Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

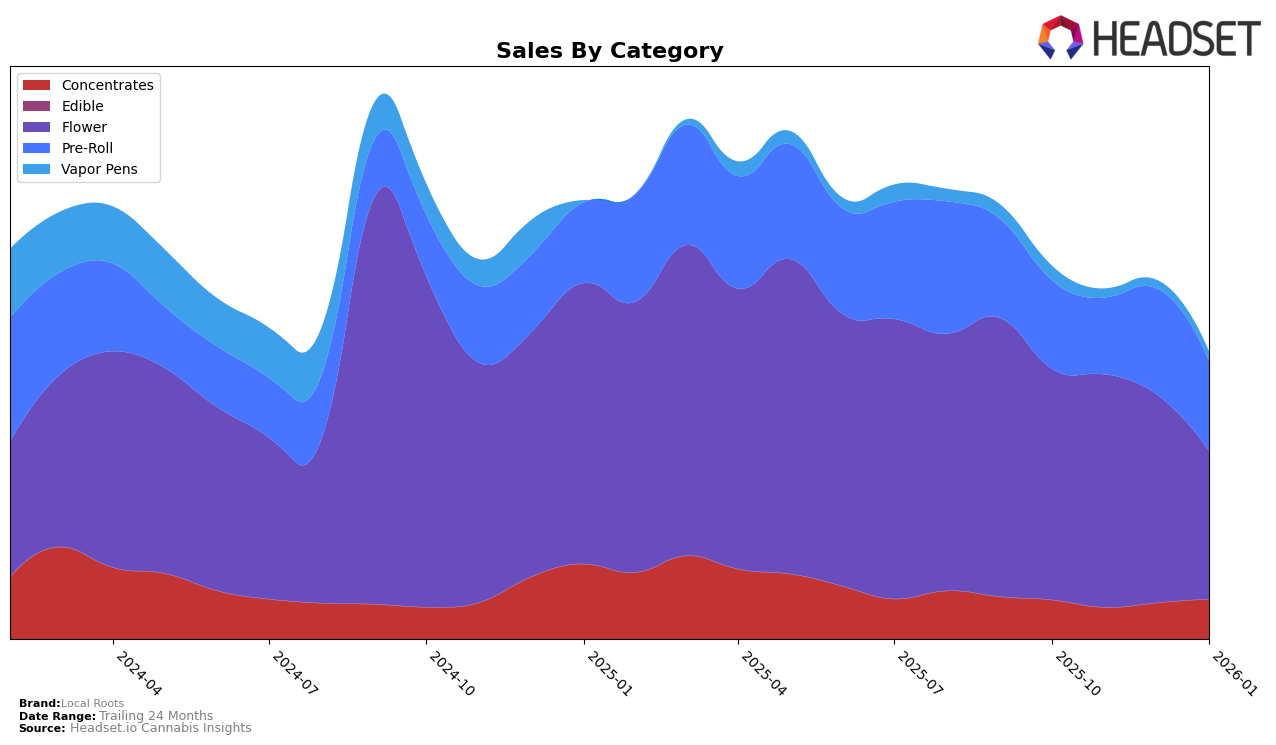

Local Roots has shown a dynamic performance across different product categories in Massachusetts. In the Concentrates category, the brand improved its ranking from 16th in November 2025 to 12th by January 2026, indicating a positive trend in consumer preference. However, the Flower category tells a different story, where Local Roots fell out of the top 30 by January 2026, dropping from 38th in December 2025 to 50th. This decline suggests a potential challenge in maintaining competitiveness in this highly popular segment. The Pre-Roll category saw a significant improvement from 56th in November 2025 to 37th in December, although the brand could not maintain the momentum into January 2026, slipping slightly to 38th.

