Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

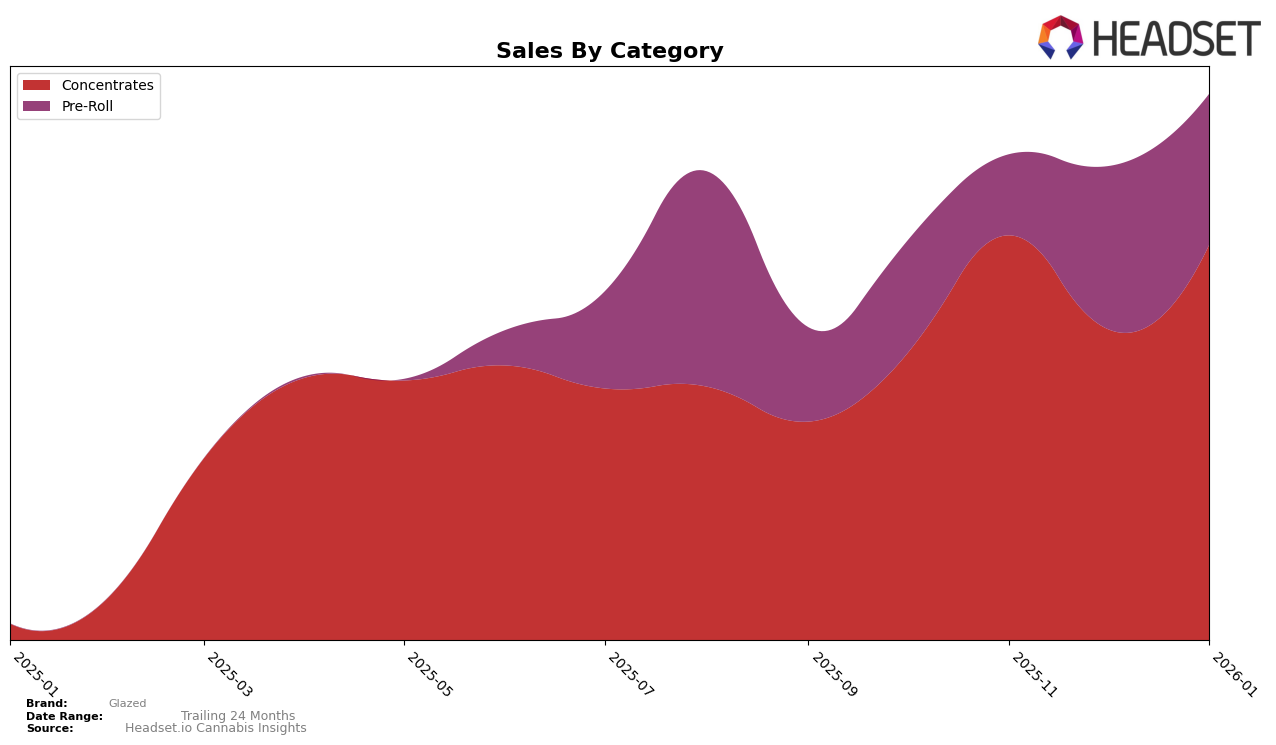

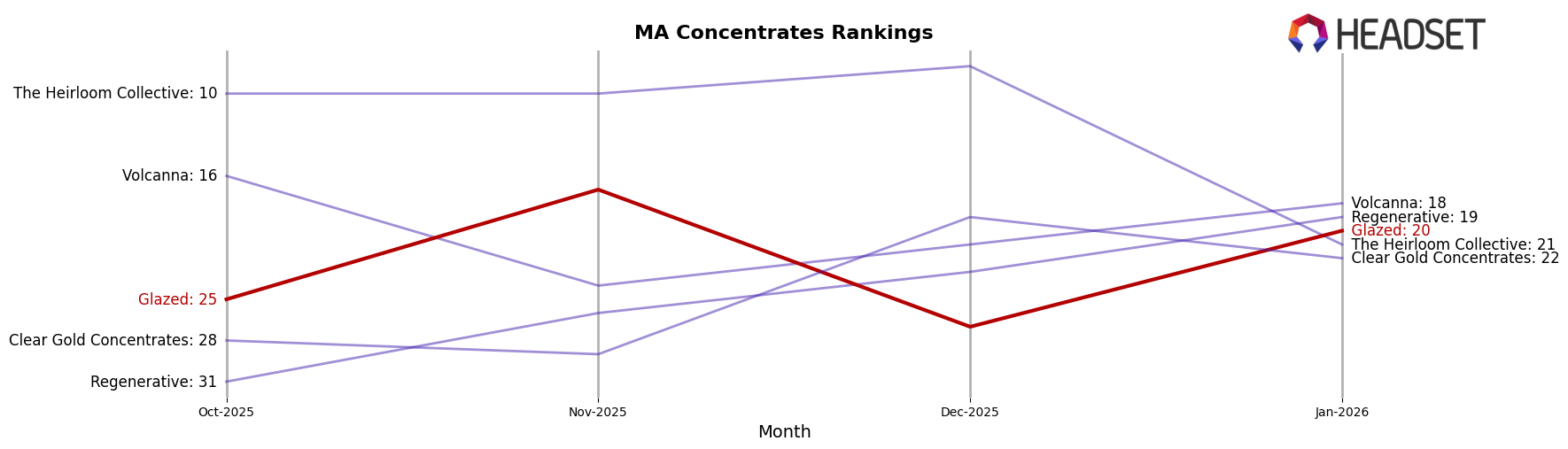

Glazed has demonstrated notable fluctuations in its performance across various categories and states over the recent months. In the state of Massachusetts, Glazed's ranking in the Concentrates category has shown a commendable improvement from October 2025 to January 2026. Initially ranked 25th in October, the brand climbed to 17th in November, though it slipped to 27th in December before recovering to 20th in January. This pattern indicates a dynamic presence in the market, with the brand experiencing both gains and losses in its competitive standing. Such volatility suggests a responsive market strategy that may be adapting to consumer preferences and seasonal trends.

While Glazed managed to maintain its presence within the top 30 in Massachusetts for the Concentrates category, the absence of rankings in other states or categories highlights areas for potential growth or concern. The brand's ability to recover its position in January after a dip in December could be indicative of strategic adjustments or promotional efforts that resonated with consumers. However, the lack of rankings in additional markets underscores the challenges Glazed faces in expanding its footprint or maintaining consistent performance across different regions. This could present both a challenge and an opportunity for the brand to explore new strategies or reinforce its efforts in markets where it is currently absent from the top tiers.

Competitive Landscape

