Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

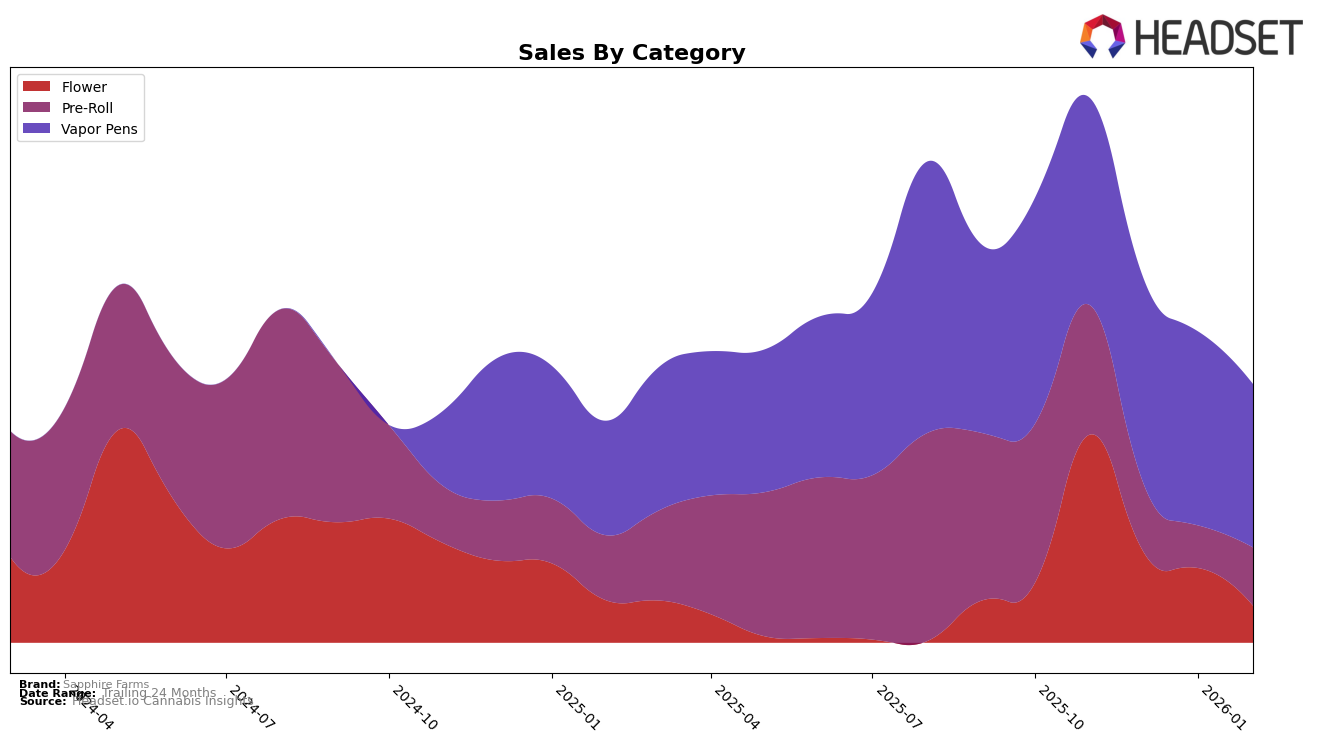

Sapphire Farms has shown varied performance across different states and product categories. In Michigan, the brand's Flower category has seen a significant decline, falling out of the top 30 rankings by February 2026 after being ranked 39th in November 2025. This downward trend is concerning, indicating a potential loss of market share or increased competition. Conversely, their Pre-Roll category has demonstrated more resilience, maintaining a presence in the top 50 throughout the same period, with a slight improvement in February 2026, where it climbed to 41st position. This suggests that while the Flower category struggles, Pre-Rolls might be a more stable product offering for Sapphire Farms in Michigan.

In New York, Sapphire Farms exhibits a different trend in the Vapor Pens category. Despite a gradual decline in sales from November 2025 to February 2026, the brand has managed to stay within the top 30 rankings, albeit dropping from 18th to 28th. This indicates that while there is a reduction in sales volume, the brand still holds a competitive position within the New York market. The ability to remain ranked suggests a strong brand presence or loyalty among consumers, even as they face challenges in maintaining their sales figures. Overall, Sapphire Farms' performance highlights the importance of category-specific strategies and market adaptability across different regions.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Sapphire Farms has experienced a notable decline in its ranking, dropping from 18th in November 2025 to 28th by February 2026. This downward trend is significant as it indicates a potential loss of market share, especially when compared to competitors like ghost., which maintained a higher rank throughout the same period, despite a similar sales decline. Meanwhile, High Garden has shown resilience by improving its rank from 29th to 26th, reflecting a positive sales trajectory. Additionally, Dragonfly Cannabis has been on an upward trend, moving from 42nd to 30th, suggesting a growing presence in the market. These shifts highlight the dynamic nature of the vapor pen category in New York and suggest that Sapphire Farms may need to reassess its strategies to regain its competitive edge.

```

Notable Products

In February 2026, the top-performing product for Sapphire Farms was Grass Valley Girl Bulk in the Flower category, which climbed to the number one spot from fourth place in January 2026, with sales reaching $20,504. The Cookies N Kush Pre-Roll 1g secured the second position, making a notable entry into the rankings this month. Sharks Breath Kush Pre-Roll 1g followed closely in third place, also appearing for the first time in the rankings. Fire OG Pre-Roll 1g and Salted Sweets Pre-Roll 1g rounded out the top five, both showing strong performances as new entries. This shift in rankings indicates a growing preference for pre-roll products, with significant sales increases compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.