In the Vapor Pens category, Local Roots had a fluctuating presence, ranking 93rd in October 2025, disappearing from the top 30 in the following months, and then reappearing at 96th in January 2026. This inconsistency might reflect a volatile market or changes in consumer preferences that the brand is yet to fully capitalize on. Notably, the absence of Local Roots in the top 30 rankings for several months suggests that while they have a presence, there is significant room for growth and improvement in this category. Overall, while Local Roots shows strong potential in some areas, there are clear opportunities for strategic adjustments to enhance their market position across various product categories in Massachusetts.

Competitive Landscape

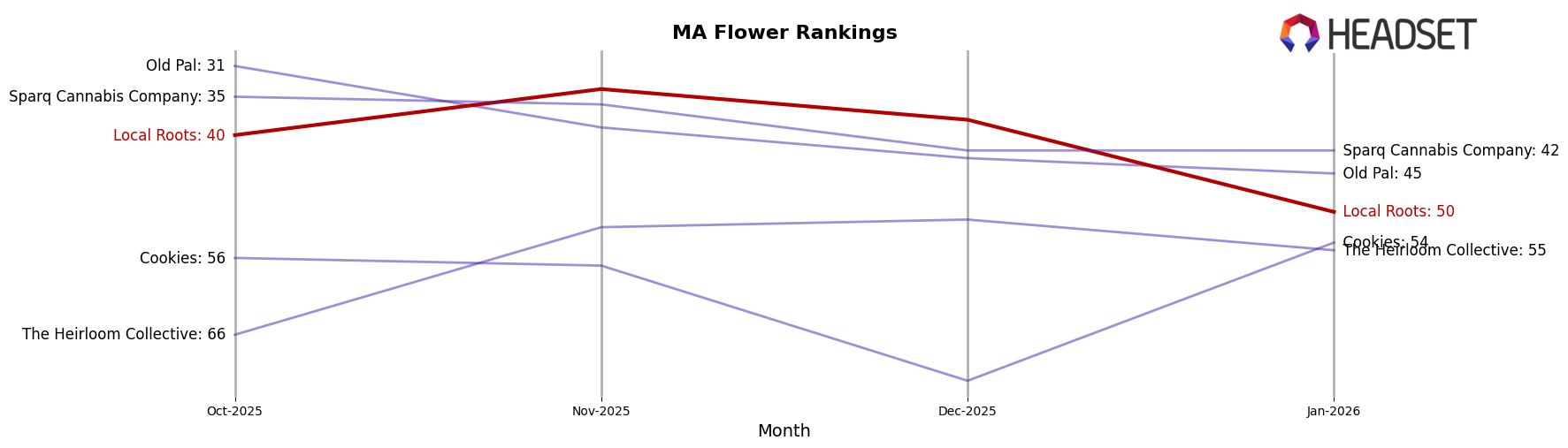

In the Massachusetts flower category, Local Roots experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 40th in October, Local Roots improved to 34th in November, but then saw a decline to 50th by January. This volatility contrasts with competitors like Old Pal, which maintained a relatively stable position, albeit with a slight decline from 31st to 45th over the same period. Meanwhile, Sparq Cannabis Company showed consistency, holding ranks in the mid-30s to low-40s. In terms of sales trends, Local Roots' sales peaked in November before a significant drop in January, mirroring its rank decline. Competitors such as Cookies and The Heirloom Collective also experienced sales fluctuations, but their rank changes were less pronounced, suggesting Local Roots may need to address factors impacting its market stability to enhance its competitive standing.

Notable Products

In January 2026, the top-performing product for Local Roots was the Blueberry Hashplant Pre-Roll (1g) in the Pre-Roll category, regaining its top position from October 2025 with a notable sales figure of 3682 units. The Blue Dream x Blowfish Pre-Roll (1g) climbed the ranks to secure the second position, showing strong performance despite not being ranked in October and November 2025. The Blueberry Hashplant (3.5g) in the Flower category, which held the top rank in December 2025, dropped to third place in January 2026. Jack Skunk Pre-Roll (1g) entered the rankings in November 2025 and maintained a steady position at fourth in January 2026. Bubba Cheese Pre-Roll (1g) debuted in the rankings in December 2025 and held its fifth-place position consistently in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.