Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

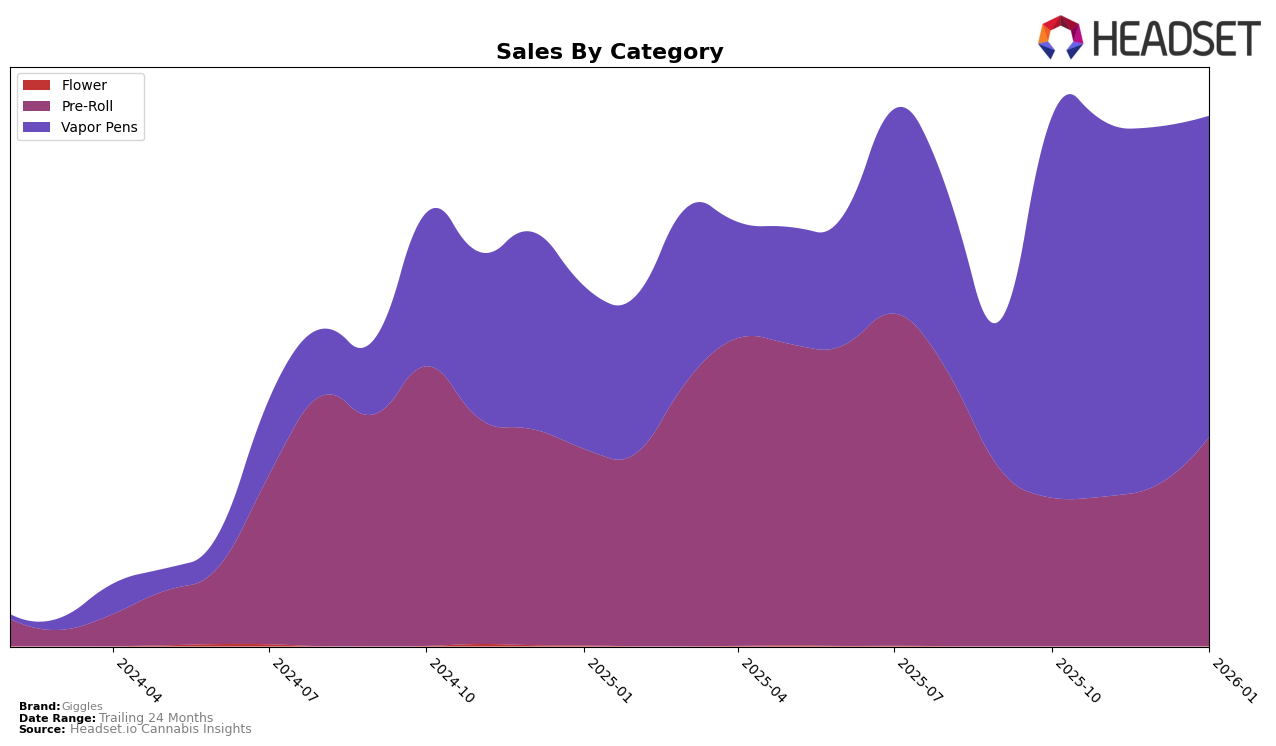

Giggles has shown notable performance improvements in the Michigan market, particularly in the Pre-Roll category. The brand experienced a significant upward trajectory, moving from a rank of 36 in October 2025 to 20 by January 2026. This progress suggests a strengthening presence and growing consumer preference for their Pre-Roll products in this state. Such a leap into the top 20 indicates a successful strategy or product innovation that resonated well with the local market. However, it's important to note that Giggles was not within the top 30 brands in this category just a few months prior, highlighting a rapid ascent that could be worth exploring further.

