Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

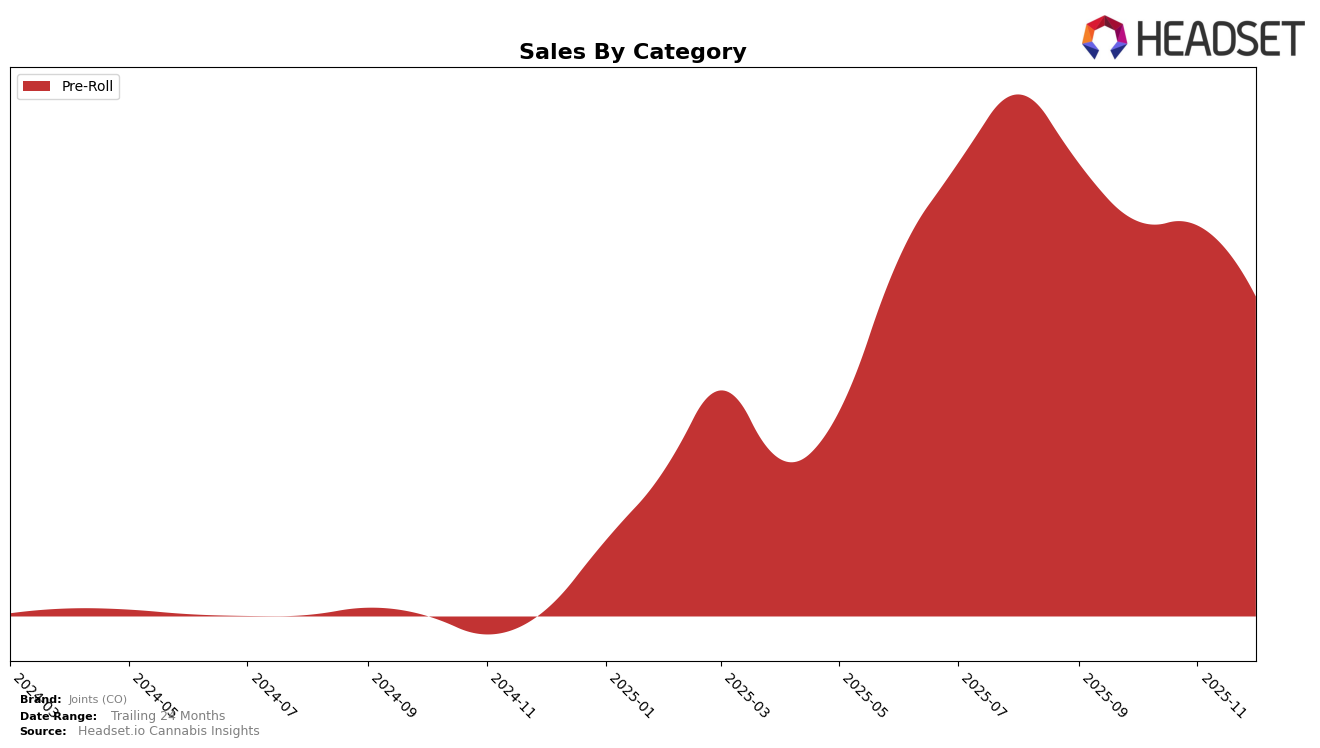

In the Pre-Roll category, Joints (CO) has shown some fluctuating performance in Colorado over the last few months of 2025. Starting at the 18th position in September, the brand improved its ranking to 16th in October and further to 15th in November. However, December saw a decline to the 22nd position, indicating a potential challenge in maintaining consistent market presence. Despite this drop, the brand's ability to climb the ranks earlier in the quarter suggests a competitive edge that could be leveraged for future growth.

Sales data from September to December reveals a downward trend, with a notable decrease from $186,096 in September to $131,306 in December. This decline in sales aligns with the drop in ranking for December, highlighting the importance of strategic adjustments to regain market share. The absence of Joints (CO) from the top 30 brands in other states or categories suggests room for expansion and diversification. By analyzing these dynamics, Joints (CO) can identify opportunities to enhance its market strategy and potentially improve its positioning in the competitive cannabis industry.

Competitive Landscape

In the competitive landscape of the Colorado pre-roll market, Joints (CO) experienced a notable fluctuation in its ranking from September to December 2025. Initially positioned at 18th in September, Joints (CO) improved to 15th by November, indicating a positive trajectory. However, by December, the brand slipped to 22nd, suggesting a potential challenge in maintaining its upward momentum. In contrast, P3 showed consistent improvement, climbing from 32nd in September to 20th in December, which could indicate a growing consumer preference for their products. Meanwhile, The Colorado Cannabis Co. and Vera demonstrated fluctuating ranks but ended the year stronger, potentially impacting Joints (CO)'s market share. The competitive dynamics highlight the importance for Joints (CO) to strategize effectively to regain and sustain its market position amidst rising competition.

Notable Products

In December 2025, the top-performing product from Joints (CO) was Yule Be High Pre-Roll (1g) in the Pre-Roll category, securing the number one rank with sales of 2499 units. Super Cake Pre-Roll (1g) climbed to the second position, improving from its fifth place in November, with notable sales growth. Chem GPT Pre-Roll (1g) debuted strongly in the third position, indicating a positive market reception. Doobski - Watermelon Stomper Pre-Roll (1g) entered the rankings at fourth, showing competitive performance. Doobski - Pineapple Creamsicle Pre-Roll (1g) returned to the list, maintaining its fifth position from September, despite not ranking in the intervening months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.