Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

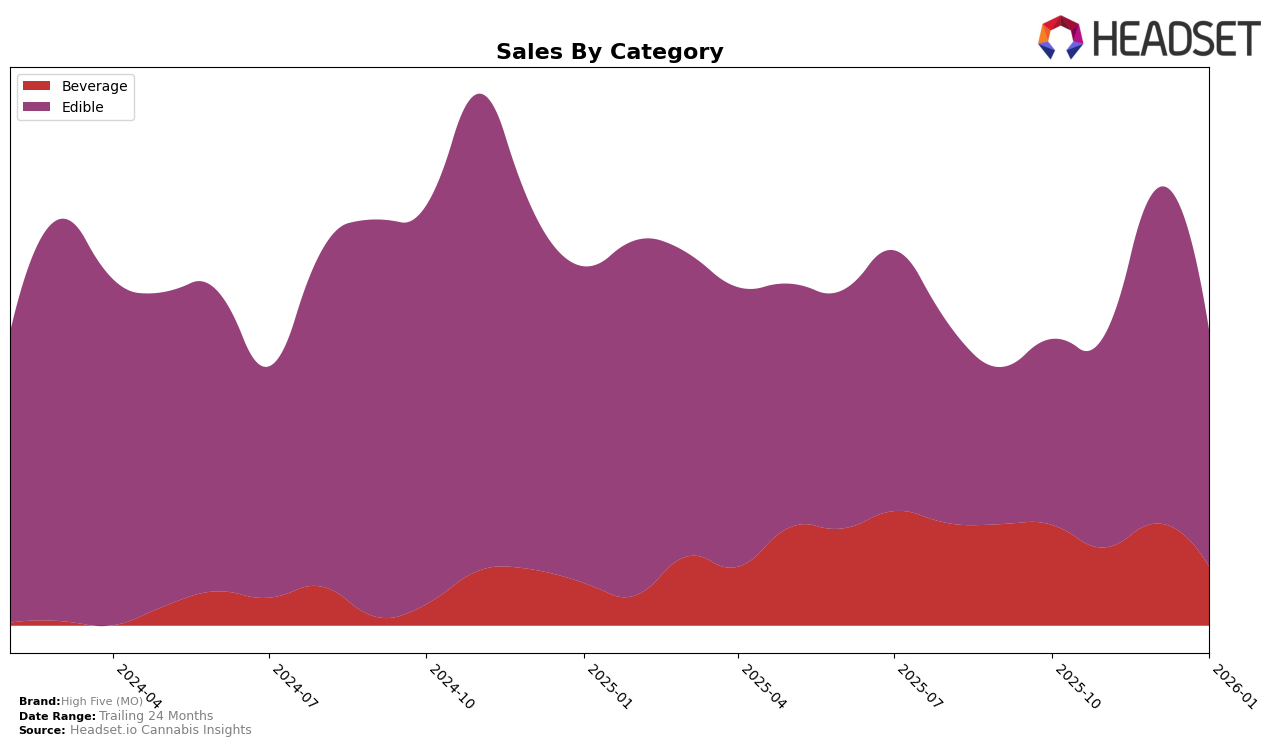

High Five (MO) has demonstrated a dynamic performance across different categories and states. In the beverage category in Missouri, the brand maintained a strong presence, with rankings fluctuating between 4th and 7th place from October 2025 to January 2026. This indicates a consistent demand and competitive positioning within the beverage market, although a dip in sales in January suggests potential challenges or seasonal variations. The brand's ability to rebound to 4th place in December showcases resilience and effective market strategies, despite the lower sales figures compared to October.

In contrast, High Five (MO) faced challenges in the edible category in Missouri, where it struggled to break into the top 30 rankings consistently. The brand managed to secure the 29th position in December 2025, marking a brief entry into the higher ranks, but it was unable to sustain this momentum, dropping back to 33rd in January. Despite this, there was a noticeable spike in sales in December, suggesting a temporary surge in popularity or a successful promotional campaign. The fluctuation in rankings and sales highlights the competitive nature of the edible market and the need for strategic adjustments to improve standing and sales consistency.

Competitive Landscape

In the Missouri edible cannabis market, High Five (MO) has experienced notable fluctuations in its rank and sales over the past few months. In December 2025, High Five (MO) achieved its highest rank at 29, correlating with a significant sales spike. However, by January 2026, its rank slipped to 33, indicating a potential challenge in maintaining its competitive edge. In comparison, Flav also saw a decline in rank from 26 in October 2025 to 31 in January 2026, despite having higher sales figures than High Five (MO) throughout the period. Meanwhile, Cheeba Chews maintained a consistent rank at 32, with a steady increase in sales, suggesting a stable market presence. Elevate entered the top 20 in November 2025 and maintained a close rank to High Five (MO), indicating emerging competition. These dynamics highlight the competitive pressures High Five (MO) faces in sustaining its market position amidst fluctuating ranks and sales trends.

Notable Products

In January 2026, High Five (MO) saw the THC/CBN 1:1 Sweet Dark Cherry Gummies 20-Pack remain at the top of the sales rankings, holding its first-place position from December with sales of 847 units. The Stiribles- Unflavorable Pure Dissolvable Powder 20-Pack maintained its second-place ranking, despite a decrease in sales figures from the previous month. The CBG/THC 3:1 Citrus Punch Gummies 20-Pack continued to rank third, consistent with its position in December. Notably, the Huckleberry Lemonade Gummies 20-Pack entered the rankings for the first time in January, securing the fourth position. The CBD/THC 1:1 Sweet Blood Orange Gummies 20-Pack slipped to fifth, showing a decline from its previous fourth-place ranking in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.