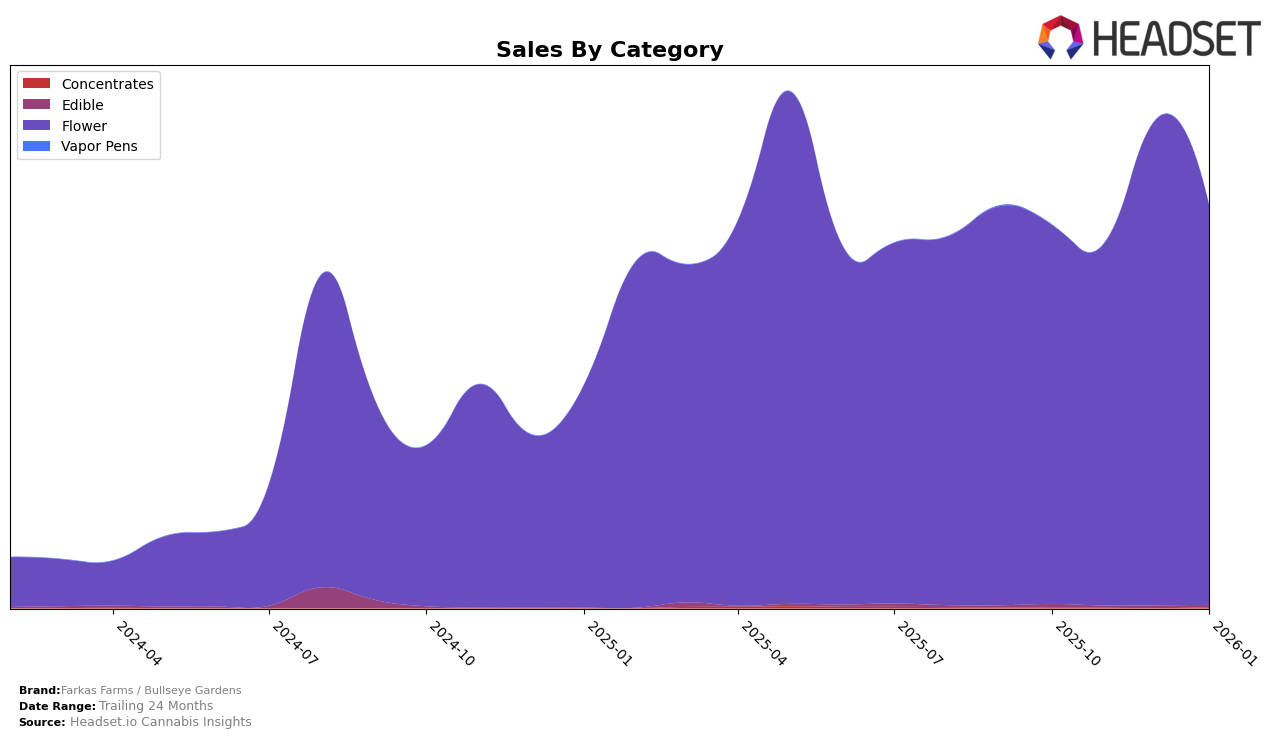

In the state of Ohio, Farkas Farms / Bullseye Gardens has shown a notable presence in the Flower category. Over the months from October 2025 to January 2026, the brand demonstrated a fluctuating yet competitive performance, maintaining a top 10 position consistently. The most significant movement was observed in December 2025, when the brand climbed to the 6th position, indicating a strong surge in sales momentum. However, by January 2026, the brand experienced a slight decline, settling back at the 10th position. This pattern suggests a dynamic market response, possibly driven by seasonal demands or strategic marketing efforts during the holiday period.

Despite this performance in Ohio, it's important to note that Farkas Farms / Bullseye Gardens did not appear in the top 30 rankings in other states or categories during this period. This absence highlights a potential area for growth and expansion for the brand beyond its current stronghold in Ohio's Flower category. The data suggests that while the brand is performing well locally, there might be opportunities to explore and penetrate other markets or categories to diversify their reach and strengthen their overall market position. The sales figures, particularly the peak in December, underscore the brand's capability to capitalize on high-demand periods, a strategy that could be leveraged in other regions as well.

Competitive Landscape

In the competitive landscape of the Flower category in Ohio, Farkas Farms / Bullseye Gardens has shown notable fluctuations in its market position over the past few months. Starting from October 2025, Farkas Farms / Bullseye Gardens ranked 10th, improved to 9th in November, peaked at 6th in December, but then dropped back to 10th in January 2026. This volatility contrasts with brands like Savvy, which steadily climbed from 14th to 9th, and Buckeye Relief, which maintained a relatively stable position around the 11th and 12th ranks. Meanwhile, Butterfly Effect - Grow Ohio experienced a decline from 7th to 11th, and King City Gardens showed a similar pattern of fluctuation, ending at 8th. These dynamics suggest that while Farkas Farms / Bullseye Gardens experienced a temporary surge in sales and rank during December, sustaining such performance remains a challenge amidst strong competition, highlighting the need for strategic adjustments to maintain a competitive edge.

Notable Products

In January 2026, the top-performing product from Farkas Farms / Bullseye Gardens was Pineapple Sherb (2.83g) in the Flower category, maintaining its first-place ranking from December 2025 with sales of 3,654 units. Kings Fire (2.83g), also in the Flower category, secured the second spot, despite not having prior rankings in previous months. Life Hack (2.83g) improved significantly, climbing to third place from its previous fifth position in October 2025. Rainbow OG (2.83g) debuted in the rankings at fourth place. Problem Child (2.83g) dropped slightly to fifth place from its fourth position in November 2025, indicating a slight decrease in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.