Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

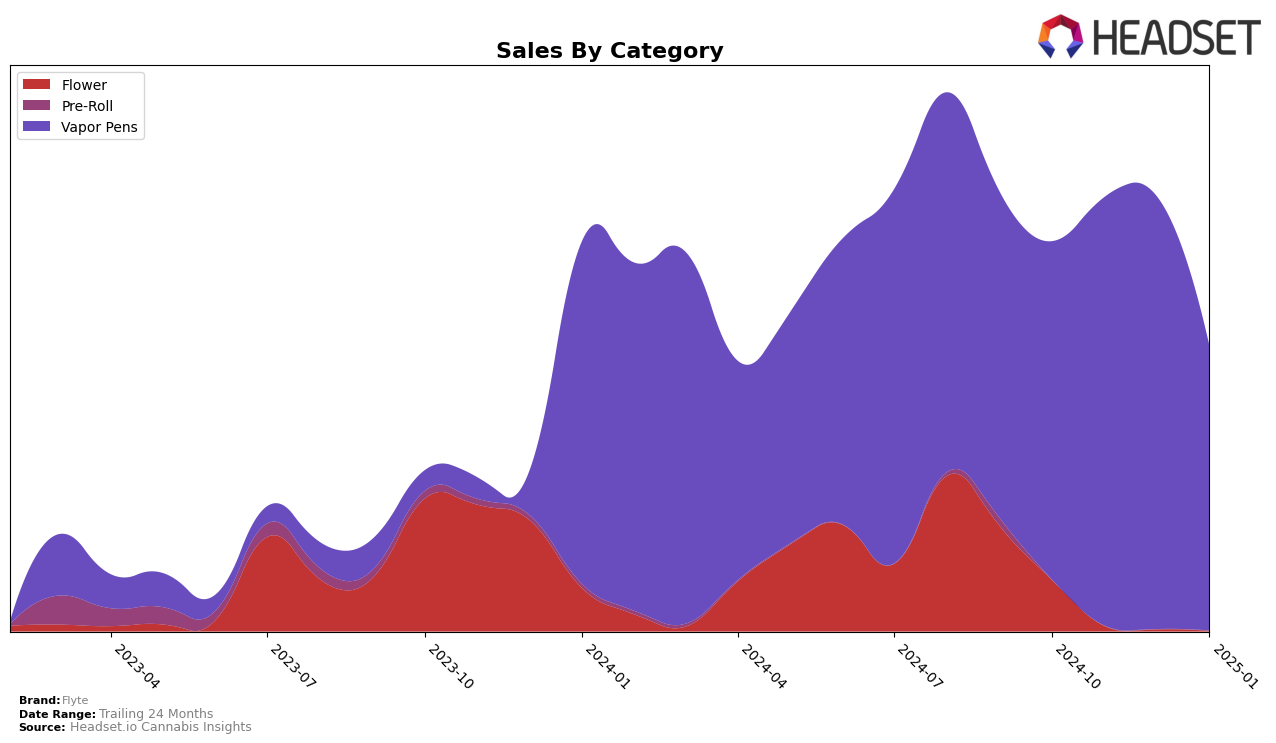

In the realm of vapor pens, Flyte has demonstrated a consistent presence in British Columbia, maintaining a position within the top 30 brands from October 2024 to January 2025. Their ranking fluctuated slightly, moving from 27th to 29th place, with a noteworthy peak in sales during November and December 2024. This indicates a solid foothold in the market, although the slight dip in January might suggest seasonal influences or increased competition. Conversely, Flyte's absence from the top 30 rankings in Ontario highlights a stark contrast, where they failed to make a significant impact in the vapor pen category during the same period.

While Flyte's performance in British Columbia suggests a stable, albeit modest, market presence, their struggles in Ontario indicate potential challenges in penetrating larger markets or facing stiffer competition. The sales data from British Columbia reflects a positive trend with a noticeable increase during the last quarter of 2024, which could be attributed to strategic marketing efforts or consumer preference shifts. However, the lack of presence in Ontario's top 30 rankings suggests that Flyte may need to reassess its strategies or product offerings to better capture the market share in this province. This dichotomy between regions underscores the importance of tailored approaches to different markets within the cannabis industry.

Competitive Landscape

In the competitive landscape of vapor pens in British Columbia, Flyte has maintained a relatively stable position, albeit outside the top 20 brands, with ranks fluctuating slightly from 27th in October 2024 to 29th in January 2025. Despite this, Flyte's sales saw a notable increase in November and December 2024, peaking at 132,691 units before a decline in January 2025. In contrast, Uncle Bob showed a more dynamic performance, climbing from 31st in October to 25th in December, with a corresponding sales increase, indicating a growing consumer preference. Meanwhile, Slerp demonstrated volatility, achieving a peak rank of 23rd in November but dropping to 27th by January, reflecting fluctuating sales figures. Carmel re-entered the rankings in December at 30th, suggesting potential for growth, while Juicy Hoots struggled with lower ranks and sales, indicating challenges in maintaining market share. These dynamics suggest that while Flyte has a consistent presence, it faces strong competition from brands like Uncle Bob and Slerp, which are experiencing more significant shifts in consumer demand and market positioning.

Notable Products

In January 2025, Flyte's top-performing product was Whata Melon Distillate Disposable (0.5g) in the Vapor Pens category, maintaining its rank at number one since November 2024, with sales of 1546 units. Smashin Passion Distillate Disposable (0.5g) also held steady at the second position across multiple months, showing consistent demand. Bella Berry Distillate Disposable (0.5g) remained in third place from December 2024, despite a notable decline in sales figures. Watermelon Distillate Disposable (0.5g) consistently ranked fourth since its introduction in November 2024. Lastly, Candy Fumez (1g) in the Flower category persisted at the fifth rank from November 2024, albeit with modest sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.