Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

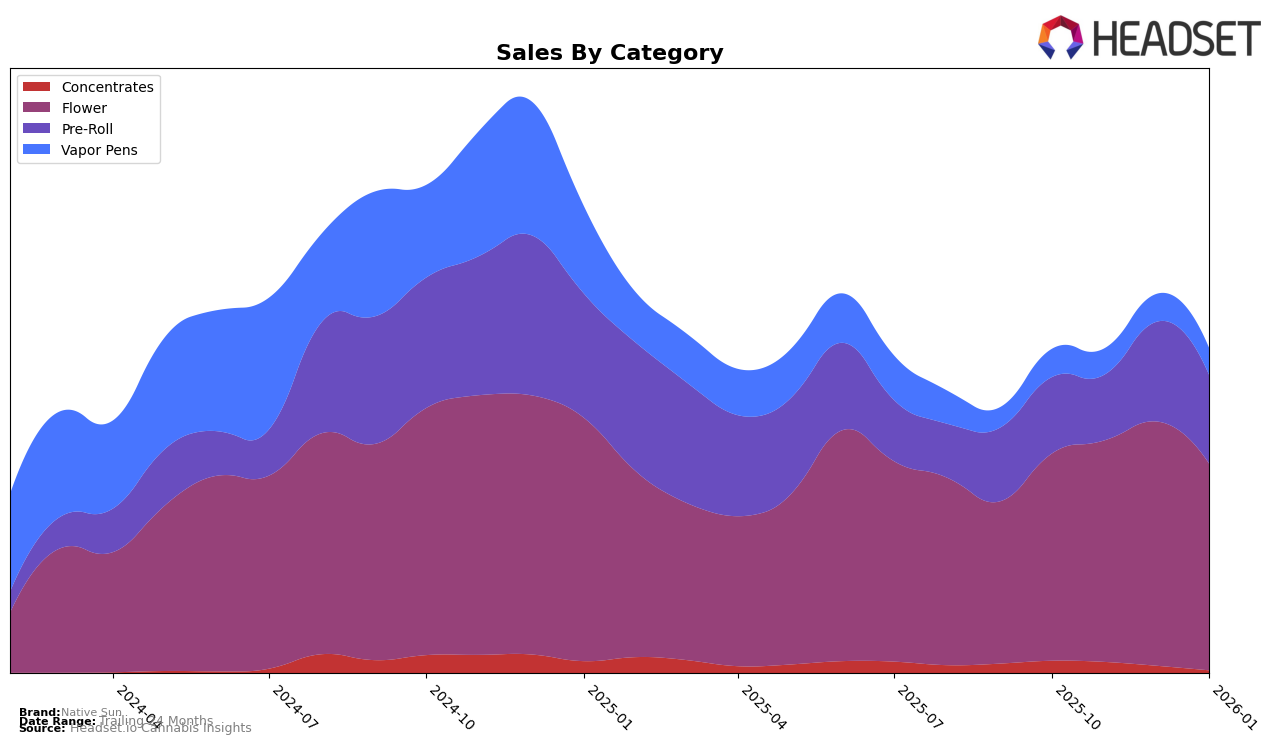

Native Sun has shown a varied performance across different product categories in Massachusetts. In the Concentrates category, the brand started with a rank of 19 in October 2025, but unfortunately, it fell out of the top 30 by January 2026, indicating a challenging period for this category. On the other hand, their Flower category demonstrated resilience and growth, climbing from rank 14 in October 2025 to a peak of rank 11 in December 2025, before settling at rank 15 in January 2026. This suggests that while the Concentrates market might be competitive, Native Sun's Flower products have maintained a strong presence and appeal among consumers in the state.

The Pre-Roll category for Native Sun showed notable improvement, with a jump from rank 23 in October 2025 to rank 15 by December 2025, before slightly dipping to 16 in January 2026. This upward trend in Pre-Rolls suggests a growing consumer interest and possibly an effective strategy in this segment. Conversely, the Vapor Pens category has struggled to gain traction, consistently ranking outside the top 30, with positions hovering around the mid-40s and 50s, indicating a potential area for strategic reevaluation. Overall, while Native Sun has shown strong performance in some categories, there are clear opportunities for growth and improvement, particularly in Concentrates and Vapor Pens.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Native Sun has experienced notable fluctuations in its rank and sales over the past few months. Starting in October 2025, Native Sun held the 14th position, climbing to 12th in November, and further improving to 11th in December. However, by January 2026, it slipped back to the 15th position. This fluctuation indicates a dynamic market environment where Native Sun faces stiff competition from brands like Strane, which maintained a relatively stable position despite a slight drop from 11th to 14th over the same period. Meanwhile, INSA showed a positive trend, moving up from 20th in October to 13th by January, potentially impacting Native Sun's market share. Additionally, NEA (Northeast Alternatives) experienced a significant drop in December, falling out of the top 20, which may have temporarily benefited Native Sun's ranking. These shifts highlight the importance for Native Sun to continually adapt its strategies to maintain and improve its competitive position in the Massachusetts flower market.

Notable Products

In January 2026, Kosher Kush Pre-Roll (1g) emerged as the top-performing product for Native Sun, climbing to the number one rank from the third position in December 2025, with notable sales of 3686 units. Blueberry Muffin Pre-Roll (1g) also showed strong performance, securing the second position, a rise from its previous unranked status in December. Larry Berry Pre-Roll (1g) maintained a consistent upward trajectory, reaching third place from fifth in the previous month. Blueberry Muffin (3.5g), while dropping to fourth place from second, continued to show robust sales. Stargazer Pre-Roll (1g) made its debut in the rankings at fifth place, indicating potential growth in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.