In the Massachusetts concentrates market, Glazed has experienced fluctuating rankings over the past few months, indicating a dynamic competitive landscape. Starting from a rank of 25 in October 2025, Glazed improved to 17 in November, only to drop to 27 in December before recovering to 20 in January 2026. This volatility suggests that while Glazed can capture market attention, sustaining it is challenging amidst strong competition. Notably, The Heirloom Collective maintained a strong presence, ranking consistently high until a significant drop to 21 in January, which could indicate a potential opportunity for Glazed to capitalize on. Meanwhile, Volcanna and Clear Gold Concentrates have shown improvements in their rankings, suggesting they are gaining traction. The sales trends reflect these shifts, with Glazed's sales peaking in November but then declining, highlighting the need for strategic marketing efforts to sustain growth. Overall, Glazed's ability to navigate this competitive environment will be crucial for maintaining and improving its market position.

Notable Products

In January 2026, Peaches N' Cream Infused Pre-Roll (1g) emerged as the top-performing product for Glazed, securing the number one spot with a notable sales figure of 469 units. Blueberry Cake Wax (1g) followed closely, ranking second, showing a slight decline from its first-place position in November 2025. Sour Dubb Infused Pre-Roll 3-Pack (1.5g) maintained a strong presence, ranking third, consistent with its performance in December 2025. Apple Pie Flavored Wax (1g) held the fourth position, experiencing a slight drop from its second-place ranking in the previous month. Surf Storm Wax (1g) rounded out the top five, showing a downward trend from its earlier rank of second in October and November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.