Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

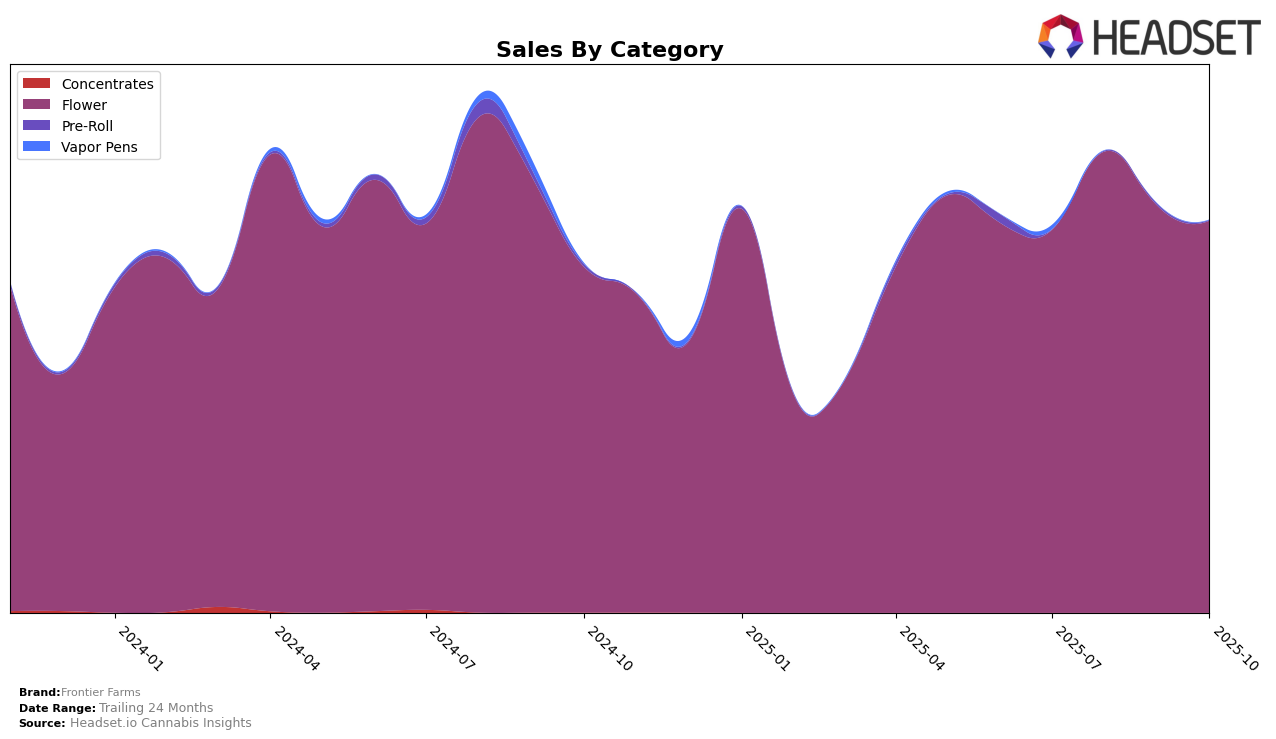

Frontier Farms has demonstrated a consistent presence in the Oregon cannabis market, particularly in the Flower category. Over the past few months, the brand has maintained a position within the top 30, showing a slight improvement from a rank of 25 in July 2025 to 19 in both August and September, before slipping to 21 in October. This fluctuation indicates a competitive landscape where Frontier Farms is holding its ground but facing challenges to climb higher. The sales data supports this observation, with a peak in August at $309,344, followed by a decline in the subsequent months, suggesting potential seasonal influences or market dynamics affecting consumer preferences.

It is noteworthy that Frontier Farms does not appear in the top 30 brands for any other categories or states, which could be interpreted as a limitation in their market reach or specialization strategy focused solely on the Flower category in Oregon. This absence from other rankings might highlight opportunities for growth or diversification within their product offerings or geographic expansion. The data suggests that while Frontier Farms is a recognized player in Oregon's Flower market, there is room for strategic initiatives to enhance their visibility and performance across other categories and regions.

Competitive Landscape

In the competitive Oregon Flower market, Frontier Farms has demonstrated resilience and adaptability amidst fluctuating rankings and sales. Over the past few months, Frontier Farms has seen its rank improve from 25th in July 2025 to 19th in both August and September, before slightly declining to 21st in October. This indicates a relatively stable position within the top 25 brands, with a notable peak in August. Meanwhile, competitors such as Dog House and Cosmic Treehouse have shown more volatility, with Dog House climbing from 34th in July to 22nd in October, and Cosmic Treehouse making a significant leap from 36th to 20th in the same period. Gud Gardens remains a strong competitor, consistently ranking higher than Frontier Farms, although its sales dipped slightly in October. The Crop Shop has also emerged as a notable competitor, improving its rank dramatically from 69th in July to 23rd in October. These dynamics suggest that while Frontier Farms maintains a solid market presence, it faces increasing competition from brands that are rapidly gaining ground, emphasizing the need for strategic marketing and product differentiation to enhance its competitive edge.

Notable Products

In October 2025, the top-performing product for Frontier Farms was Superboof (Bulk) in the Flower category, reclaiming its position at rank 1 with sales of 1773 units. Superboof (3.5g) entered the rankings for the first time at rank 2, indicating a strong market entry. Blue Dream (Bulk) experienced a drop to rank 3 from its previous top position in July, with sales declining to 995 units. Cakelatto (3.5g) held steady in the rankings, moving from rank 3 in September to rank 4 in October. Lemon Royale (28g) also made a notable debut at rank 5, showing potential for growth in the upcoming months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.