Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

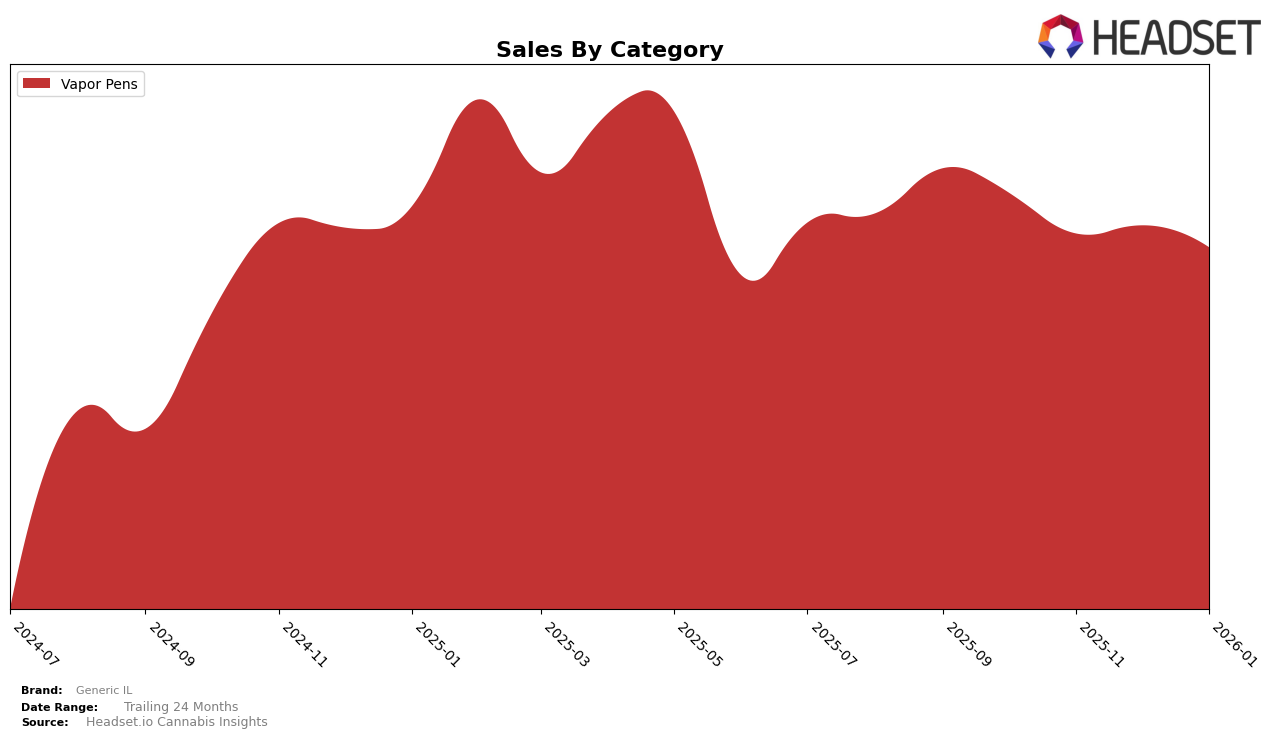

Generic IL has shown consistent performance in the Vapor Pens category within Illinois. Over the four-month period from October 2025 to January 2026, the brand maintained a steady presence in the rankings, fluctuating slightly between positions 16 and 19. This stability suggests a solid foothold in the market, though there was a noticeable drop in sales from October to January. The brand's sales peaked in October at $553,749 but experienced a decline over the subsequent months, ending at $492,964 in January. Despite this downward trend in sales, maintaining a top 20 rank indicates a strong brand presence and customer loyalty in the Illinois Vapor Pens category.

In terms of broader market presence, Generic IL's absence from the top 30 in other states and categories might be a point of concern or an opportunity for growth. The lack of rankings in other regions could suggest limited market penetration or a strategic focus on Illinois. This could be seen as a potential area for expansion, especially if the brand aims to diversify its market reach beyond its home state. The consistency in Illinois demonstrates the brand's capability to maintain a competitive position, which could be leveraged to explore new markets or strengthen its position in other product categories.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Generic IL has experienced fluctuations in its market position, reflecting a dynamic and challenging environment. Over the observed period, Generic IL's rank shifted from 16th in October 2025 to 19th by January 2026, indicating a slight decline in its competitive standing. This change is particularly notable when compared to brands like Ozone, which maintained a stronger presence, ranking as high as 14th in December 2025, and The Botanist, which despite a dip in December, managed to stay ahead of Generic IL. Meanwhile, Good News and Kanha / Sunderstorm showed a more stable trajectory, with Good News consistently outperforming Generic IL in sales. These competitive dynamics suggest that while Generic IL remains a significant player, it faces stiff competition from brands that are either maintaining or improving their market positions, emphasizing the need for strategic adjustments to regain and enhance its ranking and sales performance in the Illinois vapor pen market.

Notable Products

In January 2026, the top-performing product for Generic IL was the Pineapple Express Distillate Cartridge (1g) from the Vapor Pens category, maintaining its number one ranking for three consecutive months with a sales figure of 1463. The Granddaddy Purple Distillate Cartridge (1g) also retained its second-place position from December 2025, showing consistent popularity. Green Crack Distillate Cartridge (1g) improved its standing to third place, up from fourth in December. Alaskan Thunder Distillate Cartridge (1g) saw a decline in its rank, dropping to fourth place from third in the previous month. Kush And Cream Live Resin Cartridge (1g) entered the rankings in January 2026, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.