Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

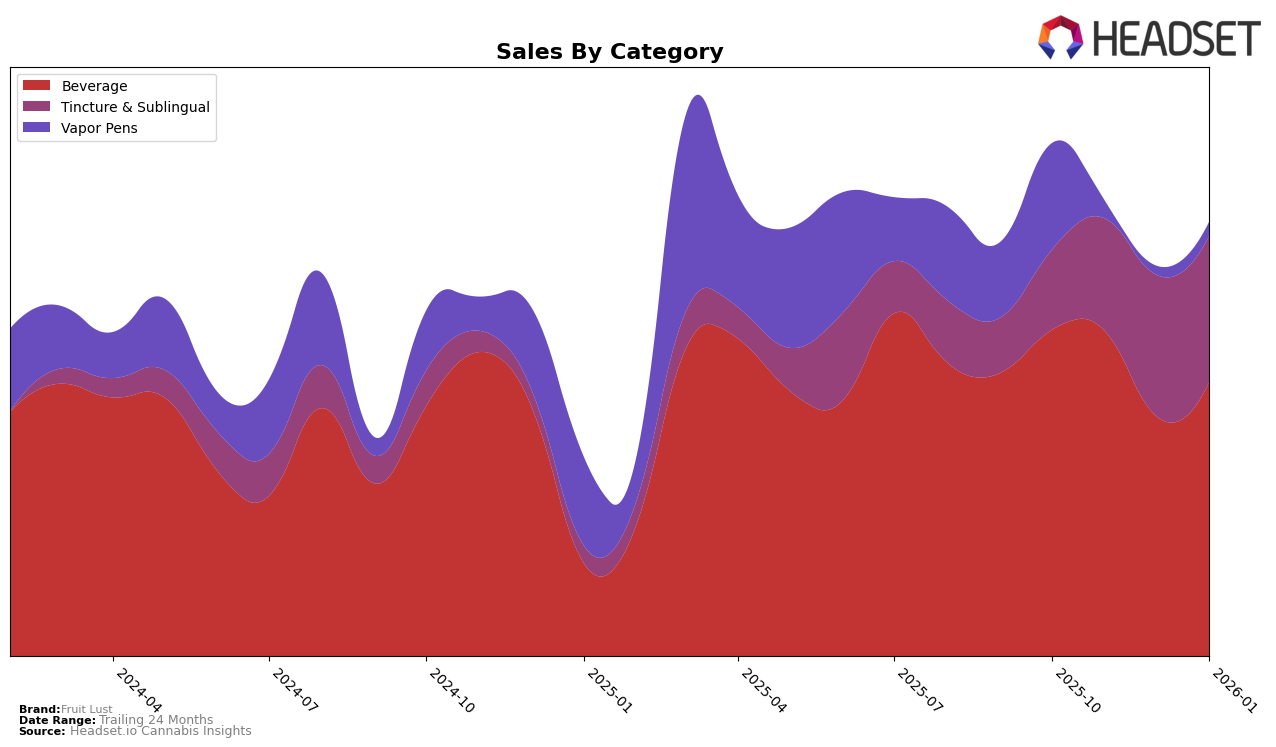

Fruit Lust has demonstrated a consistent performance in the Beverage category in Oregon, maintaining a solid position around the 6th or 7th rank over the past few months. This stability suggests a strong consumer base and effective product positioning within this category. However, the brand experienced a dip in sales in December 2025, which was subsequently recovered by January 2026. This fluctuation might indicate seasonal variations or promotional activities affecting consumer purchasing behavior. Notably, Fruit Lust did not appear in the top 30 for Vapor Pens in recent months, which could signal an area for potential growth or reevaluation of strategy in this product line.

In the Tincture & Sublingual category, Fruit Lust has shown a commendable upward trend, improving from the 14th to the 8th rank in Oregon from November 2025 to January 2026. This upward movement reflects positively on the brand's expanding influence and acceptance in this category. The consistent increase in sales figures during this period corroborates the enhanced market penetration and consumer interest. The absence of a ranking position in October 2025 suggests that Fruit Lust was not among the top 30 brands at that time, highlighting the rapid progress they have made since then.

