Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

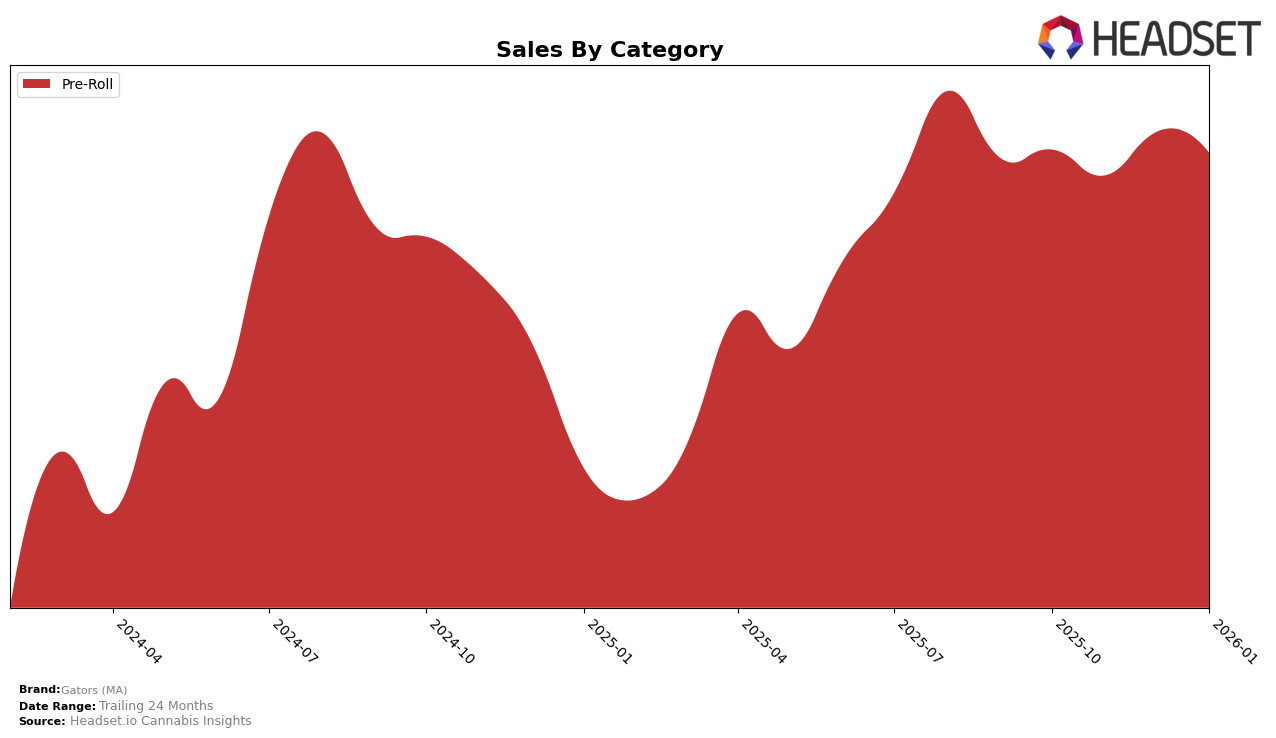

Gators (MA) has shown a consistent presence in the Pre-Roll category within the state of Massachusetts. Over the four-month period from October 2025 to January 2026, the brand maintained a stable ranking, fluctuating slightly between the 27th and 28th positions. This steadiness in rankings indicates a solid foothold in the Massachusetts market, although not breaking into the top 25 suggests room for growth. Despite the slight variations in ranking, Gators (MA) has demonstrated a reliable performance, with sales figures showing minor fluctuations, suggesting a loyal customer base that supports its products consistently over time.

It's noteworthy that Gators (MA) did not appear in the top 30 rankings for any other states or categories during this period, highlighting a concentrated market presence in Massachusetts. This focus could be strategic, allowing the brand to refine its offerings and strengthen its position before potentially expanding into new markets. The consistent sales figures, which hovered around the quarter-million mark each month, indicate a stable demand for their Pre-Roll products. However, to enhance its market presence and move up the rankings, Gators (MA) might consider exploring diversification strategies or marketing initiatives to capture a broader audience within and beyond Massachusetts.

