Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

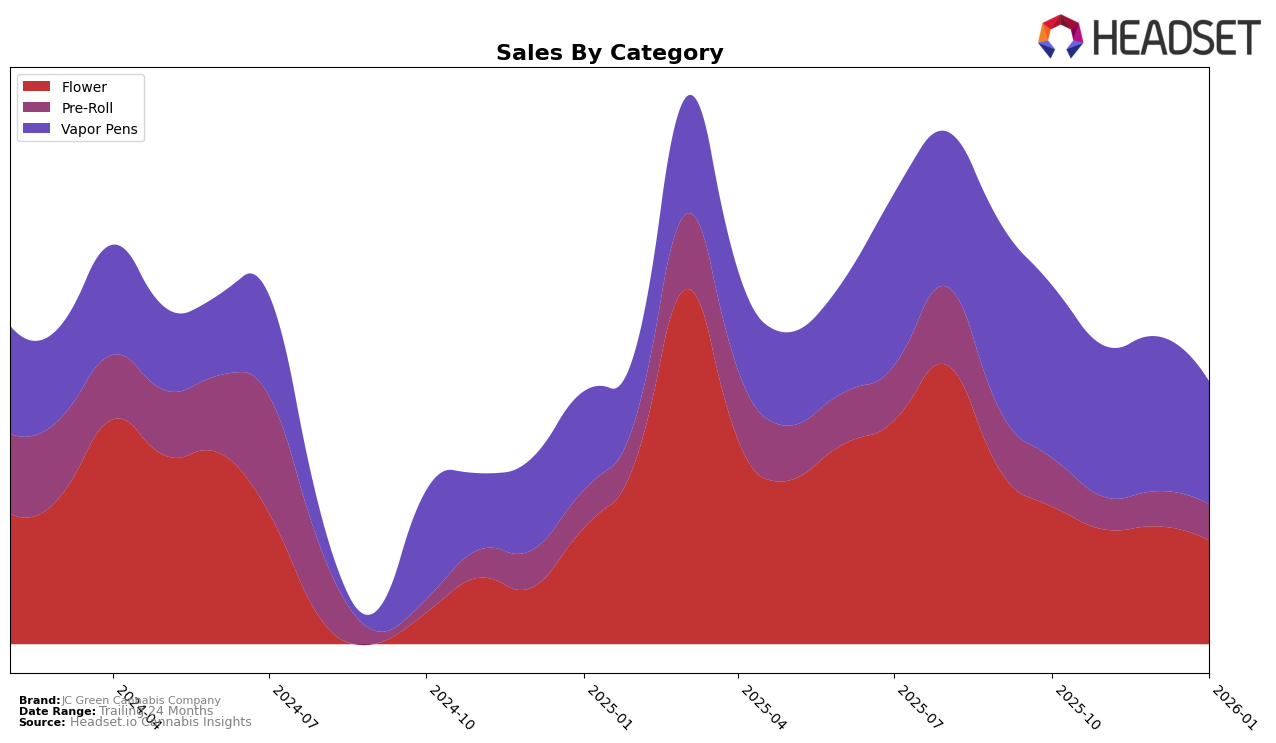

JC Green Cannabis Company has demonstrated varied performance across different product categories in Saskatchewan. In the Flower category, the brand maintained a position within the top 30, dropping out briefly in November 2025, but rebounding to the 27th spot by January 2026. This suggests a potential for stability or growth in this category, despite the fluctuations. In contrast, their performance in the Pre-Roll category has been less consistent, with rankings mostly outside the top 30, indicating challenges in gaining a strong foothold compared to competitors. Their presence in the Vapor Pens category, however, is notable, with rankings consistently within the top 20, although there was a decline to the 20th position by January 2026, hinting at a need for strategic adjustments to regain higher standings.

The sales trends for JC Green Cannabis Company reflect these category performances. While specific sales figures are not extensively detailed, it's evident that the Flower category experienced a decline in sales from October 2025 to January 2026, which aligns with their fluctuating rankings. The Vapor Pens category, despite its ranking drop, still showcases a significant sales volume, suggesting that it remains a strong revenue driver for the brand in Saskatchewan. These insights indicate areas where JC Green Cannabis Company can focus its efforts to enhance market presence, particularly in maintaining its Vapor Pens success and addressing the challenges faced in the Pre-Roll segment.

Competitive Landscape

In the competitive landscape of vapor pens in Saskatchewan, JC Green Cannabis Company has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 12th in October, JC Green saw a decline to 15th in November and December, before dropping to 20th by January. This downward trend in rank is mirrored by a decrease in sales, suggesting a potential loss of market share. Meanwhile, competitors like Phyto Extractions have shown a positive trajectory, climbing from 36th in November to 18th by January, with a significant increase in sales. Similarly, Jonny Chronic experienced a rank drop from 14th in November to 22nd in January, indicating volatility in the market. The Loud Plug re-entered the rankings at 19th in January, highlighting the dynamic nature of the competition. These shifts suggest that JC Green Cannabis Company may need to reassess its strategies to regain its competitive edge in the Saskatchewan vapor pen market.

Notable Products

In January 2026, the top-performing product for JC Green Cannabis Company was the Cherry Bomb Distillate Cartridge (1g) in the Vapor Pens category, maintaining its top rank from December 2025 despite a slight drop in sales to 931 units. The Cherry Bomb (7g) from the Flower category held steady at the second position, continuing its consistent performance over the past months. Notably, the Blueberry Kush Distillate Cartridge (1g) climbed to the third rank, up from fifth in December 2025, indicating increased consumer interest. The Big Tasty Watermelon Distillate Cartridge (1g) experienced a decline, dropping from third to fourth place, reflecting a downward trend in sales. Meanwhile, Cherry Bomb (3.5g) re-entered the rankings at fifth position, highlighting a resurgence in consumer demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.