Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

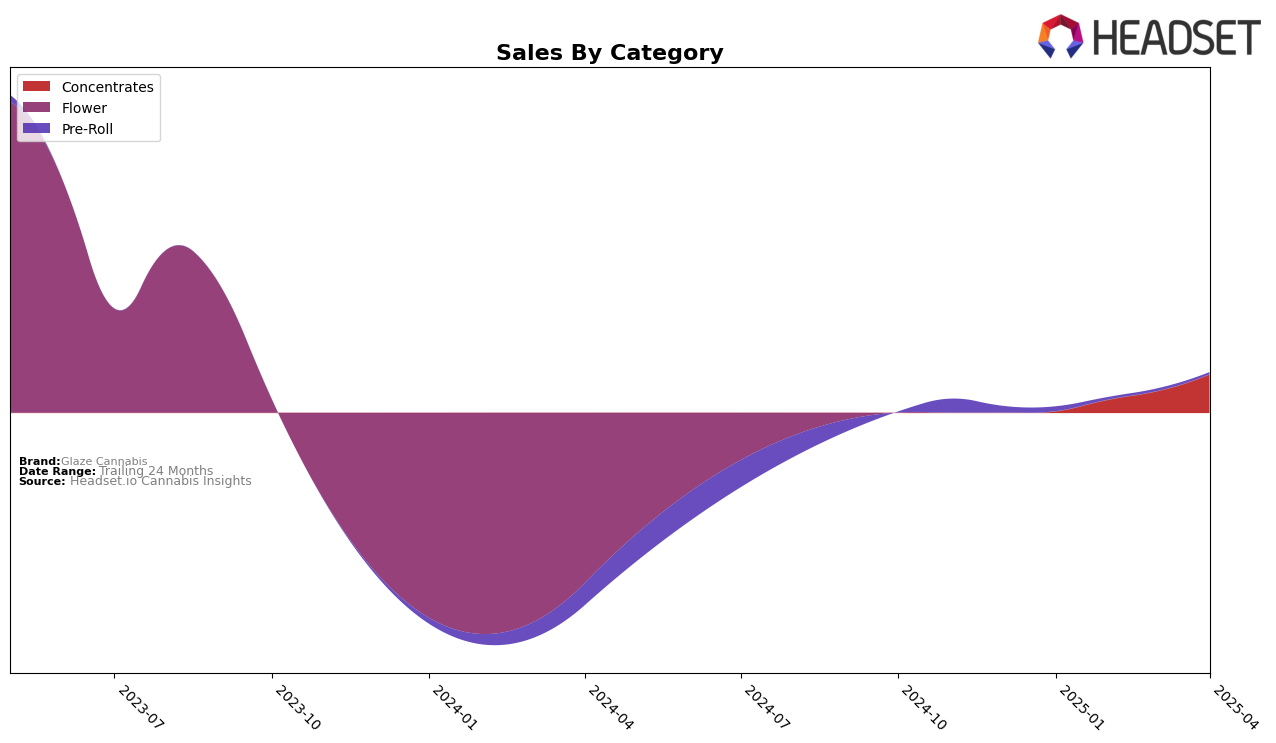

Glaze Cannabis has shown a notable upward trajectory in the concentrates category within Massachusetts. Starting the year outside the top 30, the brand made significant strides by March 2025, achieving a rank of 28th, and further improving to 20th by April. This highlights a consistent growth pattern and suggests a strengthening presence in the market. The absence of a ranking in January indicates that the brand was not among the top players initially, which emphasizes the impressive nature of its subsequent rise in rankings.

The sales figures for Glaze Cannabis in Massachusetts reflect this positive trend, with a substantial increase from February to April. This growth in sales volume suggests that the brand's strategies in the concentrates category are resonating well with consumers. The leap from not being ranked in January to breaking into the top 20 by April is a testament to their effective market penetration and consumer appeal. While specific sales numbers are not disclosed for January, the progression in the following months underscores a robust performance that could potentially lead to further market gains.

Competitive Landscape

In the Massachusetts concentrates category, Glaze Cannabis has shown a promising upward trend in its ranking over the first four months of 2025. Starting outside the top 20 in January, Glaze Cannabis made a significant leap to 37th in February, 28th in March, and finally reached the 20th position by April. This upward trajectory indicates a positive reception and growing market presence. In comparison, DRiP (MA) started strong at 12th in January but experienced a decline, dropping to 18th by April. Meanwhile, INSA showed a fluctuating performance, peaking at 15th in March before falling to 22nd in April. Fox Tales and Dab Fx also demonstrated volatility, with Fox Tales peaking at 13th in March and Dab Fx ending at 16th in April. This dynamic landscape suggests that while Glaze Cannabis is on an upward trend, maintaining this momentum will be crucial to compete effectively with established brands like DRiP (MA) and emerging competitors such as INSA.

Notable Products

In April 2025, Lemon Squares Wax (1g) emerged as the top-performing product for Glaze Cannabis, maintaining its number one rank from March with impressive sales of 820 units. Apple Ice Wax (1g) followed closely, climbing back to the second position after a dip in March. Peaches n Cream Wax (1g) secured the third spot, consistent with its performance in March. Blueberry Cake Wax (1g) remained in fourth place, showing stable sales figures across the months. Meanwhile, the Caramel Cake x Frosted Fruit Cake x Acai Berry Infused Pre-Roll 3-Pack (1.5g) held steady at the fifth position, reflecting a consistent demand for pre-rolls despite its top rank in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.