Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the state of Massachusetts, DRiP (MA) has shown a steady presence in the Concentrates category. Over the last few months, the brand has consistently ranked within the top 30, with a slight improvement from position 30 in October 2025 to 27 in November 2025, before settling at 29 in January 2026. This movement suggests a stable yet competitive performance, with sales peaking in December 2025 before experiencing a dip in January 2026. Such fluctuations could be indicative of seasonal demand or market dynamics, which might be worth exploring further for those interested in the nuances of market behavior in Massachusetts.

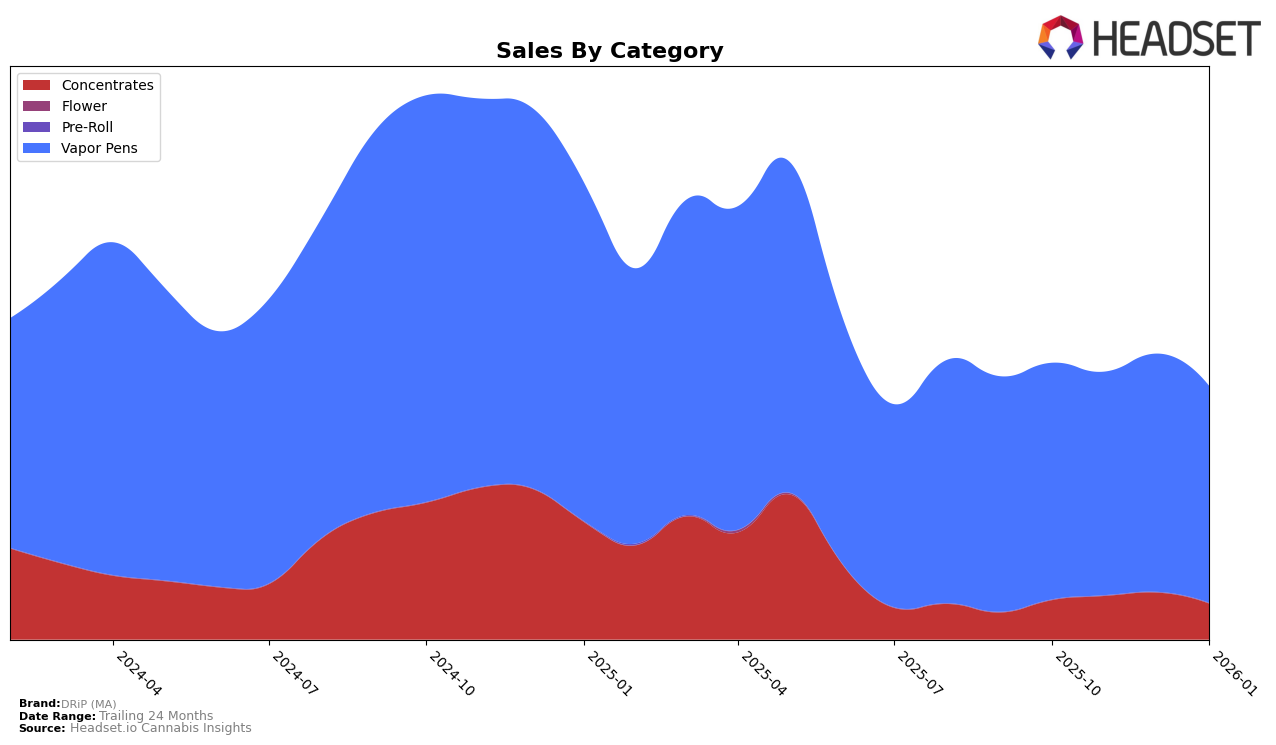

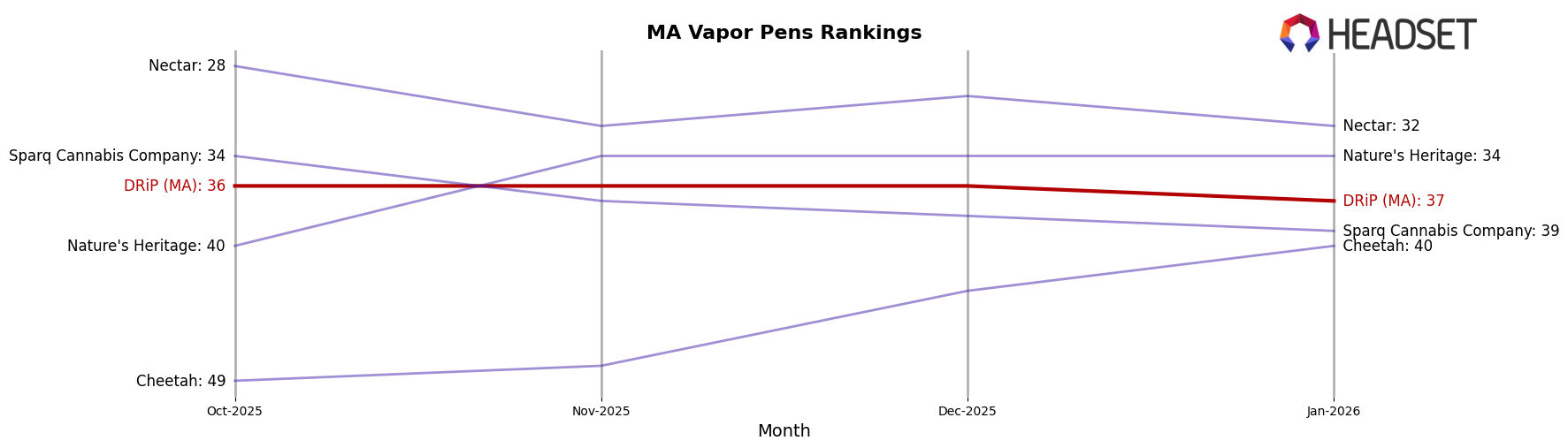

Conversely, in the Vapor Pens category, DRiP (MA) has struggled to break into the top 30 rankings, maintaining a position just outside this threshold at 36 through December 2025 and dropping slightly to 37 in January 2026. This consistent ranking outside the top 30 highlights a challenge for the brand in gaining traction within this category. Despite the lower rankings, the sales figures for Vapor Pens are significantly higher compared to Concentrates, which suggests a larger market size or higher consumer interest in this product type. Such insights could provide a strategic pivot point for DRiP (MA) to leverage its existing sales performance to improve its rankings in the coming months.

Competitive Landscape

