Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

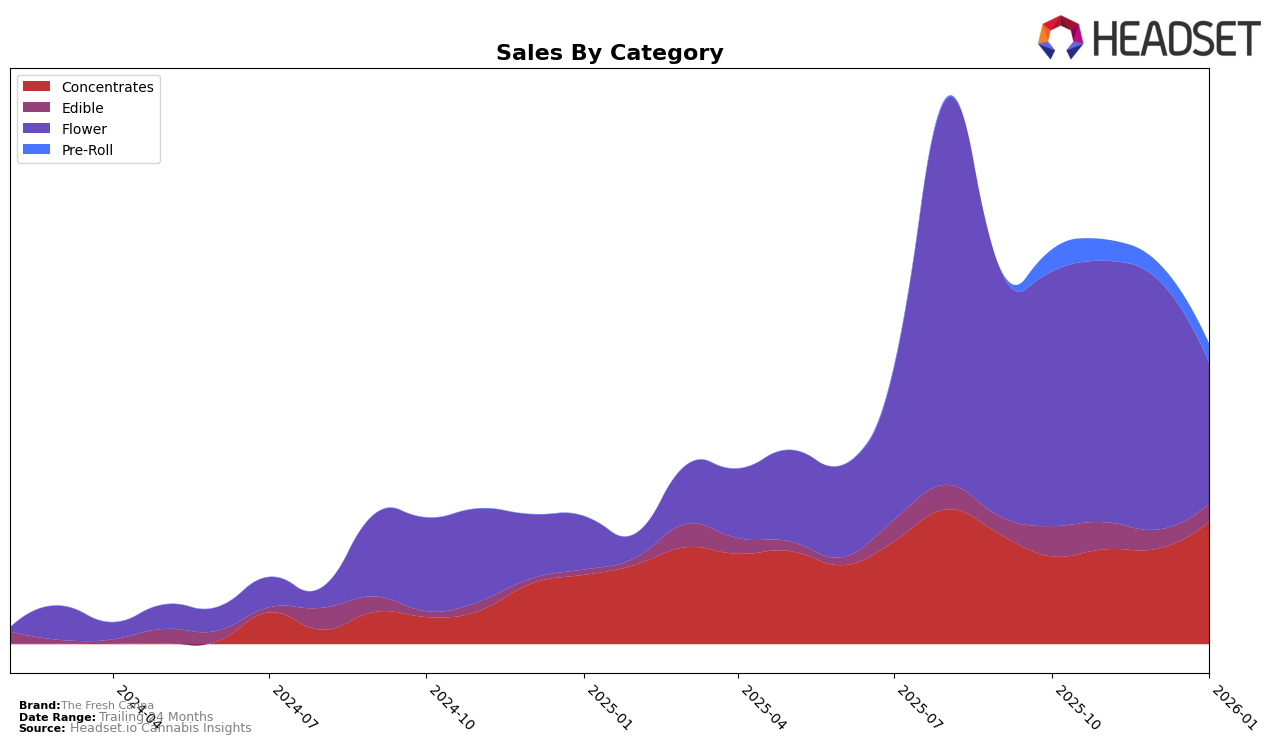

The Fresh Canna has shown a notable performance in the Michigan cannabis market, particularly in the Concentrates category. Over the months from October 2025 to January 2026, the brand maintained a strong presence, consistently ranking within the top 10. Specifically, it held the 8th position in both October and November 2025, before improving to 7th place in December 2025 and January 2026. This upward trend is underscored by a significant increase in sales, indicating a robust demand for their concentrates. In contrast, their performance in the Edible category has been less impressive, as they did not break into the top 30 rankings, suggesting potential challenges in capturing market share or consumer interest in this segment.

In the Flower category, The Fresh Canna's rankings fluctuated, beginning at 28th in October 2025, peaking at 23rd in November, and then experiencing a decline to 41st by January 2026. This downward movement, coupled with a decrease in sales, points to potential issues in maintaining competitiveness or consumer preference in this area. Meanwhile, their presence in the Pre-Roll category was sporadic, as they only appeared in the rankings in November 2025 and January 2026, at 98th and 95th respectively. This inconsistency in rankings highlights the challenges The Fresh Canna faces in establishing a foothold in the Pre-Roll market within Michigan.

