Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

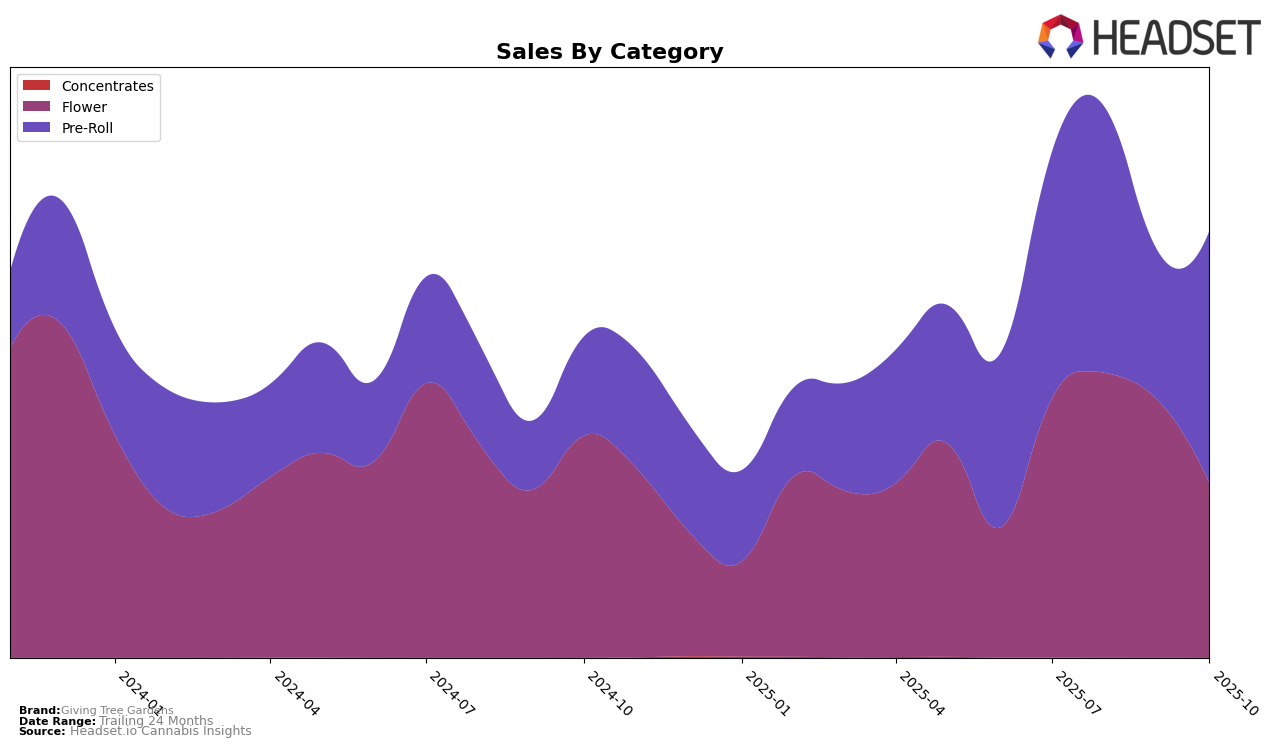

In the state of Michigan, Giving Tree Gardens has shown a varied performance across different cannabis categories. In the Flower category, the brand experienced a decline in rankings from July to October 2025, starting at 77th and dropping to 91st. This downward trend is indicative of challenges in maintaining a competitive position in this category, particularly as they fell out of the top 30. In contrast, the Pre-Roll category tells a different story. Here, Giving Tree Gardens improved its ranking from 34th in July to 27th in August, though it dipped to 49th in September before recovering to 29th by October. This fluctuation suggests a volatile but potentially positive trajectory in the Pre-Roll market, where they have managed to maintain a presence in the top 30 for most months.

The sales figures further illuminate these trends, with the Flower category seeing a significant decrease in sales from August to October, which correlates with their drop in ranking. On the other hand, the Pre-Roll category experienced a notable recovery in sales by October, aligning with their improved ranking. This rebound in the Pre-Roll segment could indicate successful strategic adjustments or market conditions favoring their products. However, the absence of Giving Tree Gardens in the top 30 for the Flower category in October is a critical point of concern, suggesting that while they have strengths in certain areas, challenges remain in others. This mixed performance across categories highlights the dynamic nature of their market presence in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan Pre-Roll category, Giving Tree Gardens has experienced notable fluctuations in its ranking over the past few months. Starting in July 2025, it was ranked 34th, but saw an improvement to 27th in August, before dropping significantly to 49th in September, and then recovering to 29th by October. This volatility in rank is indicative of a highly competitive market where brands like Redemption and Muha Meds are also vying for market share. Redemption, for instance, maintained a presence within the top 30, while Muha Meds showed a notable improvement from 33rd to 27th in October, surpassing Giving Tree Gardens. Despite these challenges, Giving Tree Gardens' sales rebounded in October, aligning closely with Muha Meds, suggesting a potential for regaining higher ranks if this positive sales trend continues. The market dynamics underscore the importance for Giving Tree Gardens to leverage strategic marketing and product differentiation to stabilize and enhance its position in this competitive sector.

Notable Products

In October 2025, the top-performing product from Giving Tree Gardens was Orange Tree Pre-Roll (1g), maintaining its leading position from September with sales reaching 22,712 units. Following closely was Mile High Club Pre-Roll (1g), which climbed from third place in September to second place in October. Forbidden Fruit Pre-Roll (1g) made a notable rise, moving from fifth to third place, indicating a significant increase in consumer interest. Space Cake Pre-Roll (1g) held steady in fourth place for consecutive months, while Captain Krunch Pre-Roll (1g) experienced a drop from second to fifth place, signaling a shift in consumer preferences. Overall, the rankings suggest a dynamic market with Orange Tree Pre-Roll consistently leading the sales charts.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.