Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

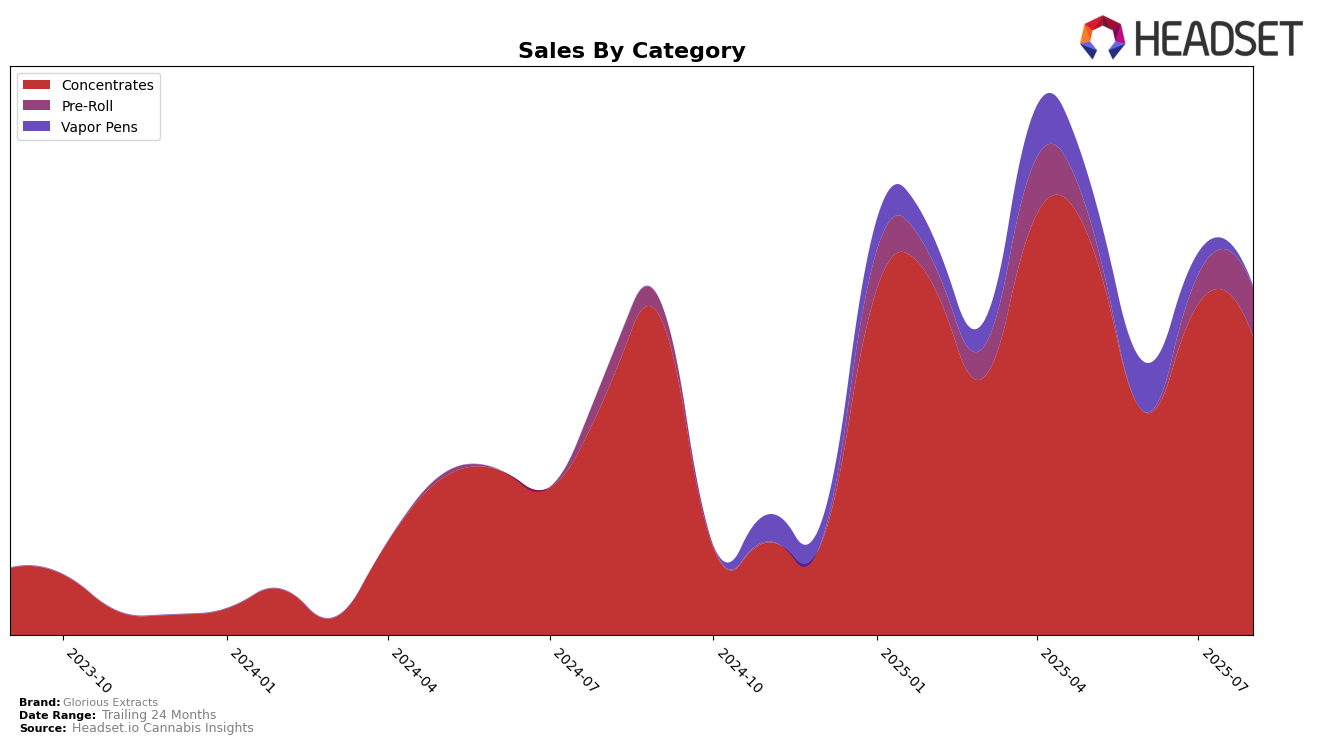

In the state of Arizona, Glorious Extracts has shown a fluctuating performance in the Concentrates category over the past few months. Starting in May 2025, the brand was ranked 27th, but it dropped to 30th in both June and July before climbing back up to 24th in August. This movement indicates a resilient comeback in the latter part of the summer, suggesting potential strategic adjustments or market responses that might have influenced their improved ranking. The sales figures reflect this variability, with a noticeable dip in June followed by a recovery in the subsequent months.

It's worth noting that Glorious Extracts managed to maintain a presence within the top 30 brands in Arizona throughout this period, which is a positive sign of their market stability despite the competitive landscape. However, their absence from the top 30 in other states or categories could be a point of concern, emphasizing the need for broader geographic or category expansion to enhance their market footprint. This mixed performance across different metrics and locations highlights the challenges and opportunities Glorious Extracts faces in solidifying its position in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Arizona concentrates market, Glorious Extracts has experienced fluctuating rankings over the summer of 2025, indicating a dynamic competitive environment. While Glorious Extracts was ranked 27th in May, it saw a slight dip to 30th in June and July, before improving to 24th in August. This improvement in August suggests a positive trend, although the brand still faces stiff competition from others like Hi-Klas, which consistently held a higher rank, maintaining a 23rd position from June to August. Meanwhile, Abundant Organics and Summus both showed varied performance, with Summus notably jumping from 36th in July to 21st in August, surpassing Glorious Extracts. Project Packs, which appeared in the rankings in July at 19th, also presents a competitive challenge. These shifts highlight the importance for Glorious Extracts to strategize effectively to maintain and improve its market position amidst a competitive and evolving market landscape.

Notable Products

In August 2025, the top-performing product for Glorious Extracts was Terp Truck Live Resin Badder (1g) in the Concentrates category, maintaining its first-place position from the previous month with sales of $162. Cherry Gary Live Resin Badder (1g) also held steady in second place, showcasing consistent popularity. Dulce de Uva Live Hash Rosin (1g) remained in third place, indicating stable demand for this product. The Champagne Mints x MCC Hash Hole Infused Pre-Roll (2g) improved its ranking, moving up from fifth to fourth place, highlighting a growing interest in pre-rolls. Meanwhile, Jungle Fire Live Rosin (1g) entered the rankings at fifth place, suggesting a new contender in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.