Competitive Landscape

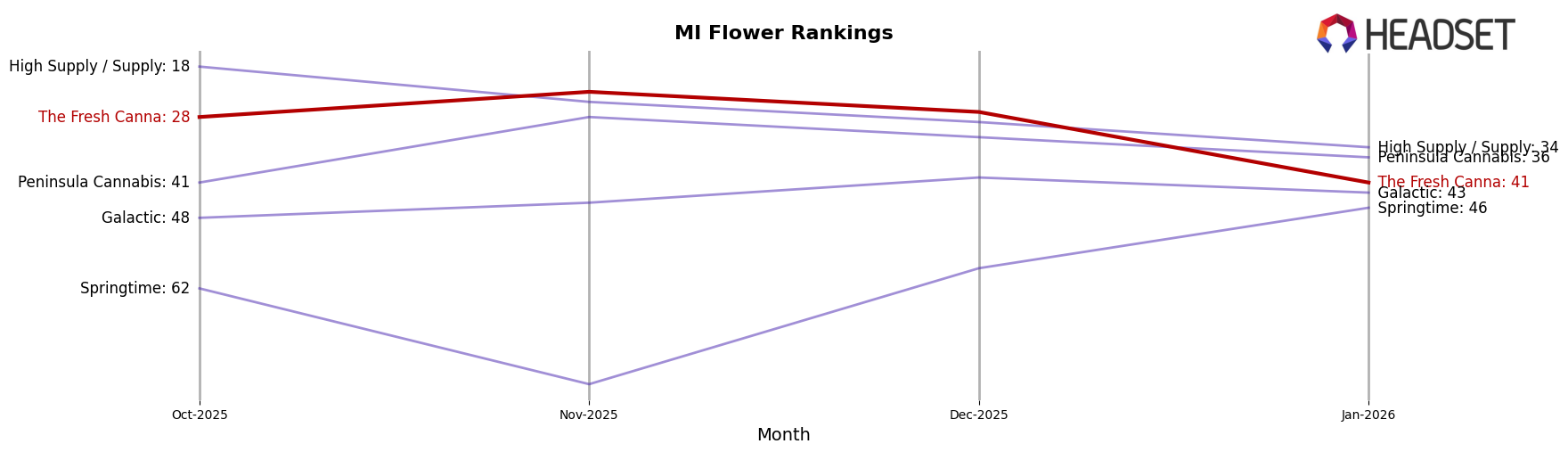

In the competitive Michigan flower market, The Fresh Canna experienced notable fluctuations in rank from October 2025 to January 2026, starting at 28th, peaking at 23rd in November, and then dropping to 41st by January. This decline in rank coincides with a decrease in sales, particularly evident in January 2026. In contrast, High Supply / Supply also saw a downward trend, moving from 18th to 34th, yet they maintained higher sales figures compared to The Fresh Canna. Meanwhile, Peninsula Cannabis showed a more stable performance, with a less dramatic rank drop from 28th to 36th, and a corresponding sales dip. Interestingly, Springtime improved its position, climbing from 62nd to 46th, suggesting a positive sales trajectory that could pose a future threat to The Fresh Canna's market share. These dynamics highlight the competitive pressures in the Michigan flower category, urging The Fresh Canna to strategize effectively to regain its standing.

Notable Products

In January 2026, Bubblegum Snow Caps Smalls (Bulk) maintained its position as the top-performing product for The Fresh Canna, with sales reaching 4442 units. This Flower category product has shown consistent growth, climbing from 5th in October 2025 to 1st place in December 2025 and holding that position in January 2026. The Blue Dream Live Resin (1g) emerged as the second-best seller in the Concentrates category. Orange Crush Pre-Roll (1g) secured the third spot, marking its debut in the rankings, while Gelato 33 Live Resin (1g) and Fudgesicle Pre-Roll (1g) rounded out the top five. Notably, these rankings highlight a strong performance in both the Concentrates and Pre-Roll categories for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.