Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

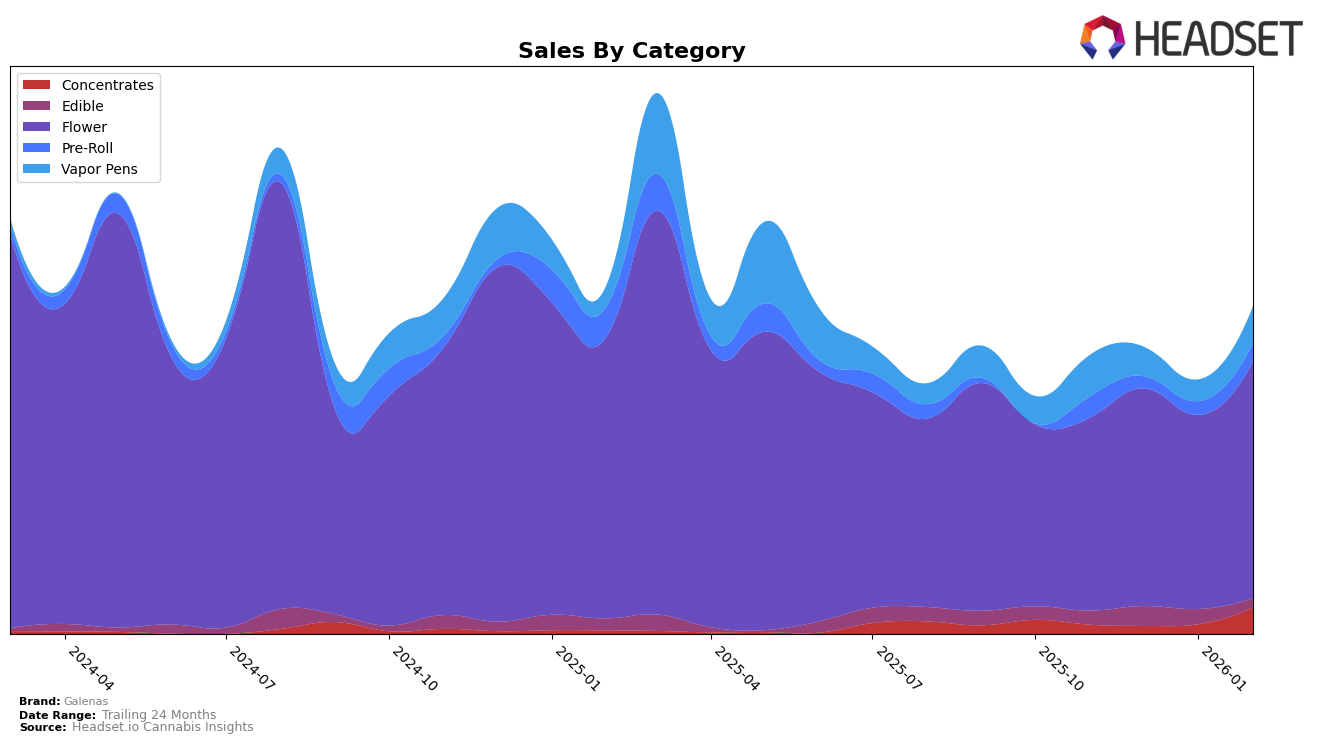

In Michigan, Galenas has shown a notable improvement in the Concentrates category, moving from outside the top 30 to rank 47th by February 2026. This upward trajectory suggests a strengthening presence in the market, although they still have room to grow to break into the top tier. Meanwhile, in the Vapor Pens category, Galenas was not ranked in the top 30, indicating either a nascent presence or a need for strategic adjustments to increase their competitiveness in this segment.

In Ohio, Galenas has maintained a consistent performance in the Edible category, though their rank slightly dipped to 43rd in February 2026. This suggests a stable but challenging market environment. The Flower category, however, presents a more dynamic picture, with Galenas climbing to 20th place, indicating a strong market position and potential for further growth. Conversely, the Vapor Pens category shows a downtrend, with Galenas dropping from 44th to 56th, highlighting an area that may require strategic realignment to regain market share.

