Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

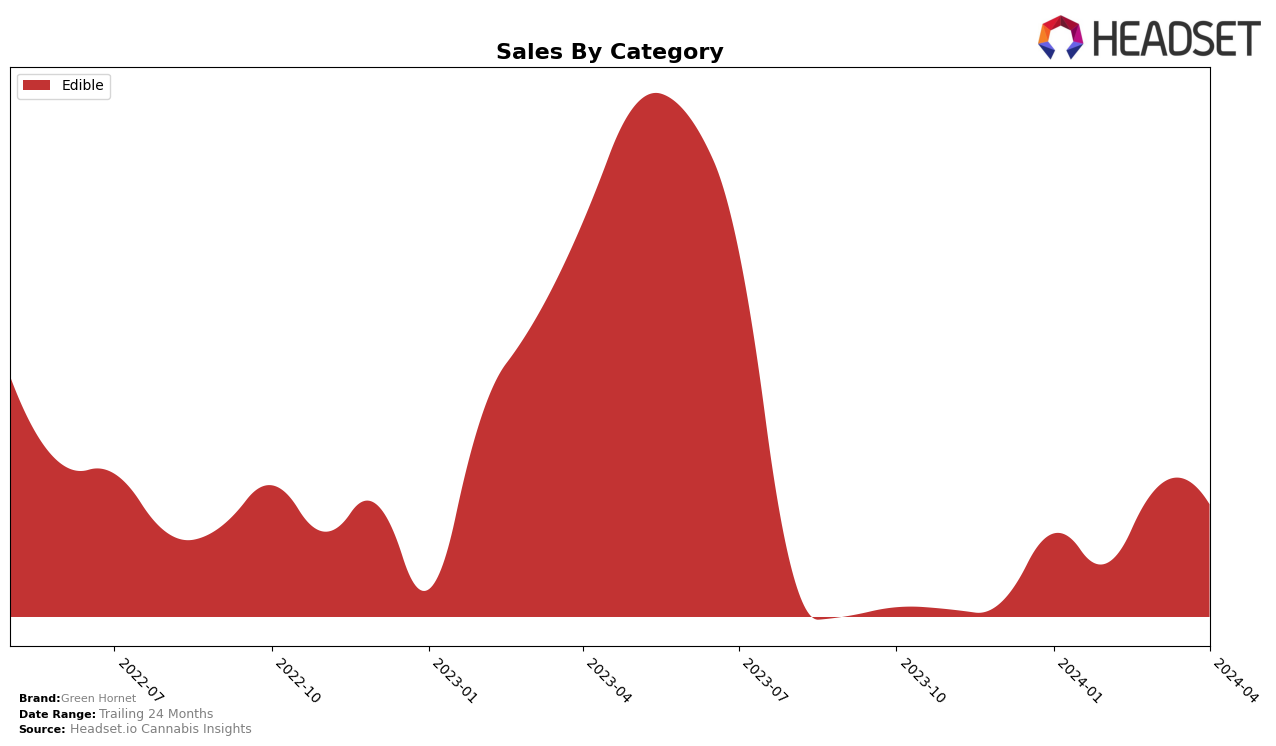

In the edible category, Green Hornet's performance has shown a notable variance across states, with particular interest in its movement within the Colorado, Massachusetts, and Missouri markets. In Colorado, the brand maintained a consistent yet fluctuating presence just outside the top 30 rankings from January to April 2024, indicating a stable demand but also room for growth. Massachusetts saw a slight decline, starting at the 30th position in January and slipping to 42nd by April, suggesting a need for strategic adjustments to counteract this downward trend. Conversely, Missouri represented a bright spot, with Green Hornet climbing from the 39th position in January to 28th by April, showcasing a significant improvement and growing consumer interest in this state.

Looking at sales figures, Missouri emerged as a standout market for Green Hornet, with sales more than doubling from January to April 2024. This dramatic increase, from 41,583 to 108,066, highlights the brand's growing popularity and effectiveness of its market strategies in the state. On the other hand, sales in Massachusetts and Colorado showed a different story, with Massachusetts experiencing a noticeable drop from 77,908 in January to 41,402 in April, and Colorado seeing a more moderate fluctuation. These trends across different states underline the importance of localized marketing strategies and the potential for Green Hornet to leverage its success in Missouri to boost its performance in other markets. The absence from the top 30 in certain months across these states indicates both challenges and opportunities for the brand to enhance its market positioning and visibility.

Competitive Landscape

In the competitive edible cannabis market of Missouri, Green Hornet has shown a notable improvement in its ranking over the first four months of 2024, moving from not being in the top 20 in January and February to 29th in March and 28th in April. This rise in rank is particularly impressive considering the sales increase it has seen, doubling from February to March and maintaining a strong performance into April. Its main competitors include Cheeba Chews, which has remained outside the top 20 but shown steady sales, and High Five, which consistently ranked higher than Green Hornet but saw a decrease in sales in April. Yum-eez and Atta also compete in the same category, with Yum-eez experiencing a slight dip in rank and sales, while Atta saw a significant sales peak in March but dropped in rank by April. Green Hornet's upward trend in both sales and rank, amidst fluctuating performances from its competitors, suggests a growing consumer preference for their products in the Missouri edible cannabis market.

Notable Products

In April 2024, Green Hornet's top-performing product was the CBG/CBD/THC 1:1:1 Trifecta Mixed Fruit Gummies 10-Pack, which achieved the number one rank with sales reaching 1166 units. Following closely behind in second place was the THC/CBN 2:1 Goodnight Grape Gummies 10-Pack, previously the top product in March but experiencing a slight dip in its ranking. The Hybrid Sours Mixed Fruit Gummies 10-Pack secured the third position, marking a significant climb from its fifth-place standing in March. The THC/THCV 2:1 Mandarin Orange Charged Energy Gummies and the Indica Blue Raspberry Gummies rounded out the top five, both making their first appearance in the rankings for April. This shift in rankings highlights a dynamic change in consumer preferences within Green Hornet's edible category, indicating a growing interest in diverse cannabinoid profiles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.