Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

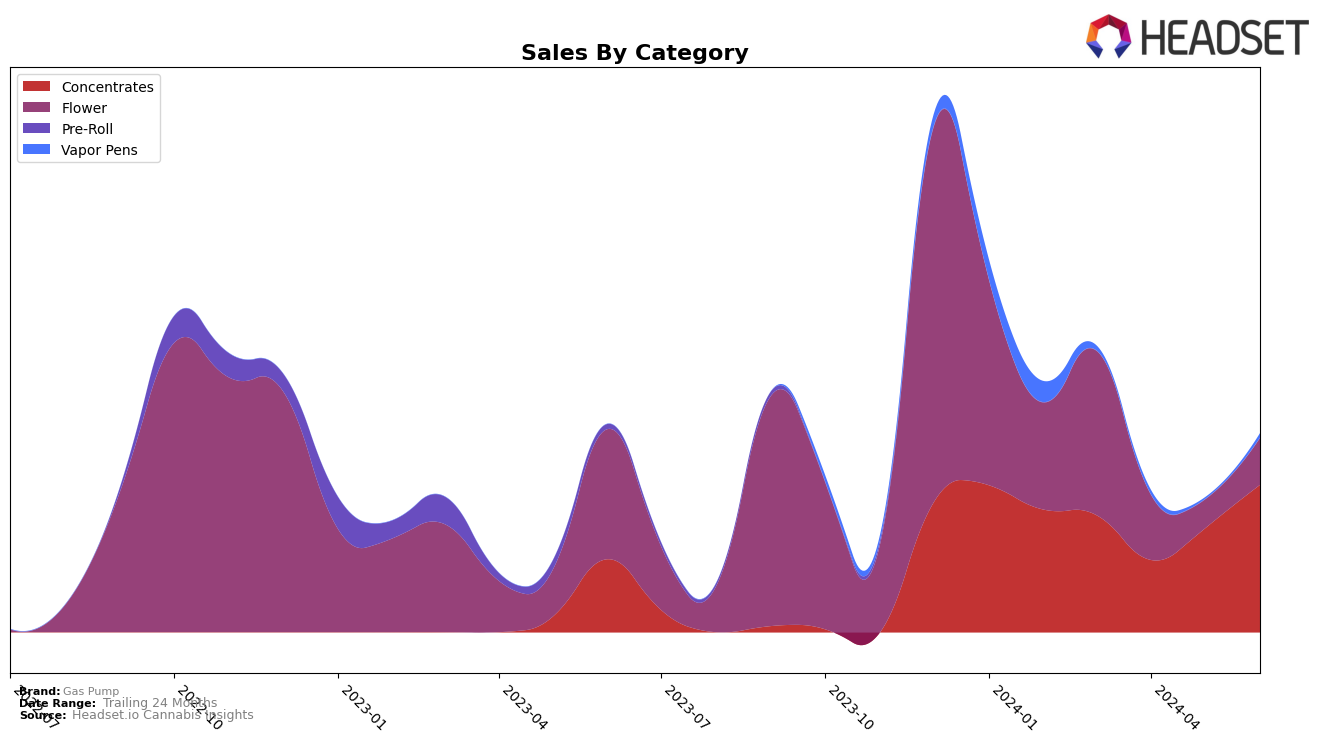

Gas Pump's performance in the Arizona market has shown notable fluctuations across different categories. In the Concentrates category, the brand demonstrated a positive trend by climbing from the 42nd position in April 2024 to entering the top 30 in June 2024, indicating a significant improvement. This upward movement is particularly noteworthy given their sales increase from $24,438 in May to $34,778 in June. However, in the Flower category, Gas Pump has struggled to maintain a consistent presence in the top rankings. Despite a brief re-entry into the top 30 in June 2024, their performance in previous months suggests volatility and challenges in this segment.

The absence of Gas Pump from the top 30 brands in the Flower category during May 2024 highlights a concerning gap in their market presence. This could be indicative of either a highly competitive landscape or potential issues within the brand's product offerings or distribution strategies. On the other hand, their steady improvement in the Concentrates category suggests that Gas Pump is finding its niche and gaining traction in Arizona. These insights underscore the importance of monitoring category-specific performance and adapting strategies to capitalize on areas of growth while addressing weaknesses.

Competitive Landscape

In the Arizona concentrates market, Gas Pump has experienced notable fluctuations in its ranking over the past few months, which has implications for its sales performance and competitive positioning. In March 2024, Gas Pump was ranked 38th, but it saw a decline to 42nd in April before rebounding to 39th in May and significantly improving to 30th in June. This upward trend in June indicates a positive shift in consumer preference or successful marketing strategies. In contrast, competitors like 22Red and Swell Edibles have maintained relatively higher and more stable rankings, with Swell Edibles consistently staying within the top 32. Meanwhile, The Giving Tree re-entered the top 30 in May and June after missing the top 20 in March and April, suggesting a resurgence in its market presence. Varz has also shown a steady performance, ranking 28th in June. These dynamics highlight the competitive pressures Gas Pump faces, underscoring the need for strategic initiatives to sustain its recent gains and further improve its market position.

Notable Products

In June 2024, the top-performing product for Gas Pump was Flap Jacks Batter (1g) in the Concentrates category, moving up from rank 3 in May to rank 1 with notable sales of 401 units. Super Boof Batter (1g) held steady at rank 2, maintaining its position from May with 382 units sold. Cherry Cosmo Cured Batter (1g) improved its ranking from 4 in May to 3 in June with 353 units sold. Apes in Space x Gelato #43 Cured Batter (1g) dropped from the top spot in April and May to rank 4 in June, showing a decrease in momentum. Hawaiian Sunset Cured Resin (1g) entered the rankings for the first time in June at rank 5 with 289 units sold.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.