Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

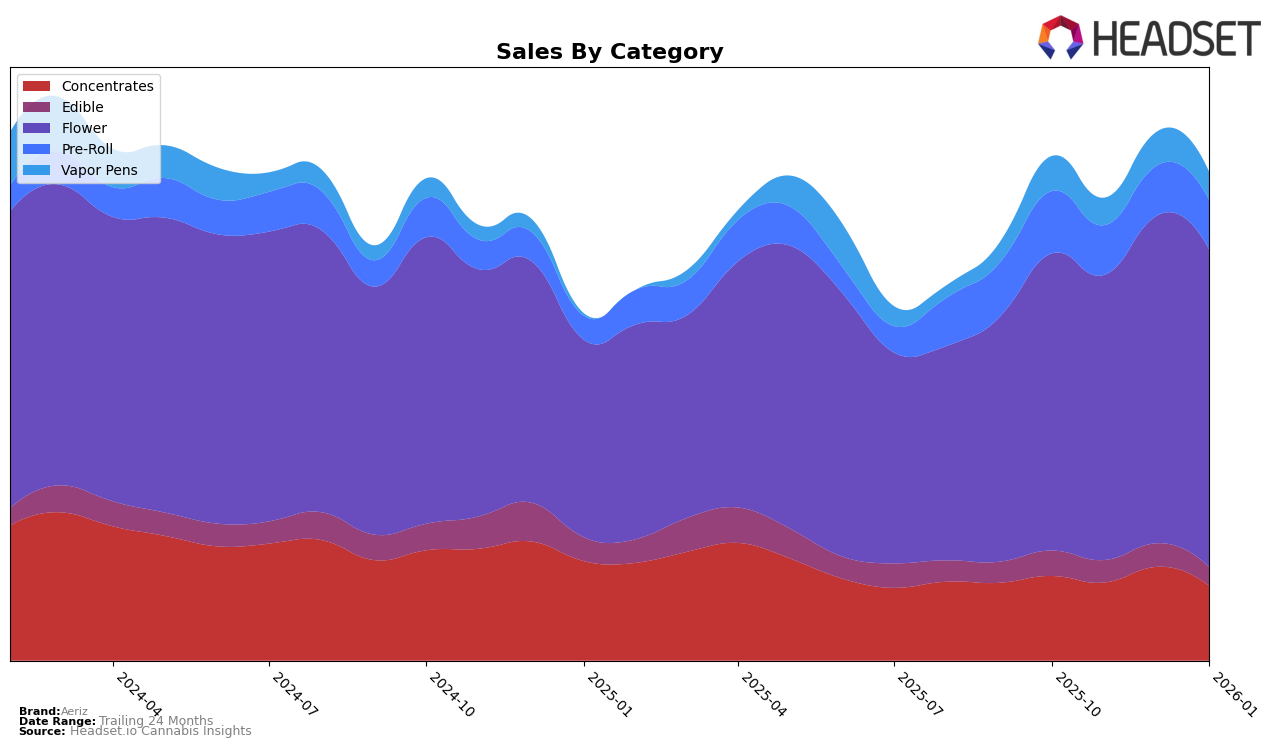

In Arizona, Aeriz has shown a consistent presence in the Flower category, although with some fluctuations in ranking. From October 2025 to January 2026, Aeriz's rank varied between 22nd and 26th position. Despite this fluctuation, there was a notable increase in sales from November to January, suggesting a rebound in consumer interest. However, their absence from the top 30 in other categories in Arizona indicates potential areas for growth and expansion.

In Illinois, Aeriz has maintained a stronghold in the Concentrates category, consistently holding the top rank over the observed months. This dominance indicates a strong brand presence and consumer loyalty within this category. In contrast, their performance in the Edible category shows a gradual decline from 14th to 18th place, which may suggest increased competition or shifting consumer preferences. Additionally, Aeriz's Flower category has seen a slight improvement, moving up from 6th to 5th place in December before settling back to 6th in January. This indicates a competitive but stable position in the Illinois market.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Aeriz has shown resilience and consistency in its rankings and sales. Despite facing strong competition, Aeriz maintained a steady presence, ranking 6th in October and November 2025, improving to 5th in December 2025, before slightly dropping back to 6th in January 2026. This stability is notable given the fluctuations experienced by competitors such as Ozone, which fluctuated between 5th and 7th place, and Simply Herb, which saw a notable rise from 7th to 4th place by January 2026. Meanwhile, Good Green consistently ranked higher than Aeriz, although its sales showed a downward trend from October to January. Aeriz's ability to maintain its rank amidst these shifts suggests a strong brand loyalty and market presence, positioning it well for future growth in the competitive Illinois flower market.

```

Notable Products

In January 2026, Jenny Kush Pre-Roll 2-Pack (1g) emerged as the top-performing product for Aeriz, climbing from fourth place in December 2025 to first place with sales reaching 5,839 units. Jenny Kush (3.5g), which consistently held the top rank from October to December 2025, slipped to second place, recording 5,488 units sold. White Peach Gelato Pre-Roll 2-Pack (1g) maintained a strong presence, securing the third position with a slight increase in sales compared to the previous month. GMO (3.5g) saw a decline in rank, moving from third to fourth, while Cash Cow Pre-Roll 2-Pack (1g) debuted in the fifth position. The rankings indicate a notable shift in consumer preference towards pre-roll products in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.