Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

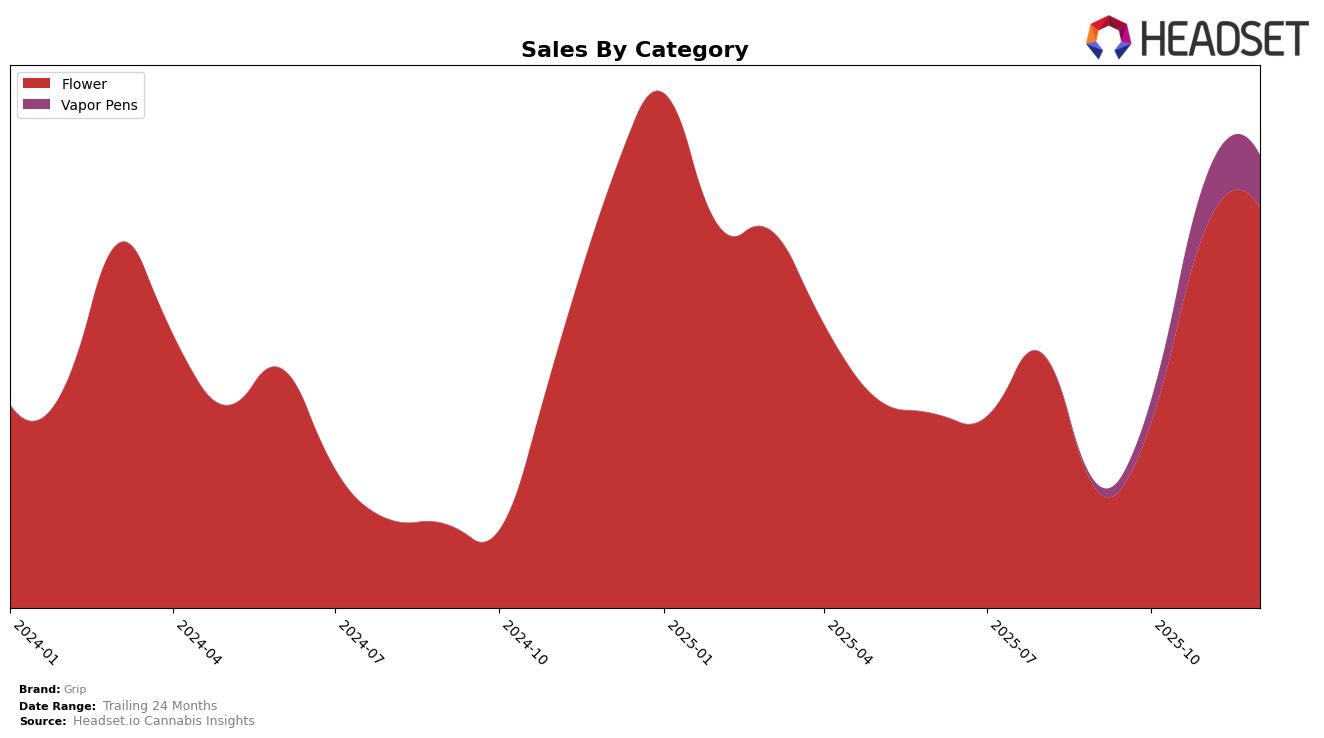

In the state of Michigan, Grip has demonstrated a notable upward trajectory in the Flower category. Starting from a rank of 51 in September 2025, the brand has surged to the 12th position by December 2025. This impressive climb is mirrored by their sales figures, which increased from approximately $469,004 in September to over $1.6 million by December. Such a significant leap in both rank and sales highlights Grip's growing presence and competitive edge in the Michigan market, particularly in the Flower category where they have successfully entered the top 15 brands.

In contrast, Grip's performance in the Vapor Pens category in Michigan presents a different narrative. While the brand was not ranked in the top 30 in September, it made its entry at position 76 in October, improving to 43 in November and 38 by December. Although the brand's sales in this category are not as high as in the Flower category, the consistent upward movement in rankings indicates a growing acceptance and potential for future growth. However, the absence from the top 30 in September suggests initial challenges in establishing a foothold in this category, which they seem to be overcoming gradually.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Grip has shown a remarkable upward trajectory in rankings over the last few months of 2025. Starting from a position of 51st in September, Grip surged to 12th by December, indicating a significant improvement in market presence and consumer preference. This rise is noteworthy when compared to competitors such as OG Farms, which experienced a decline from 9th to 14th during the same period, and Dubs & Dimes, which maintained a relatively stable position but did not achieve the same level of ascent as Grip. Meanwhile, Grown Rogue and Goldkine also demonstrated upward movement, yet Grip's rapid climb suggests a stronger consumer response and effective market strategies. This trend highlights Grip's potential to further capitalize on its momentum and continue gaining market share in the Michigan flower segment.

Notable Products

In December 2025, Donny Burger (28g) emerged as the top-performing product for Grip, climbing from fourth place in November to first place with impressive sales of 9,555 units. Permanent Marker (28g) made a notable entry into the rankings, securing the second position. Gelonade (28g) experienced a drop, moving from first place in November to third place in December. Fruity Pebbles (Bulk) maintained a consistent presence, retaining the fourth spot from its previous ranking in September. Galactic Gas (28g) entered the top five for the first time, capturing the fifth position.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.