Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

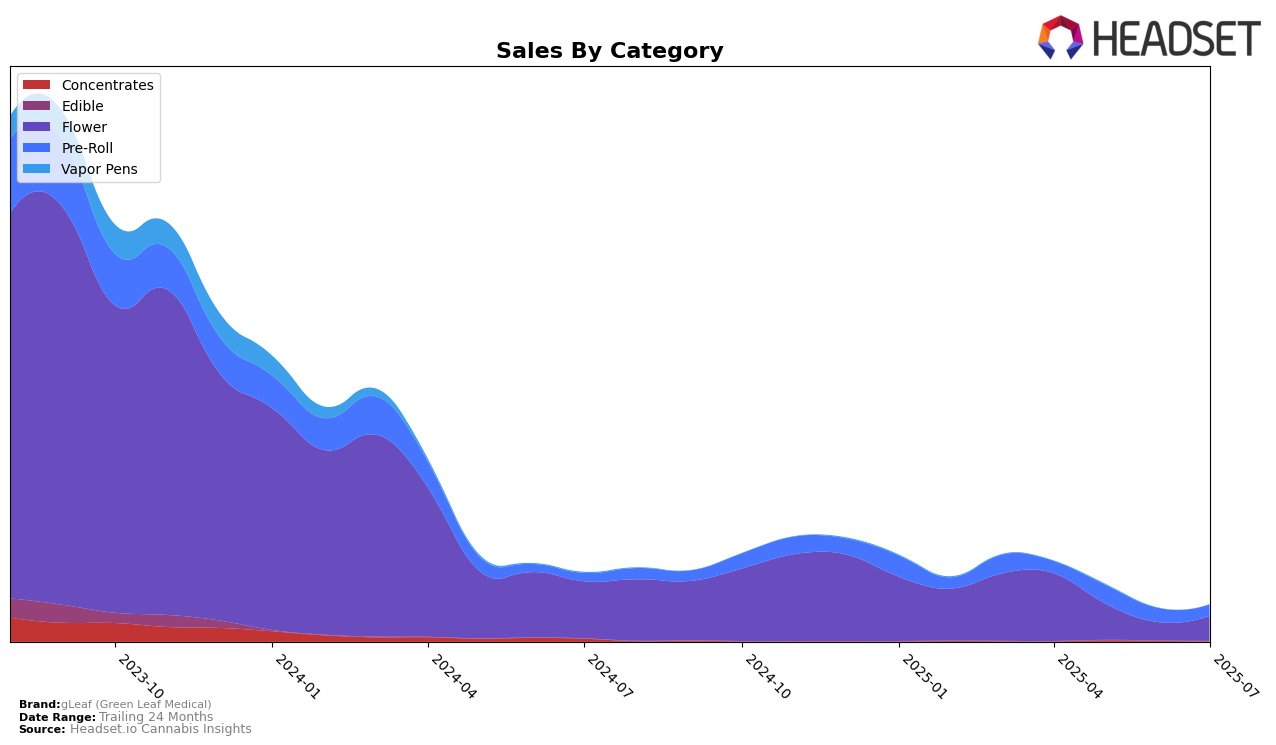

gLeaf (Green Leaf Medical) has experienced varied performance across different product categories in Maryland. In the Flower category, gLeaf saw a decline in its ranking from 22nd in April 2025 to 37th by July 2025, indicating a challenging period in maintaining its market position. This downward trend is also reflected in the significant drop in sales, from $434,044 in April to $159,116 in July, suggesting a potential shift in consumer preferences or increased competition. The brand's struggle to stay within the top 30 brands in the Flower category during June and July highlights the competitive nature of the market.

In contrast, gLeaf's performance in the Pre-Roll category in Maryland has been relatively stable, with rankings fluctuating slightly between 23rd and 27th from April to July 2025. Despite this stability, the sales figures show a decrease from May to July, after a peak in May. This indicates that while gLeaf manages to maintain a consistent presence in the Pre-Roll market, it faces challenges in sustaining sales growth. The brand's ability to stay within the top 30 in this category throughout the observed months suggests a stronger foothold compared to its Flower category performance, yet there remains room for improvement to climb higher in the rankings.

Competitive Landscape

In the competitive landscape of the flower category in Maryland, gLeaf (Green Leaf Medical) has experienced notable fluctuations in its market rank and sales performance. Starting from April 2025, gLeaf was ranked 22nd but saw a decline to 37th by July 2025, indicating a challenging period for the brand. In contrast, LivWell initially ranked 20th in April and managed to improve its position to 19th in May before dropping out of the top 20 by June. Meanwhile, Belushi's Farm showed some resilience, climbing from 42nd in April to 37th in June, only to slightly drop to 38th in July. Curaleaf re-entered the rankings at 39th in July, suggesting a potential upward trend. Flower by Edie Parker maintained a relatively stable presence, hovering around the mid-30s throughout the period. These dynamics highlight the competitive pressures gLeaf faces, as it contends with brands like LivWell and Belushi's Farm that have shown more consistent or improving performance in the Maryland flower market.

Notable Products

In July 2025, gLeaf (Green Leaf Medical) saw Gummie Bunz (3.5g) leading the sales as the top-performing product in the Flower category, achieving the number one rank with a sales figure of 1799 units. Following closely was Orangutan T (3.5g), also in the Flower category, securing the second rank. Cherrylicious Pre-Roll 2-Pack (1g) ranked third, while Vanilla Frosting Pre-Roll (1g) and Gummie Bunz Pre-Roll 2-Pack (1g) took the fourth and fifth positions, respectively, in the Pre-Roll category. Notably, these products were not ranked in the previous months, indicating a significant shift in consumer preference or marketing strategy. This change suggests a strong monthly performance for gLeaf, particularly in the Flower and Pre-Roll categories.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.