Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

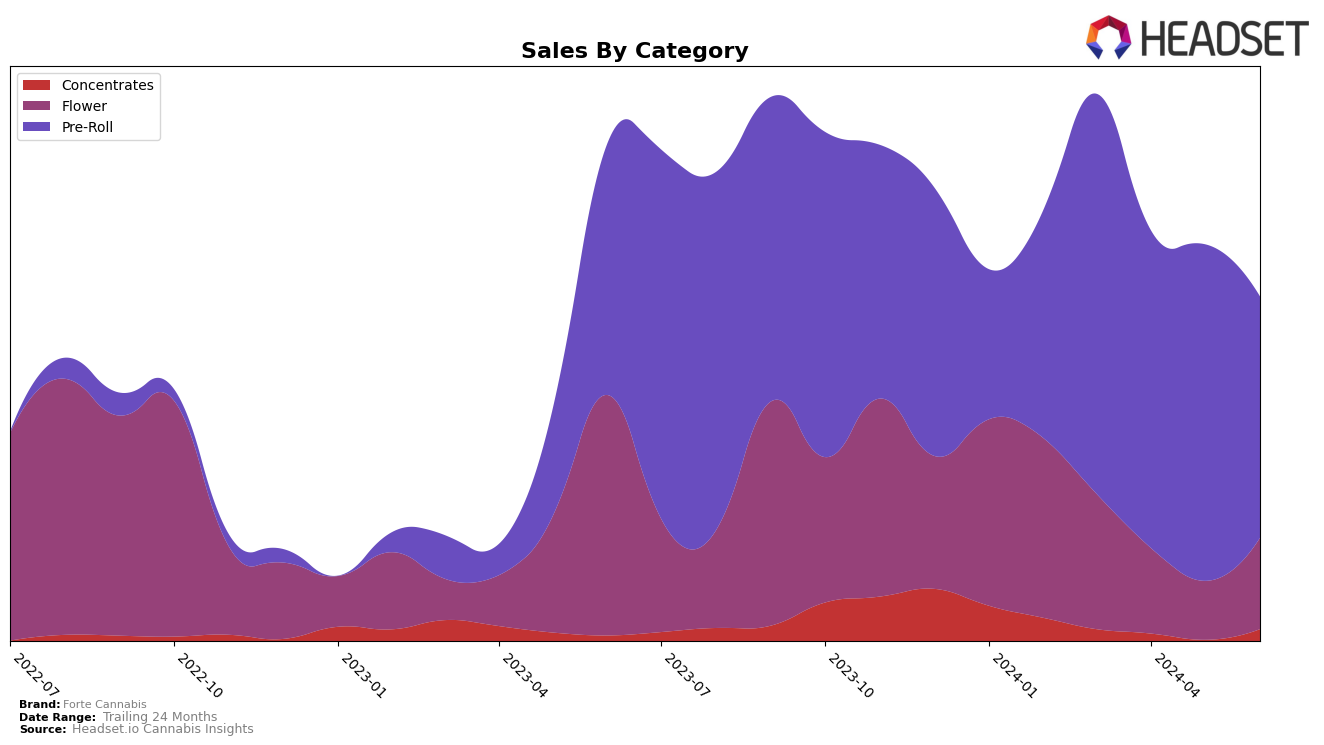

Forte Cannabis has shown a varied performance across different states and categories over the past few months. In the Pre-Roll category within Michigan, the brand's ranking has seen a downward trend. Starting at 16th place in March 2024, Forte Cannabis dropped to 24th in April, 25th in May, and further down to 28th in June. This decline indicates a potential loss of market share or increased competition within the state. Notably, the sales figures also reflect this downward trajectory, with a significant dip from $482,060 in March to $292,789 by June. This suggests that while Forte Cannabis remains within the top 30 brands, its position is becoming increasingly precarious in Michigan's Pre-Roll market.

Interestingly, the absence of Forte Cannabis in the top 30 rankings for other categories or states might be a point of concern. This could imply that the brand is either not performing well enough to break into the upper echelons of other markets or is focusing its efforts predominantly on the Michigan Pre-Roll segment. The lack of presence in other states or categories might be seen as a missed opportunity for growth and diversification. For stakeholders and potential investors, understanding the factors behind this limited presence and addressing them could be crucial for future strategic planning and expansion.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Forte Cannabis has experienced notable fluctuations in its ranking and sales over recent months. Starting at a strong 16th position in March 2024, Forte Cannabis saw a decline to 24th in April and 25th in May, before dropping further to 28th in June. This downward trend in rank correlates with a decrease in sales from $482,060 in March to $292,789 in June. In contrast, Grown Rogue showed a resurgence, climbing from 41st in May to 27th in June, indicating a potential shift in consumer preference. Similarly, Muha Meds improved its rank from 37th in March to 23rd in May, although it slightly dipped to 29th in June. Meanwhile, Traphouse Cannabis Co. maintained a relatively stable position, fluctuating between 28th and 34th. Notably, Simply Herb entered the top 20 in June, securing the 26th spot, which could signal emerging competition. These dynamics suggest that while Forte Cannabis has a strong presence, it faces significant competition from brands that are either stabilizing or improving their market positions.

Notable Products

In June 2024, the top-performing product from Forte Cannabis was Crunch Berries (Bulk) in the Flower category, achieving the number one rank with sales of $8,221. E85 (Bulk), also in the Flower category, secured the second position. Mango Haze Bubble Hash Infused Pre-Roll 3-Pack (1.5g) ranked third, followed by Jungle Juice Bubble Hash Infused Pre-Roll 3-Pack (1.5g) in fourth place. Sour Runtz (Bulk) saw a significant drop, moving from the top position in May to fifth in June. This shift indicates a notable change in consumer preference towards Crunch Berries (Bulk) and E85 (Bulk) over the past month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.