Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

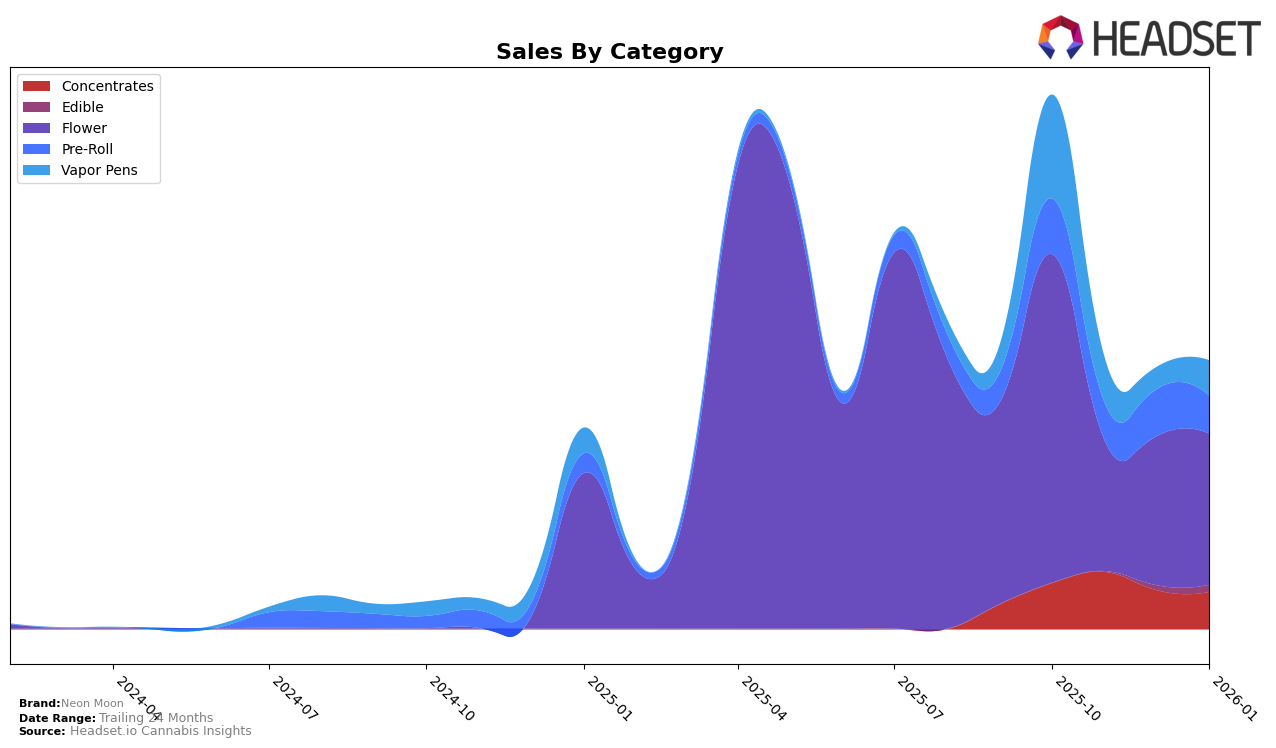

Neon Moon has demonstrated varied performance across different product categories in Nevada. In the Concentrates category, the brand has maintained a strong presence, peaking at rank 5 in November 2025, before stabilizing around rank 9 in December 2025 and January 2026. This suggests a consistent demand for their concentrate products, despite a slight drop in sales from November to January. On the other hand, the brand's performance in the Edible category is less prominent, as it did not make it into the top 30 rankings until January 2026, where it appeared at rank 31. This lack of presence in the top rankings for several months indicates potential areas for growth or a need to reassess their strategy in this category.

The Flower category has seen Neon Moon experience significant fluctuations in rankings within Nevada. The brand started strong in October 2025 with a rank of 8 but saw a substantial drop in November, landing at rank 27. However, there was a gradual recovery to rank 23 by January 2026, indicating a positive trend despite the initial setback. In Pre-Rolls, Neon Moon's performance also varied, with a notable dip in November 2025, followed by a recovery and subsequent decline by January 2026. Meanwhile, in the Vapor Pens category, the brand dropped out of the top 30 in December 2025, only to re-enter at rank 29 in January 2026, highlighting some volatility and potential challenges in maintaining a steady market presence. These insights suggest that while Neon Moon shows strength in certain areas, there are opportunities for improvement and stabilization across other product lines.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Neon Moon has experienced notable fluctuations in its ranking and sales trajectory from October 2025 to January 2026. Starting at a strong 8th position in October, Neon Moon saw a significant drop to 27th in November, before gradually improving to 23rd by January. This volatility contrasts with the more stable performance of competitors like Green Life Productions, which maintained a consistent presence in the top 20, and GB Sciences, which hovered around the mid-20s in rank. Despite these challenges, Neon Moon's sales rebounded from a dip in November, aligning closely with Khalifa Kush by January, suggesting a potential recovery in market share. This dynamic environment underscores the importance for Neon Moon to leverage advanced data analytics to better understand market trends and consumer preferences to regain its competitive edge.

Notable Products

In January 2026, Neon Moon's top-performing product was Old School Lemons Pre-Roll (1g) in the Pre-Roll category, climbing from fourth place in December 2025 to secure the first rank with sales of 1467 units. Banana Cream Truffles (14g) in the Flower category also saw a significant rise, moving from an unranked position in December to second place in January. 007 Up Pre-Roll (1g), which held the top spot in December, dropped to third place. Vanilla Custard Live Resin Batter (1g) entered the rankings for the first time in January, achieving fourth place in the Concentrates category. Glitter Bomb (14g) in the Flower category debuted in the rankings at fifth place, showcasing a strong entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.