Competitive Landscape

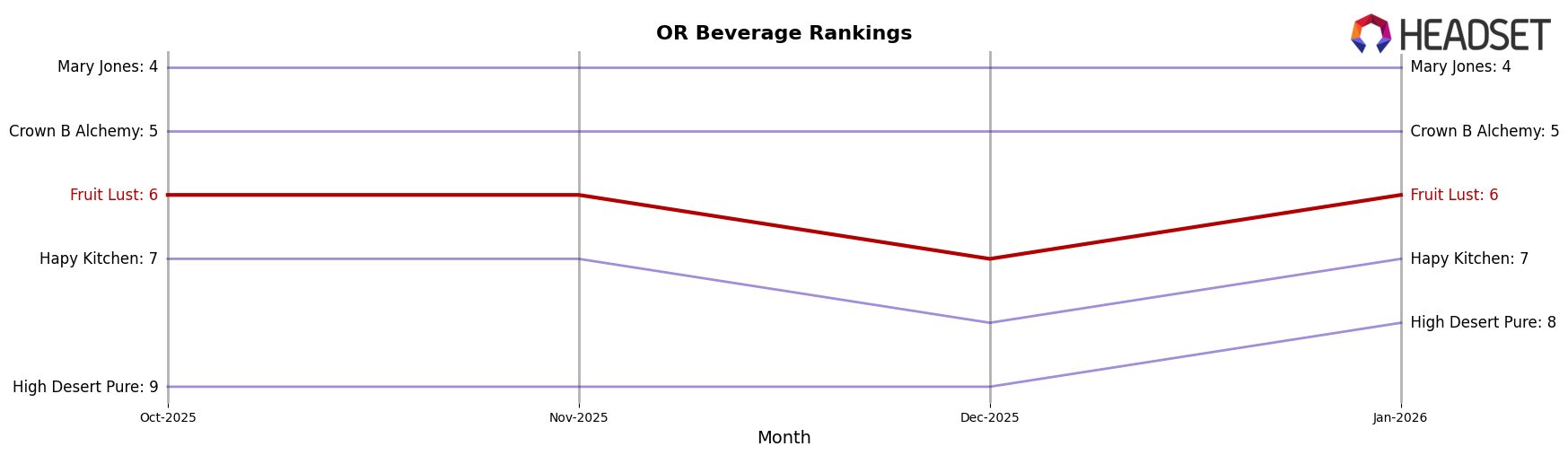

In the competitive landscape of the Oregon beverage category, Fruit Lust has experienced notable fluctuations in its ranking and sales over the recent months. Despite maintaining a stable position at rank 6 in October and November 2025, Fruit Lust saw a dip to rank 7 in December 2025, before recovering back to rank 6 in January 2026. This fluctuation coincides with a decrease in sales from November to December, followed by a rebound in January. In comparison, Hapy Kitchen consistently held rank 7, except for December when it briefly overtook Fruit Lust. Meanwhile, High Desert Pure showed a steady performance, improving its rank from 9 to 8 in January. The top performers, Mary Jones and Crown B Alchemy, maintained their strong positions at ranks 4 and 5, respectively, with significantly higher sales, indicating a competitive gap that Fruit Lust aims to close. These insights suggest that while Fruit Lust remains a strong contender, there is room for growth and strategic adjustments to enhance its market position.

Notable Products

In January 2026, Strawberry Juice Box Tincture (1000mg) maintained its position as the top-performing product for Fruit Lust, with sales reaching 289. Raspberry Syrup (1000mg THC, 4oz) experienced a slight drop to third place, while Strawberry Syrup (1000mg THC, 4oz, 120ml) rose to second place, improving from its consistent fourth-place position in the previous months. Mango Syrup (1000mg THC, 4oz, 120ml) slid to fourth place, continuing its descent from a second-place ranking in November 2025. Peach Nano Syrup (1000mg THC, 120ml, 4oz) entered the rankings for the first time, capturing the fifth spot.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.