In the competitive landscape of vapor pens in Massachusetts, DRiP (MA) has maintained a relatively stable position, ranking 36th from October to December 2025, before slightly dropping to 37th in January 2026. Despite this minor decline, DRiP (MA)'s sales figures have shown resilience, with a notable increase in December 2025. In contrast, Nature's Heritage improved its rank from 40th in October to 34th by November and maintained that position through January, reflecting a steady upward trend in sales. Meanwhile, Nectar experienced fluctuations in rank but consistently outperformed DRiP (MA) in sales, indicating a stronger market presence. Sparq Cannabis Company and Cheetah both trailed behind DRiP (MA) in terms of sales, with Sparq Cannabis Company seeing a decline in both rank and sales, while Cheetah showed a positive sales trajectory, climbing from 49th to 40th in rank by January 2026. These dynamics suggest that while DRiP (MA) faces stiff competition, particularly from Nature's Heritage and Nectar, there is potential for growth if strategic adjustments are made to capitalize on market trends.

Notable Products

In January 2026, the top-performing product for DRiP (MA) was the Cuban Linx Distillate Cartridge (1g) in the Vapor Pens category, which ascended to the number one rank with sales of 817.0. The Pure Michigan Distillate Cartridge (1g) maintained a strong presence, ranking second, although its sales decreased compared to December 2025. Sunset Sherbet Live Resin Cartridge (1g) made a notable climb to third place from its previous fifth position in December 2025. Snake Eyes Distillate Cartridge (1g) entered the rankings at fourth position for the first time. Valley Vixen Distillate Cartridge (1g), which had been the top product in November and December 2025, fell to fifth place as its sales significantly dropped.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.