Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

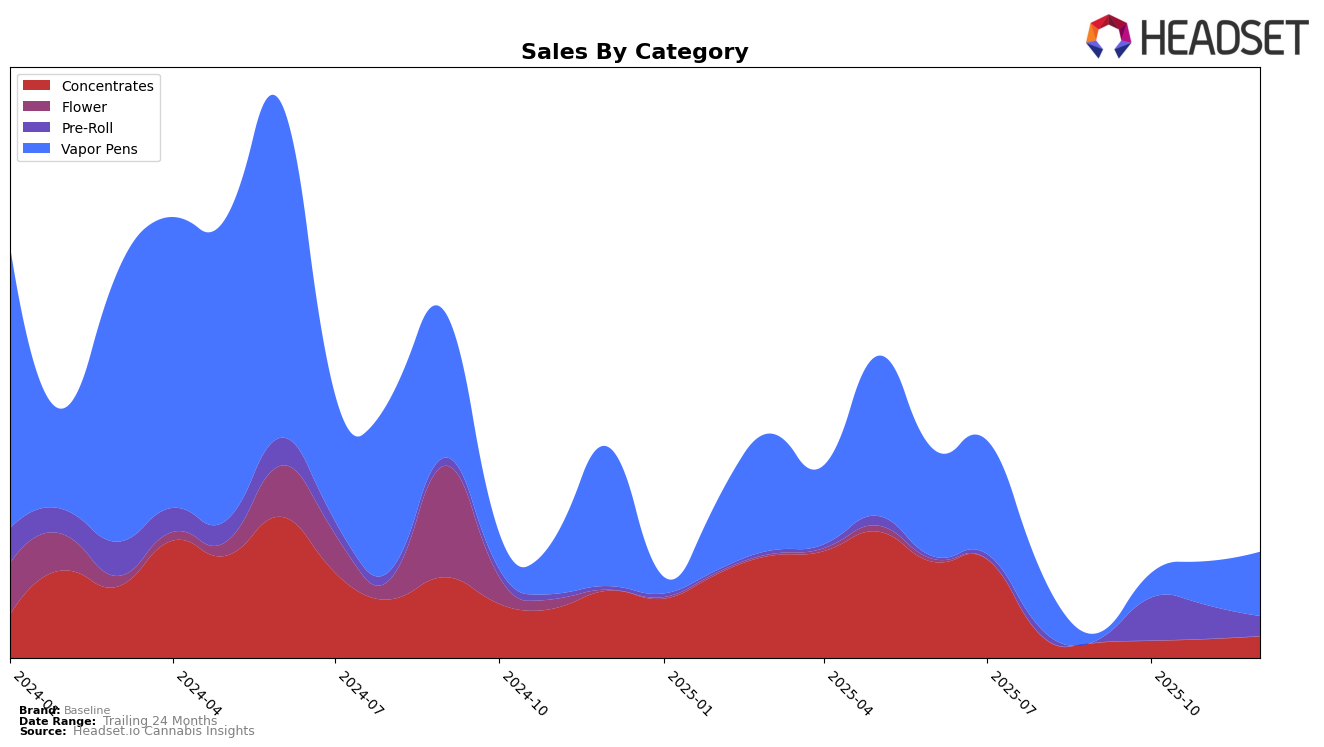

In the Nevada market, Baseline's performance in the Pre-Roll category has been notably absent from the top 30 rankings from September to December 2025, indicating a challenge in maintaining a competitive edge in this segment. This absence from the rankings suggests that there may be room for improvement or a strategic reevaluation to better compete in this category. On the other hand, Baseline's presence in the Vapor Pens category shows a positive trend, with a steady climb from the 58th position in October to the 45th position by December. This upward movement could signify growing consumer interest or successful marketing efforts in this category.

While Baseline's absence from the Pre-Roll top 30 rankings could be seen as a setback, their performance in the Vapor Pens category in Nevada highlights a different narrative. The brand's sales in the Vapor Pens category increased significantly from October to December, reflecting a strong market presence and potential growth trajectory. The consistent rise in rankings from 58th to 45th over just two months suggests that Baseline may be capitalizing on a growing demand for vapor products or effectively differentiating its offerings within this competitive space. This trend in the Vapor Pens category could be indicative of strategic shifts or consumer preferences that are worth exploring further.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Baseline has shown a promising upward trajectory over the last few months of 2025. Initially absent from the top 20 rankings in September, Baseline made a notable entry at rank 58 in October and continued to climb to rank 45 by December. This ascent is particularly significant when compared to competitors like Nature's Chemistry, which has seen a consistent decline in rank, falling from 39 in September to 43 in December. Meanwhile, Tyson 2.0 maintained a stable presence, slightly improving from rank 46 to 42 over the same period. Spiked Flamingo experienced a downward trend, dropping significantly from rank 32 to 53. Baseline's sales growth, from $10,454 in October to $27,480 in December, underscores its rising popularity and competitive edge in the market, positioning it as a brand to watch in the Nevada vapor pen category.

Notable Products

In December 2025, the top-performing product for Baseline was the Berry Gelato Distillate Disposable (0.8g) in the Vapor Pens category, which rose to the first rank with sales reaching 280 units. The Garlic Le Crème Pre-Roll (1g) maintained its strong position at second place, consistent with its ranking in November, although its sales decreased to 172 units. The Strawberry Kiwi Distillate Disposable (0.8g) entered the rankings for the first time at the second position in December, showing significant growth. The Grape Distillate Cartridge (0.8g) achieved a third-place rank, slightly trailing the top two products. Meanwhile, the Peanut Butter Souffle Cured Sauce (1g) dropped from third to fourth place, indicating a decline in its popularity compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.