Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

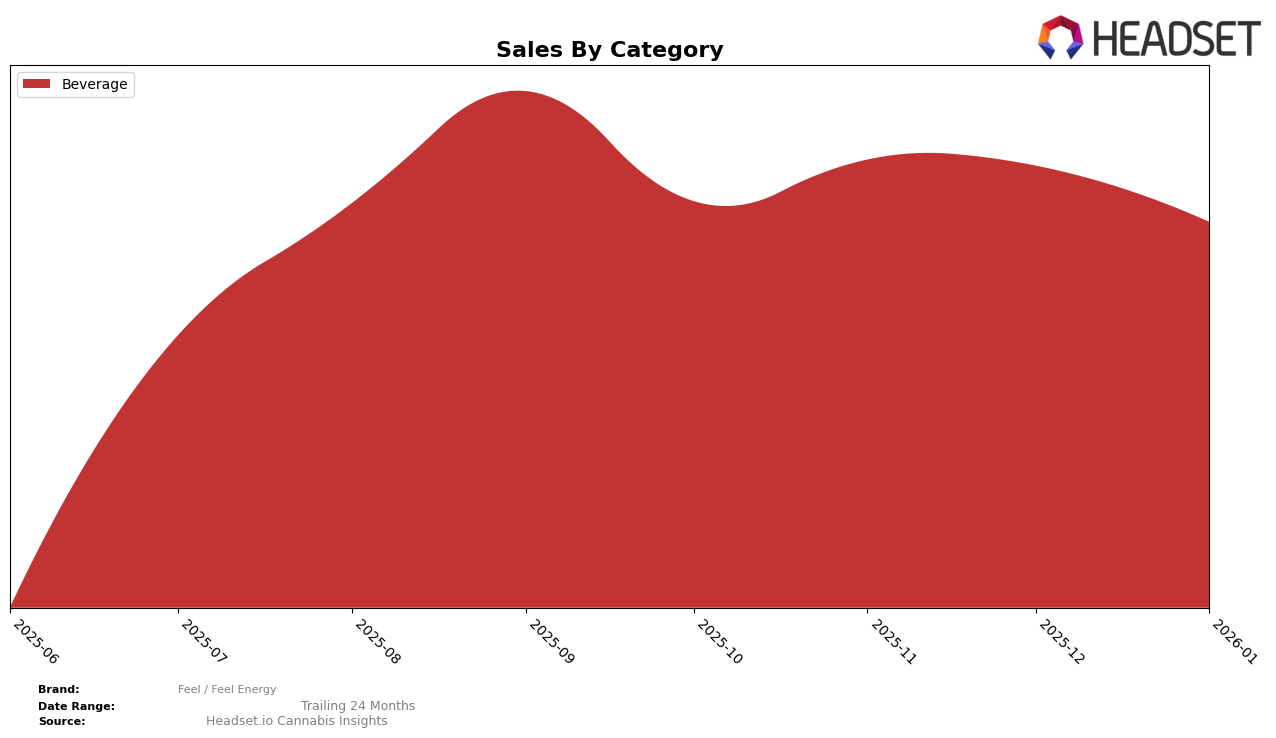

Feel / Feel Energy has shown a consistent presence in the Beverage category in Michigan, maintaining a stable ranking at 12th place from November 2025 through January 2026. This stability indicates a strong foothold in the market, even though there was a slight dip in sales from December 2025 to January 2026. Despite this minor decrease, the brand's ability to hold its ranking suggests a loyal customer base and effective market strategies that keep them competitive among the top players in the state.

It is noteworthy that Feel / Feel Energy did not appear in the top 30 rankings for any other states or provinces, highlighting a potential area for growth or a strategic focus on Michigan. The absence from other markets might be seen as a limitation or a deliberate choice to concentrate resources and efforts in a single state. This approach could either be a stepping stone for future expansion or a signal of challenges in penetrating other regions. As the brand continues to navigate the competitive landscape, monitoring its performance in Michigan could provide insights into its broader market strategies and potential areas for growth.

Competitive Landscape

In the competitive landscape of the Michigan beverage category, Feel / Feel Energy has maintained a consistent presence, holding the 12th rank from November 2025 through January 2026. This stability in rank, however, contrasts with the dynamic movements of its competitors. For instance, The Best Dirty Lemonade improved its position from 12th in October 2025 to 10th by January 2026, indicating a positive trend in consumer preference or marketing effectiveness. Meanwhile, Northern Connections experienced a decline from 8th in October 2025 to 11th by January 2026, which could suggest challenges in maintaining its earlier momentum. Despite these shifts, Feel / Feel Energy's sales figures have seen slight fluctuations, with a notable dip in January 2026, potentially signaling the need for strategic adjustments to enhance its market position and compete more effectively with brands like Sweet Justice, which showed a positive sales trend from December 2025 to January 2026. Overall, while Feel / Feel Energy remains a steady player, the evolving competitive dynamics highlight opportunities for growth and differentiation in the Michigan beverage market.

Notable Products

In January 2026, the top-performing product for Feel / Feel Energy was the Wildberry Pomegranate Seltzer in the Beverage category, maintaining its number one rank from December 2025 with sales of 2088 units. The Dragonfruit Lime Seltzer ranked second, showing a positive shift from its third place in December 2025, despite a slight decrease in sales from its peak in November. The Mango Passionfruit Seltzer held steady in third place, although its sales saw a decline compared to the previous month. The THC/Caffeine 1:3 Mango Passionfruit remained consistent in fourth place over the past four months, with sales figures showing modest fluctuations. Overall, the rankings indicate stable performance for Feel / Feel Energy's top products, with Wildberry Pomegranate Seltzer consistently leading the pack.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.