Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

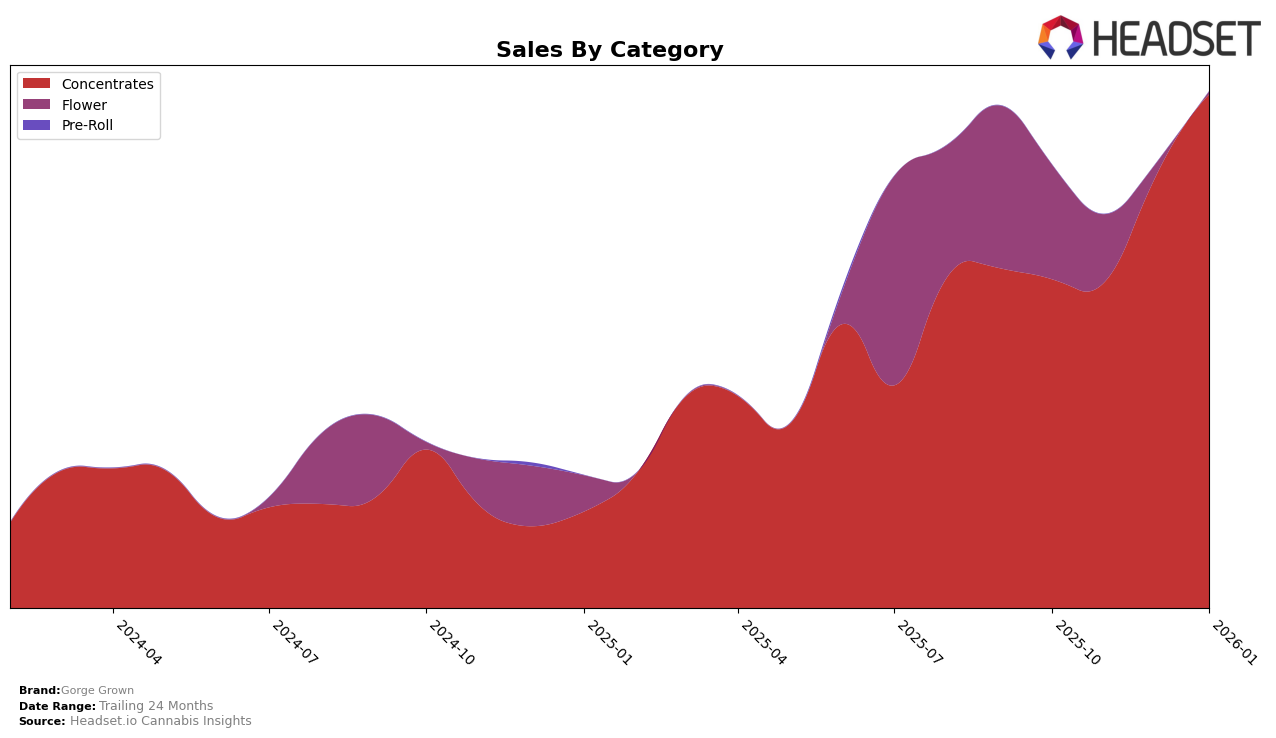

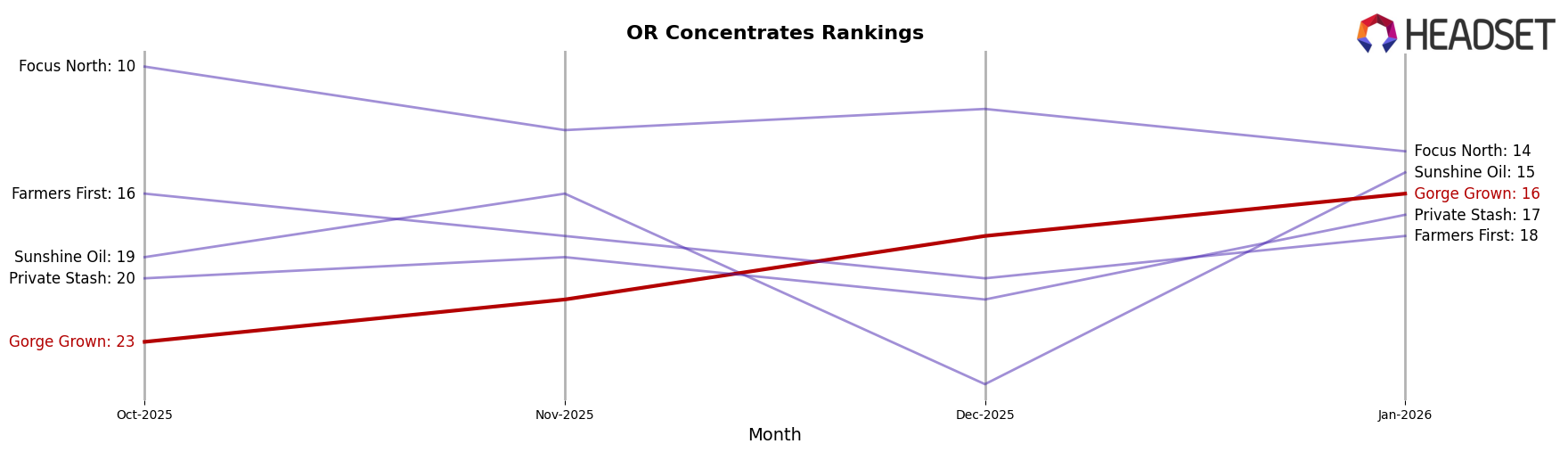

Gorge Grown has demonstrated notable progress in the Concentrates category within Oregon. Over the four-month period from October 2025 to January 2026, the brand has shown a consistent upward trajectory in its rankings, moving from 23rd place in October to 16th by January. This steady climb suggests a strengthening market presence and possibly an increase in consumer preference for Gorge Grown's products. Notably, the brand's sales in January 2026 reached a new high, indicating a positive reception in the market. However, it is important to note that Gorge Grown's absence from the top 30 in other states or categories could imply limited geographic reach or category diversity.

While Gorge Grown's performance in Oregon is commendable, the lack of data from other states highlights areas for potential growth. The absence of rankings outside Oregon suggests that the brand might currently be focusing its efforts locally, which could be a strategic decision to solidify its position before expanding further. This localized success could serve as a foundation for future growth into other states and categories, provided the brand can replicate its strategy effectively. Observing how Gorge Grown navigates this potential expansion will be crucial in understanding its long-term trajectory in the cannabis market.

Competitive Landscape

