Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

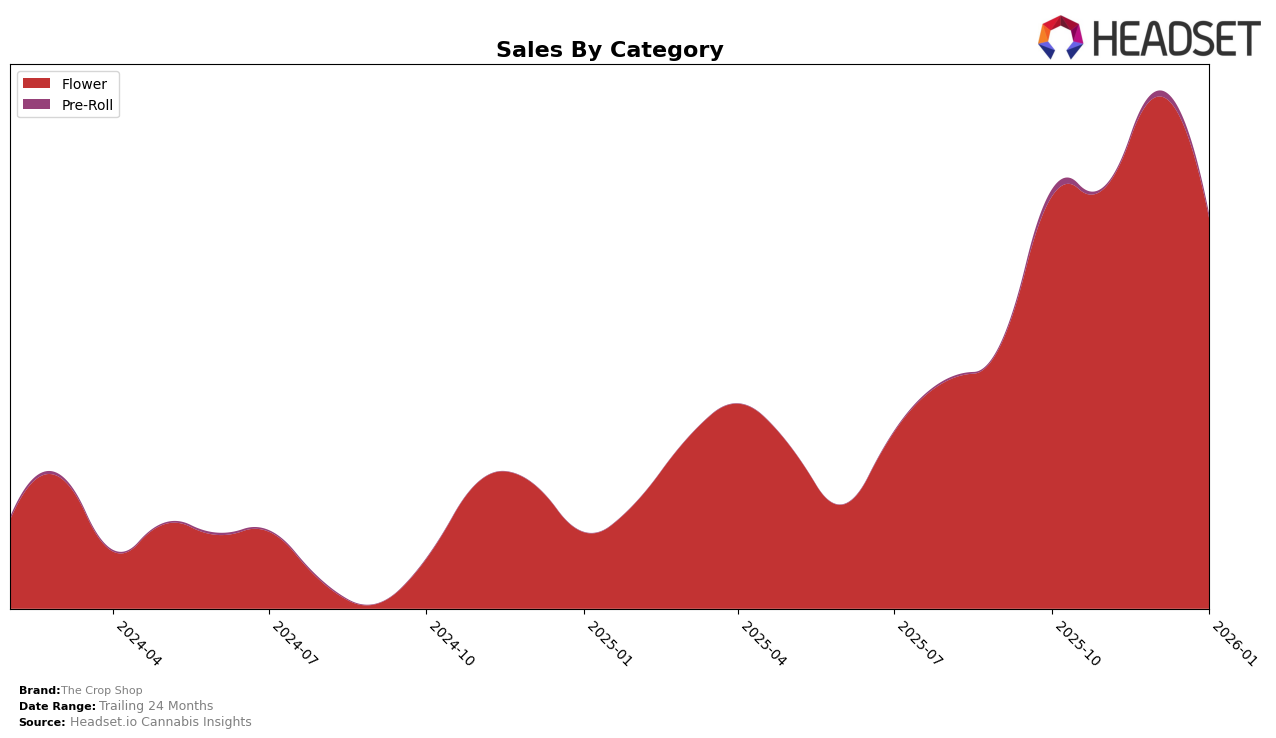

The Crop Shop has shown varying performance across different categories and states over the past few months. In the Flower category in Oregon, the brand has experienced some fluctuations in its rankings. Starting in October 2025, The Crop Shop was ranked 26th, and it managed to climb to 22nd in November and further to 18th in December. However, January 2026 saw a decline back to the 28th position. This indicates a level of volatility in the brand's standing within the competitive Flower market in Oregon, although the brand's ability to reach the 18th position in December suggests potential for significant upward movement when conditions are favorable.

Despite the fluctuations in ranking, The Crop Shop's sales figures in Oregon reveal a more nuanced picture. While there was a noticeable increase in sales from October to December 2025, peaking at 283,100, there was a decline in January 2026 to 215,295. This sales trajectory suggests that while the brand has the capability to increase its market share, sustaining that growth remains a challenge. The absence of top 30 rankings in other states or categories might indicate areas where The Crop Shop could explore opportunities for expansion or improvement. Such insights are crucial for understanding the brand's competitive positioning and potential strategies for growth.

```Competitive Landscape

In the competitive landscape of the Oregon flower category, The Crop Shop has demonstrated a fluctuating yet commendable performance in recent months. Notably, The Crop Shop improved its rank from 26th in October 2025 to an impressive 18th in December 2025, before experiencing a slight decline to 28th in January 2026. This fluctuation in rank is indicative of the competitive pressures from brands such as PDX Organics, which consistently maintained a higher rank, peaking at 9th in November 2025. Meanwhile, Gud Gardens and Dog House have also been formidable competitors, with Gud Gardens ranking as high as 18th in November 2025. Despite these challenges, The Crop Shop's sales peaked in December 2025, suggesting strong market demand during that period. However, the subsequent decline in both rank and sales in January 2026 highlights the need for strategic adjustments to regain momentum and compete effectively against these established brands.

Notable Products

In January 2026, The Crop Shop's top-performing product was Koosh the Magic Dragon Bulk in the Flower category, maintaining its leading position from December 2025 with sales of 1595 units. Wedding Pie 1g emerged as a strong contender, ranking second, despite not being ranked in previous months. Jellyz 1g, which held the second position in December, dropped to third place in January. Runtz OG Bulk and Triangle Kush 1g secured the fourth and fifth positions, respectively, both making their debut in the rankings. This shift indicates a dynamic change in consumer preferences, with new entries shaking up the leaderboard.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.