Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

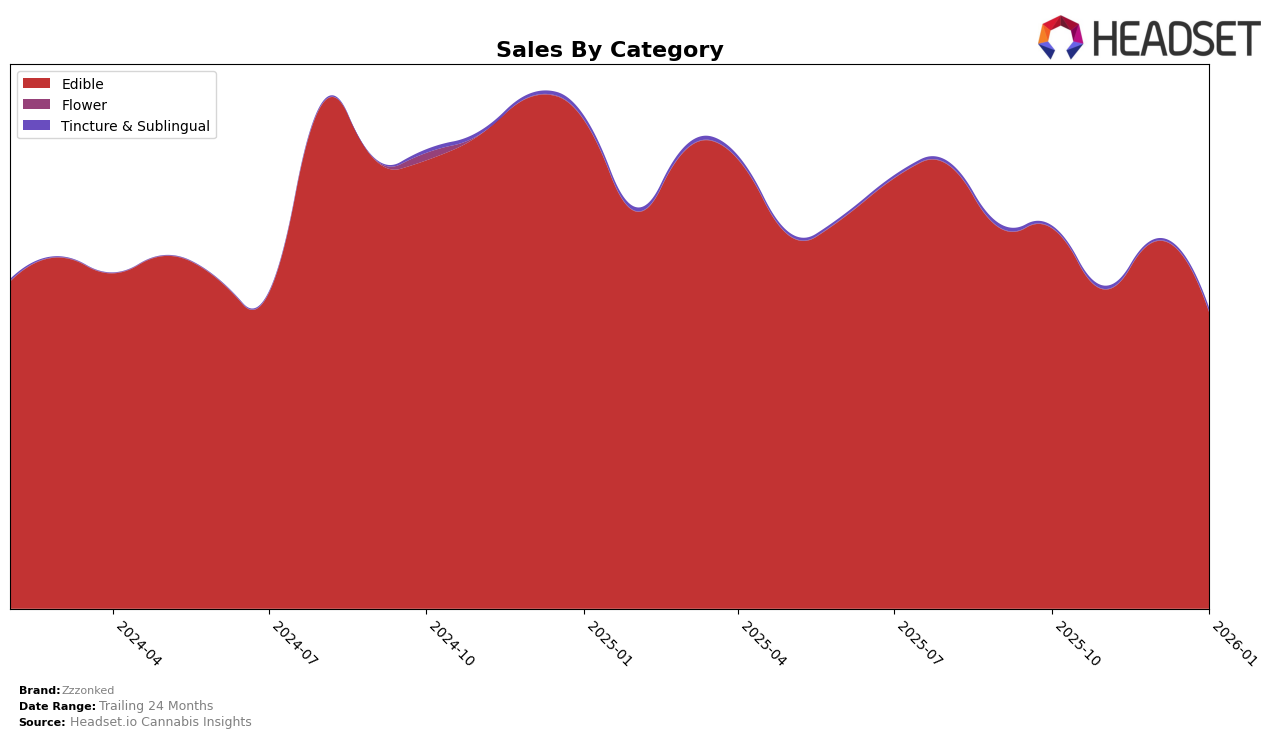

In the Massachusetts market, Zzzonked has maintained a stable presence in the Edible category over the past few months. Despite a dip in sales from October to November, the brand managed to regain its footing in December, maintaining a consistent 10th place ranking through January 2026. This consistency in ranking indicates a strong brand loyalty or effective market strategy that keeps Zzzonked within the top 10 in Massachusetts, despite fluctuations in sales figures. The ability to hold a steady position in a competitive market like Massachusetts is noteworthy and suggests a solid consumer base.

Conversely, the performance of Zzzonked in New Jersey presents a different narrative. The brand's ranking in the Edible category has shown a downward trend, slipping from 18th to 24th place by January 2026. This drop is coupled with a significant decrease in sales, particularly from December to January, which could be indicative of increased competition or changing consumer preferences in the state. The absence from the top 30 in future months could pose a challenge for Zzzonked, highlighting the need for strategic adjustments to regain its standing in New Jersey's market.

Competitive Landscape

In the Massachusetts edible market, Zzzonked has experienced notable fluctuations in its ranking and sales over the past few months. Initially ranked 9th in October 2025, Zzzonked saw a decline to 11th place in November, before recovering slightly to 10th place by December and maintaining that position into January 2026. This volatility contrasts with the steady performance of competitors like In House, which consistently held the 8th rank throughout the same period, and Incredibles, which improved from 10th to 9th place. Despite these challenges, Zzzonked's sales figures reveal a resilient brand, with a notable rebound in December. However, the brand faces pressure from Good News, which closely trails Zzzonked's rank and sales. The competitive landscape indicates that while Zzzonked has the potential to regain and improve its standing, strategic adjustments may be necessary to sustain growth against consistently performing rivals.

Notable Products

In January 2026, the top-performing product from Zzzonked was the CBD/THC/CBN 1:1:1 Strawberry Slumber Gummies 20-Pack, maintaining its leading position from December 2025 with sales of 5640 units. The CBD/THC/CBN 1:1:1 Sleepy Mixed Berry Gummies 20-Pack, which was the top product in December, ranked second this month. The CBD/THC/CBN 1:1:1 Sleepy Pineapple Dreams Gummies 20-Pack held steady in third place, consistent with its December ranking. The CBD/THC/CBN 1:1:1 Tutti Frutti Sleepy Gummies 20-Pack and the CBD/THC/CBN Sleepy Tincture both maintained their fourth and fifth positions respectively, unchanged from the previous months. Notably, the Strawberry Slumber Gummies showed a slight decrease in sales compared to December, yet still retained the top spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.