Competitive Landscape

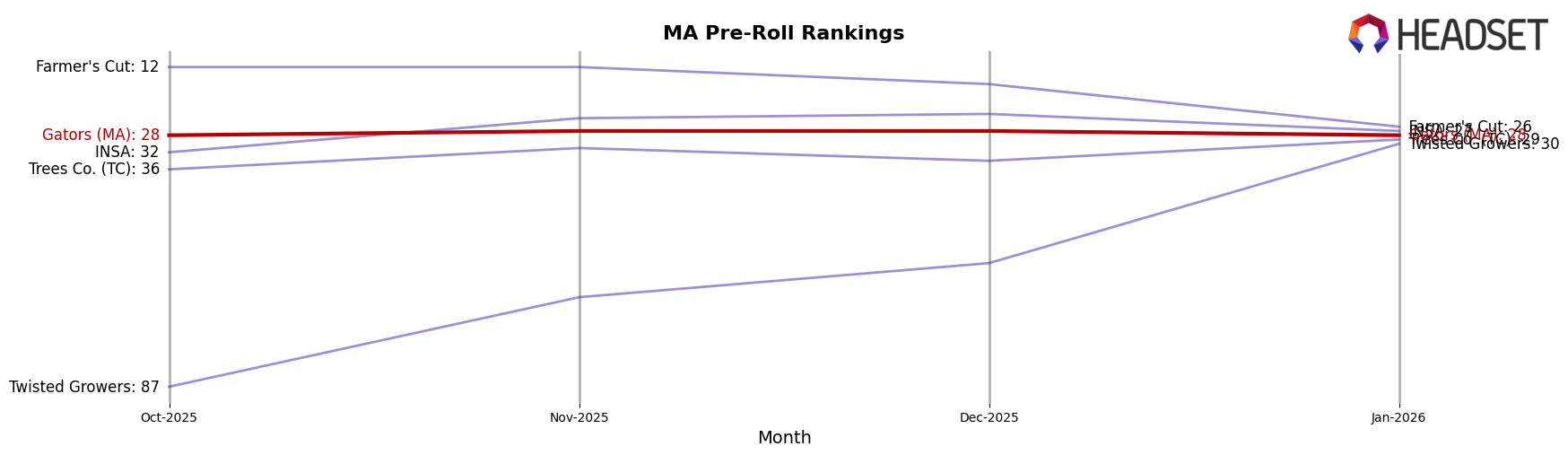

In the competitive landscape of the Pre-Roll category in Massachusetts, Gators (MA) has maintained a relatively stable position, consistently ranking around 27th to 28th from October 2025 to January 2026. This stability suggests a steady customer base, although it faces significant competition. Notably, Farmer's Cut consistently outperforms Gators (MA) with a higher rank, despite a drop from 12th to 26th, indicating a potential vulnerability that Gators (MA) could exploit. Meanwhile, INSA and Trees Co. (TC) have shown fluctuating ranks, with INSA improving from 32nd to 27th and Trees Co. (TC) showing a slight improvement from 36th to 29th. This suggests that while Gators (MA) maintains its position, competitors are actively vying for market share, highlighting the need for strategic initiatives to enhance its competitive edge. Additionally, Twisted Growers has made a significant leap from 87th to 30th, showcasing a rapid growth trajectory that could pose a future threat to Gators (MA) if not addressed.

Notable Products

In January 2026, the top-performing product for Gators (MA) was the Gators Pre-Roll 7-Pack (3.5g) in the Pre-Roll category, maintaining its number one rank consistently from October 2025 through January 2026. This product achieved a sales figure of 17,785 units in January. The Gators Pre-Roll 7-Pack (3.5g) has demonstrated steady sales performance, reflecting a slight dip from December 2025 but maintaining its top position. This consistent ranking over the months indicates strong consumer preference and market dominance in its category. The stability in its ranking suggests that it has effectively retained its customer base despite minor fluctuations in sales numbers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.