In the Oregon concentrates market, Gorge Grown has shown a promising upward trajectory in its rankings from October 2025 to January 2026. Starting from a rank of 23rd in October, Gorge Grown climbed to 16th by January, indicating a consistent improvement in market presence. This positive trend is notable when compared to competitors such as Focus North, which experienced a decline from 10th to 14th place over the same period, and Sunshine Oil, which fluctuated significantly, dropping out of the top 20 in December. Meanwhile, Private Stash and Farmers First maintained relatively stable positions, with Private Stash improving slightly from 20th to 17th. Gorge Grown's sales growth, particularly the substantial increase in December, suggests that the brand is effectively capturing market share from its competitors, positioning itself as a rising contender in the Oregon concentrates category.

Notable Products

In January 2026, the top-performing product from Gorge Grown was the Permanent Peach Pie RSO Syringe (1g), leading the sales chart in the Concentrates category. Gary's Garlic Juice Sugar Wax (1g) climbed to the second position with notable sales of 1,267 units, marking a significant rise from its third-place ranking in December 2025. GMO Sugar Wax (1g) saw a slight decline, moving to the third position after holding the second spot the previous month. Purple Churro Spritzer Sugar Wax (1g) maintained a steady fourth place from November 2025, while Into the Blue Sugar Wax (1g) entered the top five rankings for the first time. These shifts highlight a dynamic market where product positioning is subject to rapid changes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.