Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

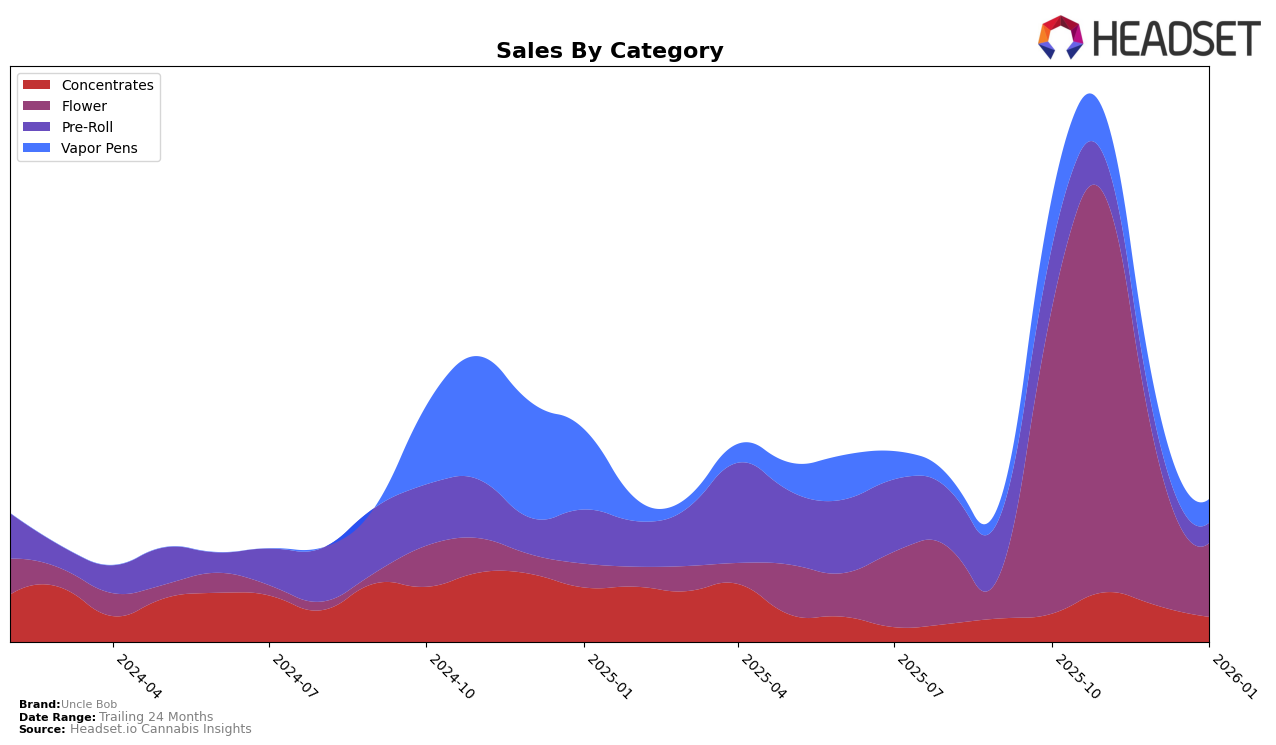

In the province of British Columbia, Uncle Bob has shown varied performance across different cannabis categories. Within the Concentrates category, the brand maintained a presence within the top 30, although it experienced a slight decline from 15th in November 2025 to 21st by January 2026. Despite this fluctuation, the sales figures for November were notably higher, suggesting a peak in consumer interest during that month. In contrast, the Flower category saw a more significant drop, with Uncle Bob falling from 6th place in October to outside the top 30 by January. This decline indicates a potential shift in consumer preferences or increased competition within the Flower segment.

Meanwhile, Uncle Bob's performance in Pre-Rolls and Vapor Pens in British Columbia highlights further challenges. The brand did not rank in the top 30 for Pre-Rolls in December and January, suggesting it struggled to capture market share in this category. Vapor Pens also saw a consistent decline in ranking, moving from 35th in October to 61st in January. This downward trend in Vapor Pens could reflect broader market dynamics or perhaps a need for Uncle Bob to innovate or adjust its product offerings to better meet consumer demands. Overall, these shifts across categories point to a competitive landscape where Uncle Bob may need to strategize to regain its footing.

Competitive Landscape

In the competitive landscape of the Flower category in British Columbia, Uncle Bob has experienced significant fluctuations in rank and sales from October 2025 to January 2026. Initially, Uncle Bob held a strong position at rank 6 in October 2025, but it saw a steady decline, dropping to rank 48 by January 2026. This downward trend in rank coincides with a notable decrease in sales, from a peak in November 2025 to a substantial drop by January 2026. In contrast, competitors like Color Cannabis have shown a positive trajectory, improving their rank from 65 in October to 43 in January, with sales consistently increasing over the same period. Similarly, 7 Acres and Tenzo have also demonstrated upward trends in both rank and sales, suggesting a shift in consumer preference within the market. This competitive pressure highlights the need for Uncle Bob to reassess its market strategies to regain its former standing in the Flower category in British Columbia.

Notable Products

In January 2026, Uncle Bob's top-performing product was the Day Trippin Pre-Roll (0.5g), maintaining its number one rank for three consecutive months with a notable sales figure of 2489 units. Following closely, Devil's Lettuce Pre-Roll (0.5g) held the second position, consistent with its rank from the previous month. Indica Shatter (1g) showed a significant improvement, climbing to the third position from fifth in December 2025. Sativa Shatter (1g) entered the rankings for the first time, securing the fourth spot. Meanwhile, Green Zkittles THC Distillate Cartridge (1g) dropped to fifth place from its third position in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.