Competitive Landscape

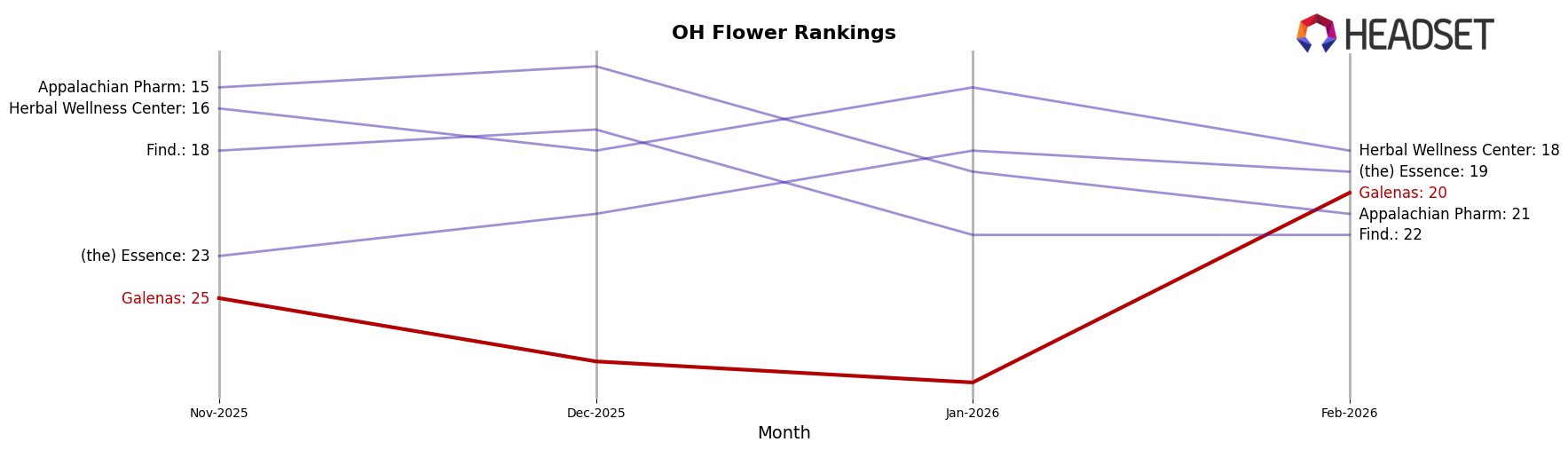

In the competitive landscape of the Flower category in Ohio, Galenas has shown a notable improvement in its rank, climbing from 29th in January 2026 to 20th by February 2026. This upward trajectory is significant, especially when compared to competitors like Find., which experienced a slight decline, dropping from 17th in December 2025 to 22nd in February 2026. Similarly, Appalachian Pharm and Herbal Wellness Center also saw a decrease in their rankings during this period, indicating a potential shift in consumer preference towards Galenas. Despite (the) Essence maintaining a relatively stable position, Galenas' sales surged in February 2026, suggesting a strong market response to its offerings. This trend highlights Galenas' growing influence and potential to capture a larger market share in the Ohio Flower category.

Notable Products

In February 2026, Dual OG (2.83g) from Galenas maintained its top position in the Flower category, achieving the highest sales with a notable figure of 2328. First Brunch (2.83g) rose to the second position in the same category, marking its first appearance in the rankings. Billy Ocean Pre-Roll (1g) secured the third spot in the Pre-Roll category, consistent with its previous performance in November 2025. Blueberry Cookies Distillate Cartridge (1g) and Billy Ocean Distillate Cartridge (1g) ranked fourth and fifth, respectively, in the Vapor Pens category, indicating strong sales for Galenas' vapor products. The stability and rise in rankings for these products highlight a growing consumer preference for Galenas' offerings in February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.