Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

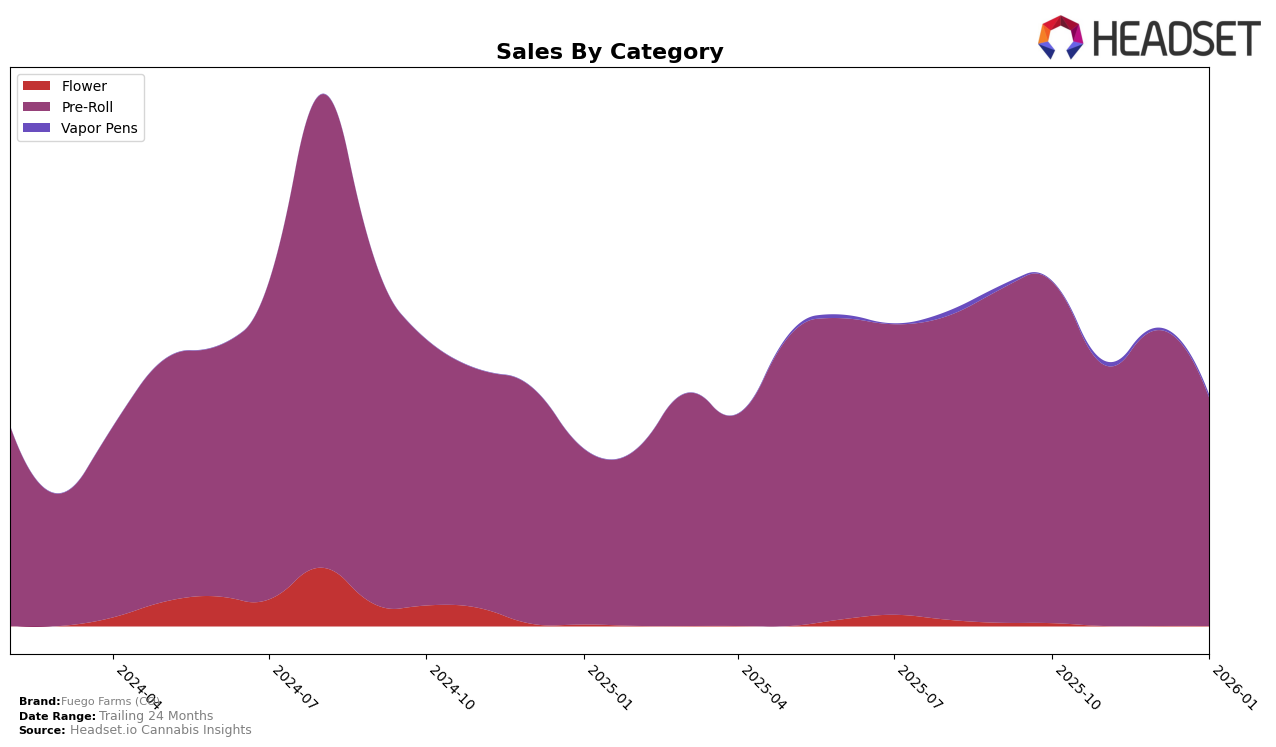

Fuego Farms (CO) has shown a noticeable shift in its performance within the Pre-Roll category across the state of Colorado. The brand held a steady position in the rankings, starting at 14th place in October 2025, before experiencing a gradual decline to 19th place by January 2026. This downward trend in rankings is mirrored by their sales figures, which saw a decrease from $203,022 in October to $135,225 in January. The consistent drop in both rank and sales suggests potential challenges in maintaining market share amidst competition or changing consumer preferences within the state.

Interestingly, while Fuego Farms (CO) managed to stay within the top 20 brands in the Pre-Roll category throughout this period, their absence from the top 30 in other states or categories is notable. This could imply a strong regional presence in Colorado but limited reach or brand recognition beyond. Such a pattern emphasizes the importance of regional strategies and perhaps hints at opportunities for expansion or diversification into other states or product categories. This data provides a glimpse into the brand's current positioning and potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll category, Fuego Farms (CO) has experienced notable fluctuations in its market position, which could impact its strategic planning and sales performance. From October 2025 to January 2026, Fuego Farms (CO) saw a decline in rank from 14th to 19th, indicating increased competition and potential challenges in maintaining its market share. During the same period, The Colorado Cannabis Co. improved its rank from 28th to 20th, demonstrating a positive sales trajectory that may threaten Fuego Farms (CO)'s position. Similarly, Natty Rems showed resilience by climbing from 21st to 17th, while Noot maintained a competitive edge, staying close to Fuego Farms (CO) with a rank of 18th in January 2026. These shifts suggest that while Fuego Farms (CO) has a strong presence, it must innovate and adapt to the evolving market dynamics to regain its competitive advantage and boost sales.

Notable Products

In January 2026, the top-performing product from Fuego Farms (CO) was The Whip Pre-Roll (1g) in the Pre-Roll category, climbing from fourth place in December 2025 to first place with sales reaching 2,483 units. Following closely, Durban Poison Pre-Roll (1g) held the second position, having dropped from its leading spot in December. Grateful Tang Pre-Roll (1g) secured the third rank, showing a consistent presence in the top tier despite missing out in December. Trop Smoothie Pre-Roll (1g) maintained its fourth position from October, indicating stable demand. Apple Fritter Pre-Roll (1g) entered the rankings in fifth place, showcasing a new entry into the competitive landscape.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.