Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

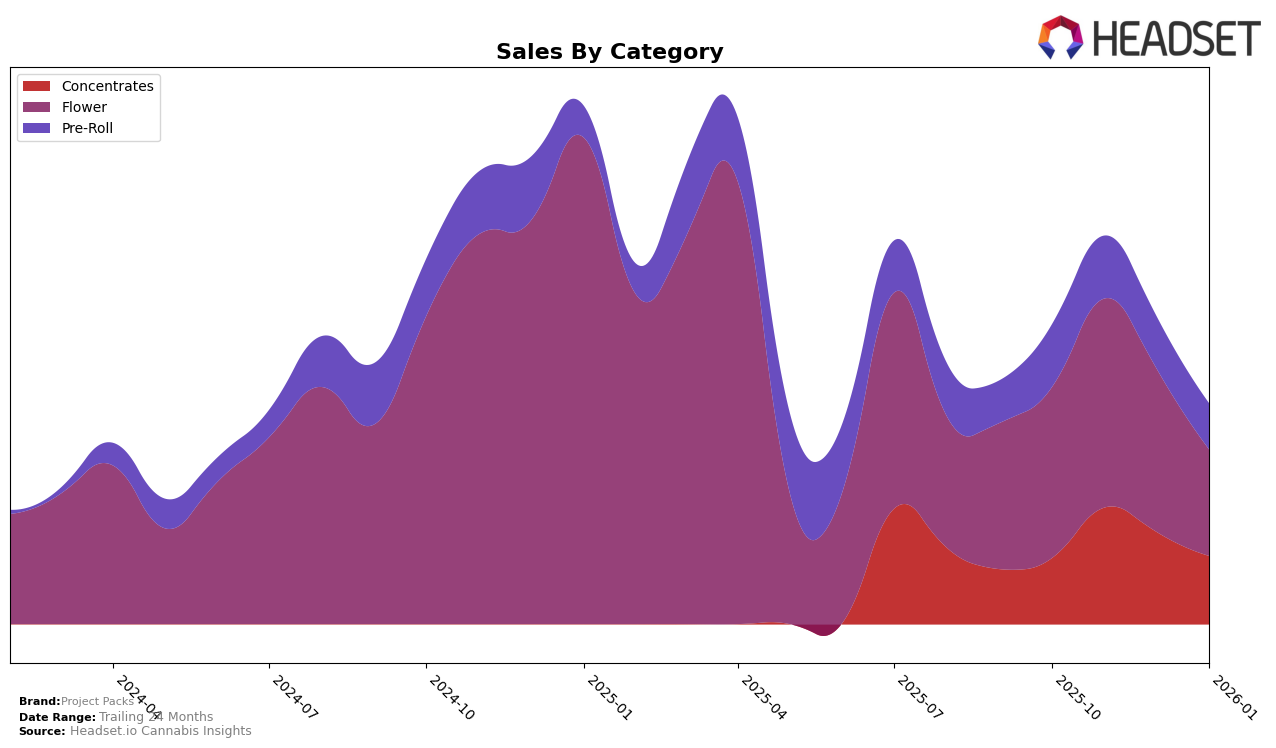

In the state of Arizona, Project Packs has shown fluctuating performance across various categories. Notably, in the Concentrates category, the brand managed to climb up to the 22nd rank in November 2025, a significant improvement from barely making the top 30 in October. However, the subsequent months saw a slight decline, with the brand ranking 24th in December and dropping to 29th by January 2026. This movement indicates a volatile presence in the Concentrates market, suggesting that while there is potential for growth, consistency remains a challenge. The Flower category tells a slightly different story, with Project Packs not breaking into the top 30 at all, peaking at 43rd in November, and slipping to 52nd by January. This underlines a need for strategic adjustments if the brand aims to gain a stronger foothold in this highly competitive segment.

When examining the Pre-Roll category, Project Packs' performance in Arizona also reflects a struggle to secure a top-tier position. The brand consistently hovered outside the top 50, with its best rank being 53rd in November 2025. Despite maintaining a relatively stable position, with only minor fluctuations, the brand did not manage to break significant ground, as evidenced by its rank of 56th in January 2026. This static performance may indicate a saturation point or a need for differentiation in their product offerings. Interestingly, while sales figures reveal some ups and downs, the lack of a breakthrough into the top 30 across these categories suggests a potential area for growth and strategic focus for Project Packs moving forward.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Project Packs has experienced fluctuating rankings and sales figures over the recent months, indicating a dynamic market position. From October 2025 to January 2026, Project Packs saw a decline in rank from 48th to 52nd, with a corresponding decrease in sales from $74,547 to $46,261. This downward trend contrasts with brands like Varz, which maintained a relatively stable position, ranking between 42nd and 47th, and Tyson 2.0, which re-emerged in the rankings at 39th in December 2025 but dropped to 48th by January 2026. Meanwhile, Uncle X experienced a significant drop from 33rd to 60th, highlighting the volatility in this market. These shifts suggest that while Project Packs faces challenges in maintaining its rank, there is potential for recovery and growth if strategic adjustments are made, especially considering the competitive movements of other brands in the Arizona Flower market.

Notable Products

In January 2026, Project Packs' top-performing product was The Wow Pre-Roll 2-Pack (2g), which climbed to the number one spot from fourth place in December 2025, with sales reaching 648 units. Obsidian (3.5g) maintained its strong performance, holding steady at second place with 398 units sold. Lemon Kush Live Resin Badder (1g) emerged as a notable contender, securing the third position. Sugar Berry Cold Cure Live Rosin Badder (1g) and Poison Pre-Roll 2-Pack (2g) entered the rankings at fourth and fifth positions, respectively, indicating a growing interest in concentrates and pre-rolls. The January rankings reflect a shift in consumer preference towards pre-rolls and concentrates compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.