Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

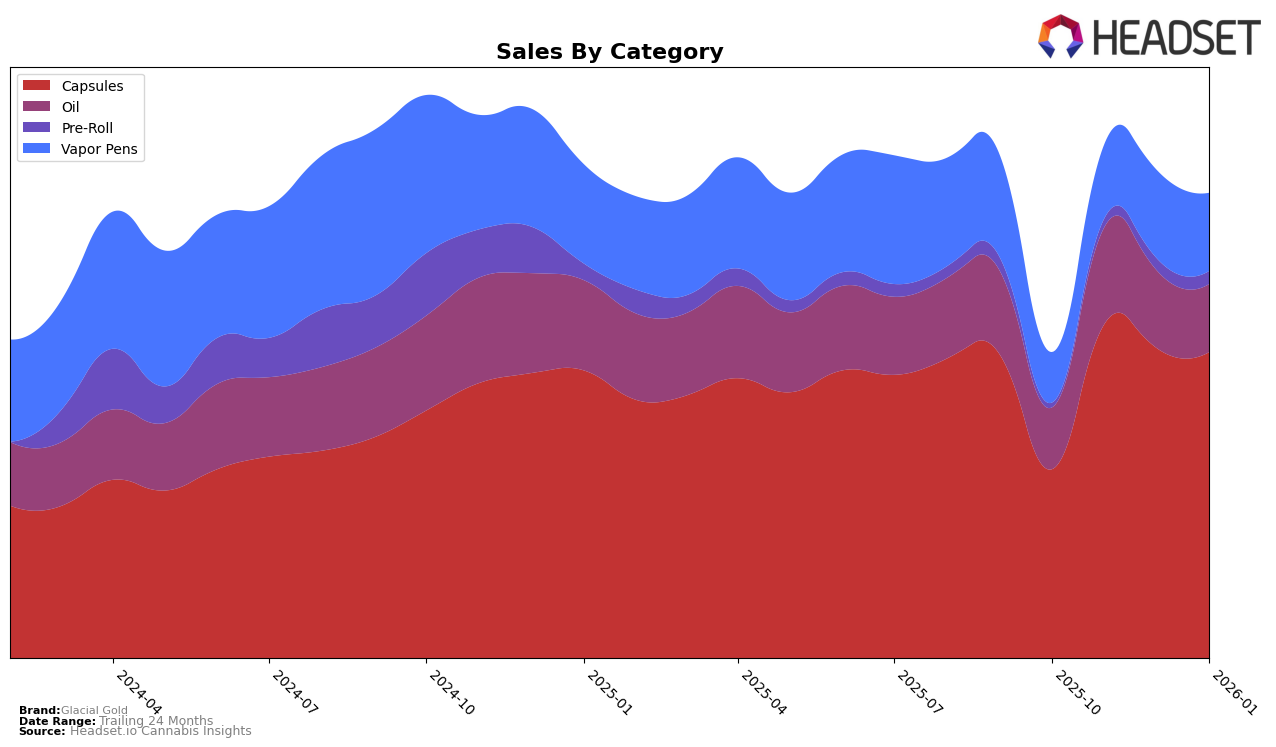

In the Canadian market, Glacial Gold has shown a strong and consistent performance in the capsules category, particularly in British Columbia and Alberta. In British Columbia, Glacial Gold has maintained the top position in both capsules and oil categories consistently over the past four months. This indicates a strong brand presence and consumer preference in these product lines. In Alberta, while the capsules category remains stable at the second rank, the vapor pens category has seen a decline, moving from 41st to 56th place, signaling potential challenges in maintaining its market position in this segment.

In Ontario, Glacial Gold's performance in the capsules category has been impressive, improving from 4th to 3rd place by January 2026. However, the oil category has seen a steady 5th place ranking, suggesting consistent yet limited growth. The vapor pens category in Ontario has shown some positive momentum, rising from 58th to 45th before slightly declining to 46th. Meanwhile, in Saskatchewan, the brand's presence is notable in the capsules category, ranking 3rd in October 2025 and January 2026, although data for the intervening months is missing, indicating a possible drop outside the top 30 during that period. This fluctuation highlights the competitive nature of the market and the challenges brands face in maintaining their rankings.

Competitive Landscape

In the competitive landscape of cannabis capsules in British Columbia, Glacial Gold has consistently maintained its top position from October 2025 to January 2026. This stability in rank underscores its dominance in the market, despite fluctuations in sales figures. Notably, Indiva has shown a strong upward trend, climbing from third place in October 2025 to secure the second position by November 2025, maintaining this rank through January 2026. Meanwhile, Emprise Canada experienced a slight decline, dropping from second to third place in November 2025 and remaining there. Although both competitors have shown improvements in their sales, they remain significantly behind Glacial Gold, which continues to lead the market by a substantial margin. This consistent leadership indicates Glacial Gold's strong brand presence and customer loyalty in the capsules category within the province.

Notable Products

In January 2026, the top-performing product from Glacial Gold was THC Softgels 100-Pack (1000mg) in the Capsules category, maintaining its number one rank for the third consecutive month with sales of 6,178 units. The CBD/THC 1:1 Balanced Softgel 50-Pack (500mg CBD, 500mg THC) rose to second place, showing an increase from its previous third-place position in December 2025. The CBD/THC 1:1 Balanced Softgel 100-Pack (1000mg CBD, 1000mg THC) ranked third, dropping from its second-place position in December. THC 10 Softgels 10-Pack (100mg) maintained a stable performance, ranking fourth, consistent with its December ranking. THC 10 Softgels 50-Pack (500mg) held its fifth-place rank, demonstrating steady sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.