Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

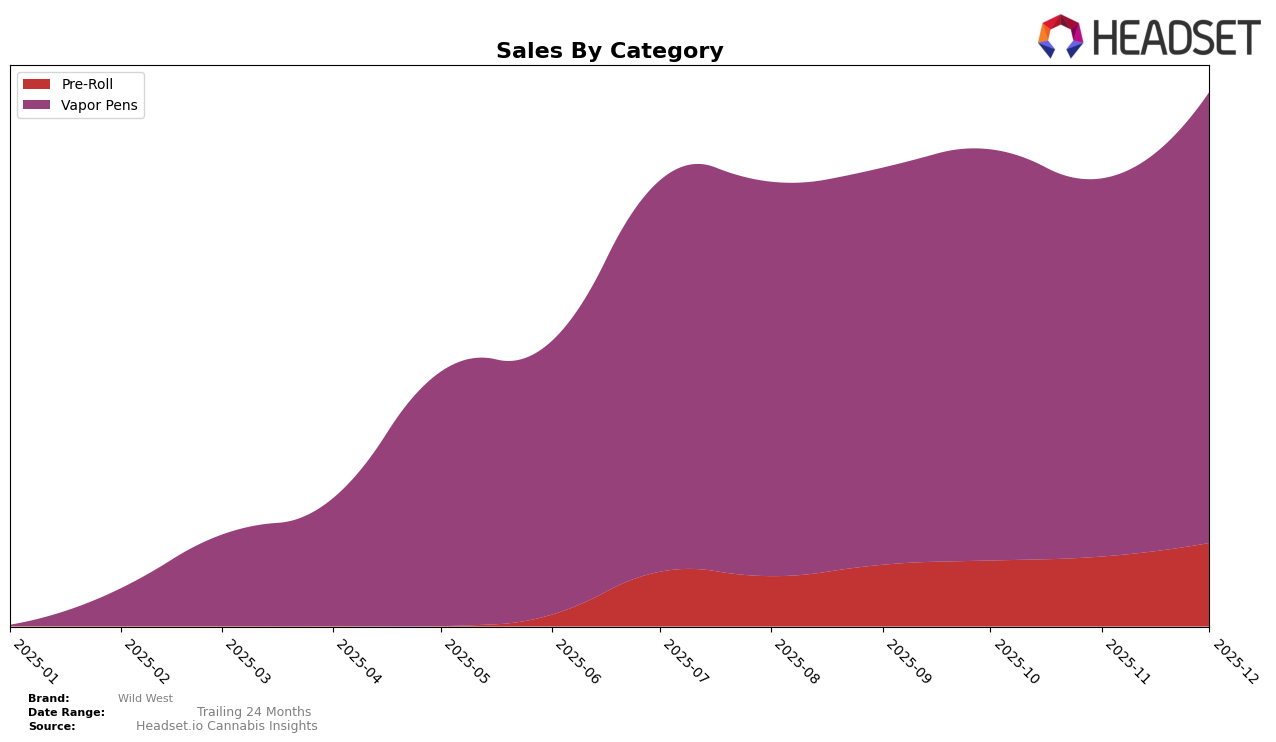

Wild West has shown notable performance across various categories in different provinces, with intriguing movements in rankings. In the Pre-Roll category in Alberta, Wild West was not in the top 30 rankings for September and October 2025 but made a significant leap to 73rd place by December 2025, indicating a positive trajectory. Conversely, their Vapor Pen category in Alberta maintained more consistent rankings, hovering around the 18th to 20th positions over the last few months of 2025, suggesting a stable presence in the market.