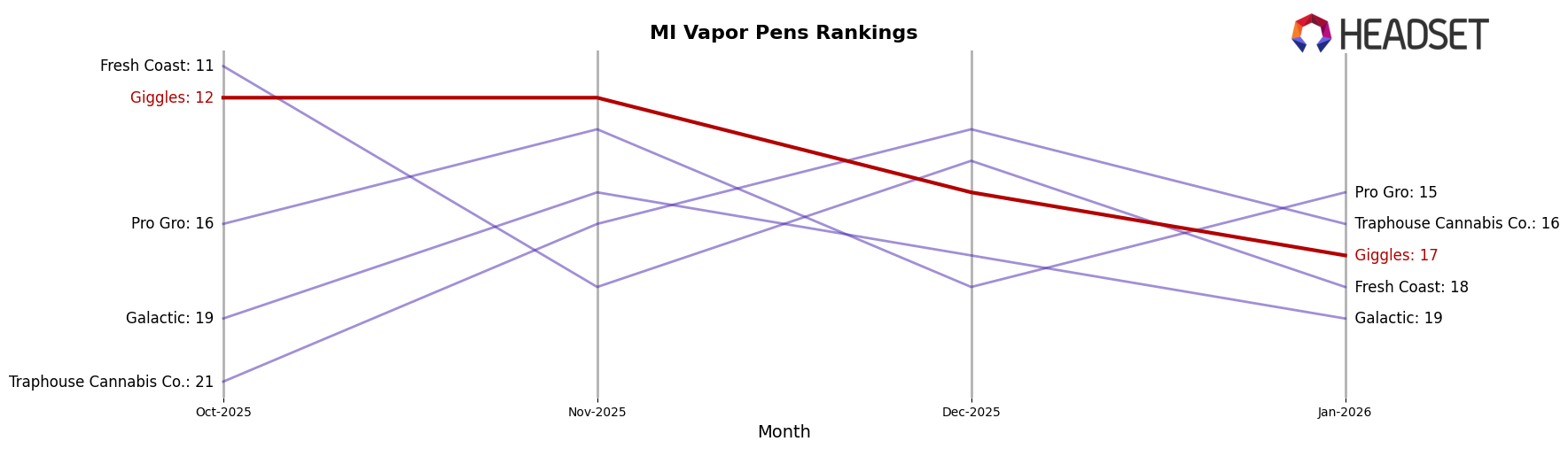

In contrast, Giggles' performance in the Vapor Pens category in Michigan appears to be on a downward trend. The brand maintained a steady rank of 12 in October and November 2025 but slipped to 17 by January 2026. This decline could suggest increasing competition or a shift in consumer preferences impacting their sales. Despite this, the brand's Vapor Pens remain within the top 20, indicating that while there may be challenges, Giggles still holds a significant market share. Observing these dynamics offers insight into the competitive landscape and potential areas for strategic adjustments.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Giggles has experienced notable fluctuations in its ranking, which could have implications for its market strategy and sales performance. While maintaining a steady rank of 12th in October and November 2025, Giggles saw a decline to 15th in December and further to 17th in January 2026. This downward trend contrasts with the performance of competitors like Traphouse Cannabis Co., which improved from 21st to 16th over the same period, and Pro Gro, which consistently hovered around the mid-teens. Meanwhile, Fresh Coast also experienced a drop from 11th to 18th, indicating a volatile market environment. Despite these shifts, Giggles' sales remained relatively stable, suggesting that while rank changes may reflect competitive pressures, the brand's customer base might still be loyal. Understanding these dynamics can help Giggles strategize to regain its competitive edge and potentially improve its rank and sales in the coming months.

Notable Products

In January 2026, the top-performing product from Giggles was the Giggle Stick - Oreoz Pre-Roll (1g), securing the first position with impressive sales of 11,545 units. Following closely was the Puffs - Watermelon OG Live Rosin Cartridge (1g), which climbed to second place from its previous fifth position in November 2025. The Puffs - Blue Slushie Live Hash Rosin Cartridge (1g) also saw a rise, moving to third place, showcasing a strong performance compared to its fifth rank in October 2025. Meanwhile, the Gigglesticks - Apricot Scone Pre-Roll (1g) debuted at fourth place, indicating growing consumer interest. Lastly, the Dragon Slayer - Watermelon Infused Pre-Roll (1.2g) dropped to fifth place from its previous top positions in late 2025, reflecting a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.