Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

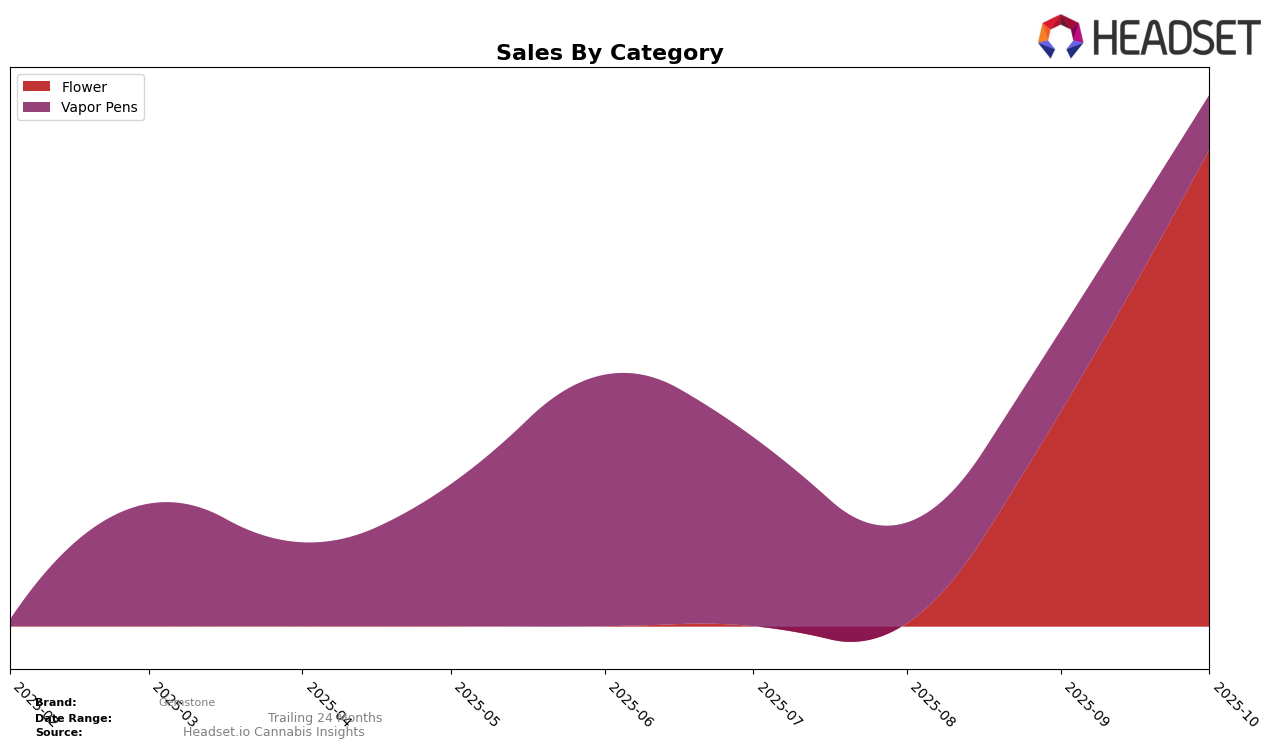

Gemstone's performance across different states and categories has shown varied momentum. In New York, the brand's presence in the Vapor Pens category was notable in July 2025, where it ranked 89th. However, in subsequent months, it did not maintain a position within the top 30, indicating a potential decline or increased competition in the market. This absence from the top 30 in the later months could be seen as a challenge for Gemstone to address in order to regain its standing in the Vapor Pens category in New York.

In contrast, Saskatchewan has shown a positive trajectory for Gemstone in the Flower category. The brand made its way into the rankings in September 2025 at 34th and improved to 24th by October 2025. This upward movement suggests a growing acceptance and popularity of Gemstone's Flower products in Saskatchewan, hinting at successful market strategies or product offerings that resonate well with consumers there. The increase in sales from September to October further supports this positive trend, marking Saskatchewan as a promising market for Gemstone's Flower category.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, Gemstone has shown a notable upward trajectory in its rankings, moving from outside the top 20 to securing the 24th position by October 2025. This is a significant improvement, especially considering that brands like FIGR experienced a decline, dropping from the 11th position in September to 21st in October, while JC Green Cannabis Company also fell from 19th to 26th in the same period. Meanwhile, North 40 Cannabis maintained a relatively stable position, slightly improving from 23rd to 22nd. Gemstone's rise in rank is accompanied by a notable increase in sales, indicating a positive market reception and potential for further growth. This trend suggests that Gemstone is successfully capturing market share from its competitors, positioning itself as a rising player in the Saskatchewan Flower market.

Notable Products

In October 2025, Cosmic Candy (3.5g) from Gemstone maintained its leading position as the top-selling product with sales reaching 442 units, showing a consistent performance from the previous month. Laughing Buddha (7g) made a significant debut, securing the second rank in the sales chart. Sour Chem (3.5g) followed closely as the third best-seller, demonstrating a strong entry into the top sales rankings. White Buffalo (3.5g) and Afghan Kush (3.5g) occupied the fourth and fifth positions respectively, both newly ranked in October. This indicates a shift in consumer preference towards these new entries compared to prior months where they were not ranked.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.