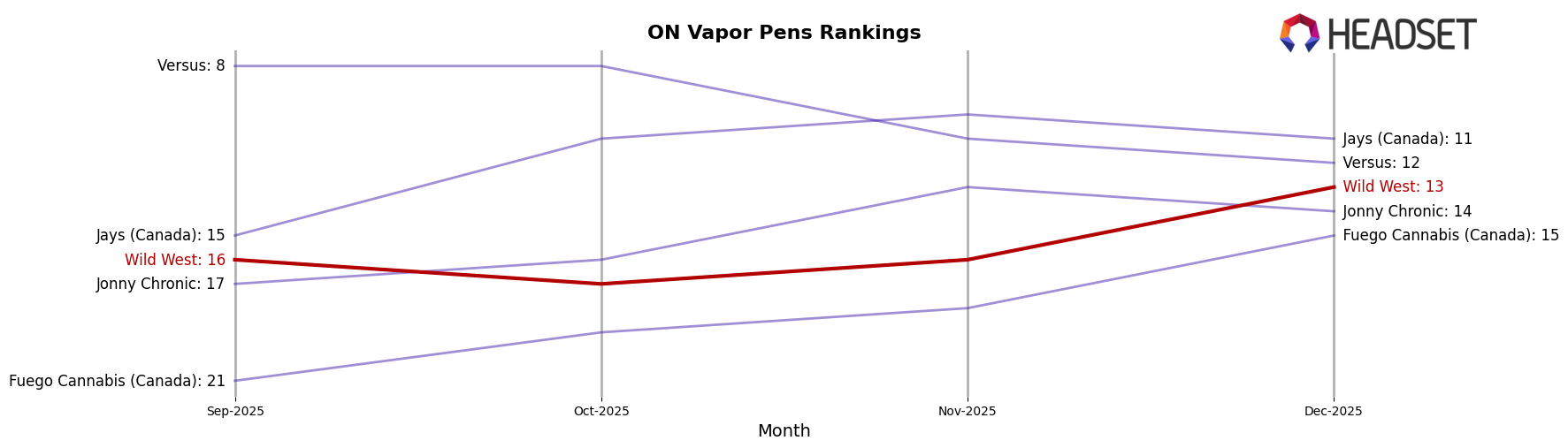

In Ontario, Wild West's performance in the Pre-Roll category has been improving steadily, climbing from 93rd in September 2025 to 77th by December 2025. This upward trend might indicate a growing consumer interest or successful marketing strategies. In contrast, their Vapor Pens in Ontario have shown resilience, maintaining a strong position within the top 20, and even advancing to 13th place in December 2025. This suggests that Wild West's Vapor Pens are gaining traction and possibly increasing their market share in this category.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Wild West has demonstrated a fluctuating performance in the rankings over the last few months of 2025. While Wild West started at rank 16 in September, it experienced a slight dip to 17th place in October before recovering to 16th in November and climbing to 13th in December. This upward trend in December coincides with a notable increase in sales, suggesting a positive reception in the market. However, competitors such as Jays (Canada) consistently maintained higher ranks, peaking at 10th place in November, and Versus also showed strong performance, although it slipped from 8th in October to 12th in December. Meanwhile, Jonny Chronic and Fuego Cannabis (Canada) have shown significant upward momentum, with Fuego notably climbing from 21st in September to 15th in December. These dynamics highlight the competitive pressure Wild West faces, emphasizing the need for strategic marketing efforts to maintain and improve its position in the Ontario vapor pen market.

Notable Products

In December 2025, Wild West's top-performing product was the 95+ Strawberry Stampede Liquid Diamonds Cartridge in the Vapor Pens category, maintaining its position as the number one product for four consecutive months, with sales reaching 10,313 units. The 92+ Saskatoon Berry Liquid Diamonds Cartridge improved its ranking from third to second place, showcasing a significant increase in popularity with 8,314 units sold. The Blueberry Bronco 95+ Liquid Diamond Cartridge, also in the Vapor Pens category, experienced a slight decline, moving from second to third place. The 60+ Strawberry Stampede Diamonds Dipped Infused Blunt 3-Pack in the Pre-Roll category climbed to fourth place, demonstrating a steady increase in sales. A new entry, the 96+ Peach Pony Liquid Diamonds Cartridge, made its debut in fifth place, indicating strong initial consumer interest.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.