Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

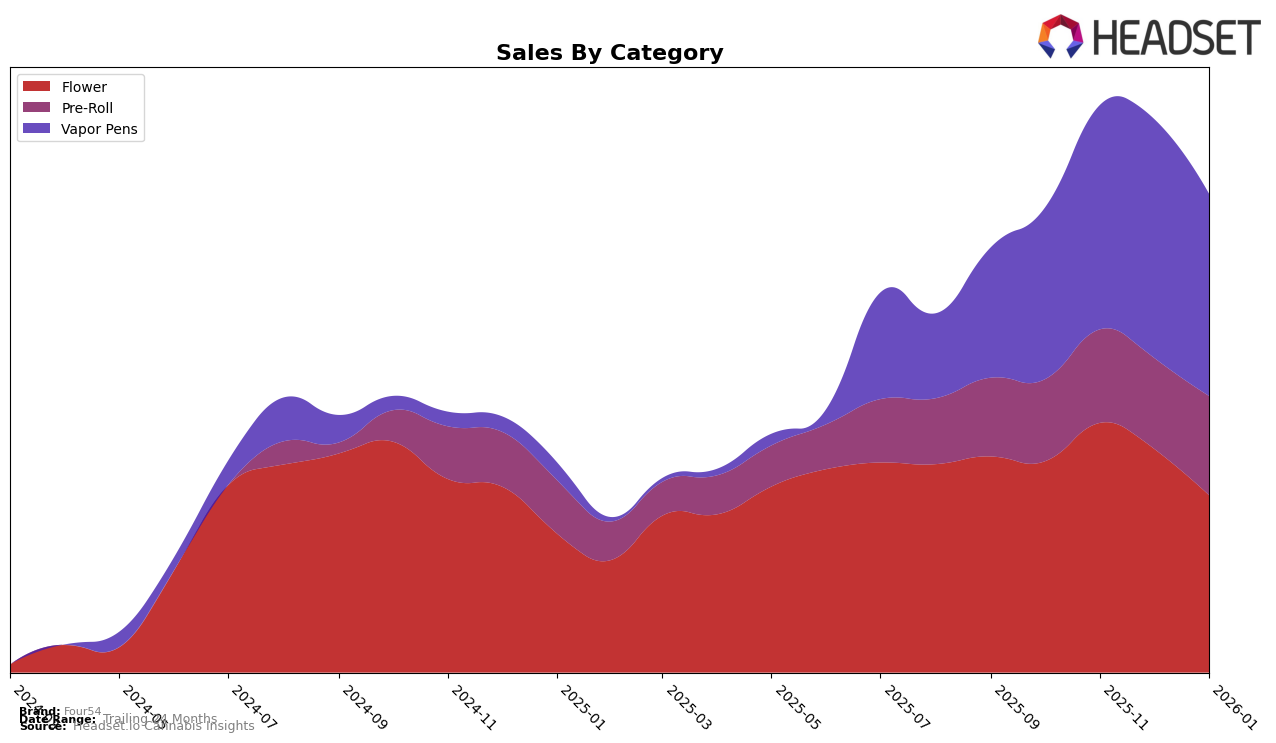

Four54 has demonstrated varied performance across different categories and provinces, with notable movements in rankings and sales. In Alberta, the brand's presence in the Flower category has seen a steady improvement, moving from a rank of 65 in October 2025 to 52 by January 2026. This upward trend indicates a strengthening position within the market. However, the Pre-Roll category presents a different story, where Four54 was not ranked in the top 30 until January 2026, where it entered at rank 79. This suggests that while there is some traction, the brand still faces challenges in establishing a strong foothold in this category. Conversely, in the Vapor Pens category, Four54 has maintained a consistent presence within the top 30, showing resilience and stability in its market position.

In Ontario, Four54's performance in the Flower category has seen a decline, with rankings slipping from 56 in October 2025 to 69 by January 2026. This downward movement is accompanied by a decrease in sales, possibly indicating increased competition or shifts in consumer preferences. The Vapor Pens category tells a slightly different tale, where the brand has shown some improvement, moving up from rank 74 in October 2025 to 68 by January 2026. This suggests that while Four54 faces challenges in maintaining its position in some categories, there are areas where the brand is gaining traction and could potentially leverage for future growth.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, Four54 has demonstrated notable fluctuations in its market position over recent months. In October 2025, Four54 was ranked 28th, but it climbed to 21st in November, showing a significant improvement in its competitive standing. However, by December 2025 and January 2026, Four54's rank slightly declined to 26th, indicating a need for strategic adjustments to maintain its upward momentum. Despite these rank changes, Four54's sales figures have shown a positive trend, with a substantial increase from October to December 2025, before a slight dip in January 2026. In comparison, Bold maintained a relatively stable presence, consistently ranking around the 23rd to 25th positions, while LITTI experienced a similar sales trajectory but managed to rank higher than Four54 in December. Meanwhile, Redecan and Versus did not make it into the top 20 during this period, highlighting Four54's competitive edge in maintaining a stronger market presence. This analysis underscores the dynamic nature of the vapor pen market in Alberta and the importance for Four54 to leverage its sales momentum to regain and sustain higher rankings.

Notable Products

In January 2026, the top-performing product from Four54 was the Gastro Pop Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its consistent number one rank from the previous months with sales of 4508 units. The Gastro Pop Pre-Roll 3-Pack (1.5g) in the Pre-Roll category saw a significant rise, climbing from fifth place in December to second place, indicating a notable increase in popularity. Gastro Pop (3.5g) in the Flower category dropped to third place after holding the second position for two consecutive months. Strawberry Pave (1g), also in the Flower category, fell to fourth place as sales decreased from previous months. The Emerald Triangle Live Resin Cartridge (1g) made its debut in the rankings, securing the fifth position in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.