Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

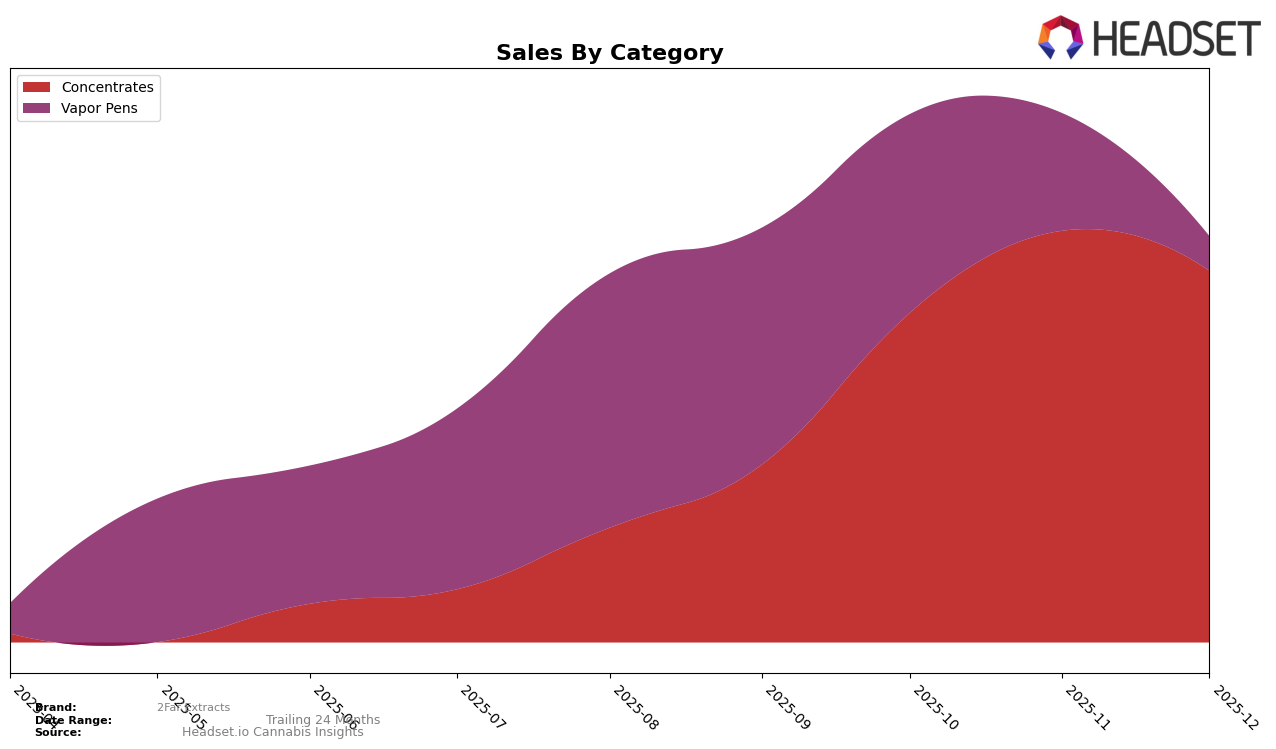

2Far Extracts has shown notable performance in the Oregon market, particularly in the Concentrates category. Over the last few months of 2025, the brand has climbed from a rank of 32 in September to a high of 17 in November, before slightly dropping to 18 in December. This upward trajectory in the Concentrates category indicates a strengthening presence and growing consumer preference for their products. The increase in ranking suggests improved market penetration and possibly an enhanced product lineup or marketing strategy that resonated well with consumers in Oregon.

Conversely, 2Far Extracts faced challenges in the Vapor Pens category within the same state. The brand's ranking fell from 44 in September to 80 by December, indicating a significant decline in market position. This drop could point to increased competition or a shift in consumer preferences away from their vapor pen offerings. The absence of a top 30 ranking in this category highlights potential areas for improvement or strategic reevaluation. Such contrasting performances across categories underscore the dynamic nature of the cannabis market in Oregon and the importance for brands like 2Far Extracts to adapt and innovate continuously.

Competitive Landscape

In the competitive landscape of the Oregon concentrates market, 2Far Extracts has demonstrated a notable upward trajectory in brand ranking from September to November 2025, moving from 32nd to 17th place, before slightly dropping to 18th in December. This upward movement is indicative of a significant increase in sales, particularly from October to November, where sales surged past competitors such as Elysium Fields, which climbed from 31st to 20th place during the same period. Meanwhile, Private Stash consistently outperformed 2Far Extracts, maintaining a higher rank and ending the year at 16th place. Despite the slight decline in December, 2Far Extracts' overall trend suggests a strengthening market position, potentially challenging established brands like Farmers First, which saw a decline from 13th to 19th place over the same period. This dynamic indicates a competitive yet promising environment for 2Far Extracts as it continues to capture market share in Oregon.

Notable Products

In December 2025, the top-performing product from 2Far Extracts was Lemon Berries Rocks n Sauce (2g) in the Concentrates category, securing the number one rank with notable sales of 708 units. Following closely was Bubblegum Sherb Rocks & Sauce (2g) in second place, while Illemonatti Rocks & Sauce (2g) and Southern Sunset Rocks & Sauce (2g) held the third and fourth positions, respectively. Pink Runtz Rocks & Sauce (2g) maintained its fifth-place rank from November 2025, showing a positive increase in sales. Compared to previous months, Lemon Berries Rocks n Sauce (2g) saw a significant rise to the top, indicating a surge in popularity. The consistent performance of Pink Runtz Rocks & Sauce (2g) highlights its steady demand in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.