Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

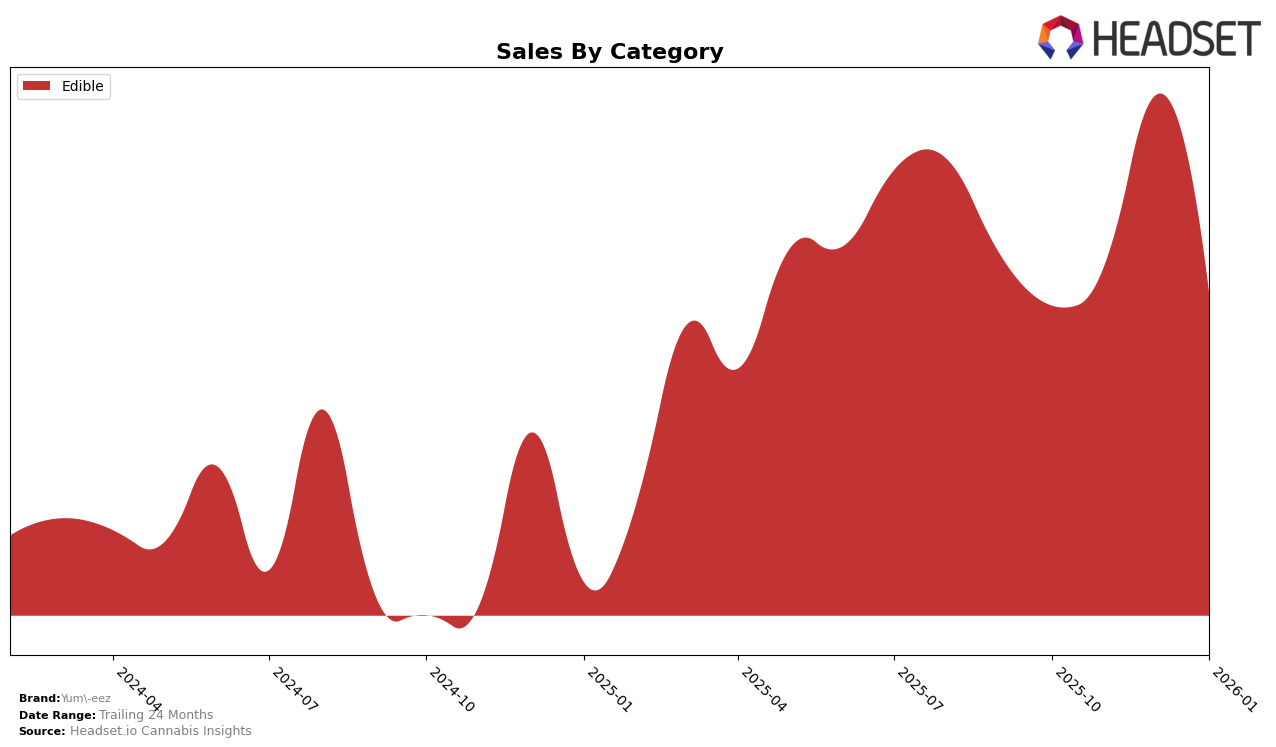

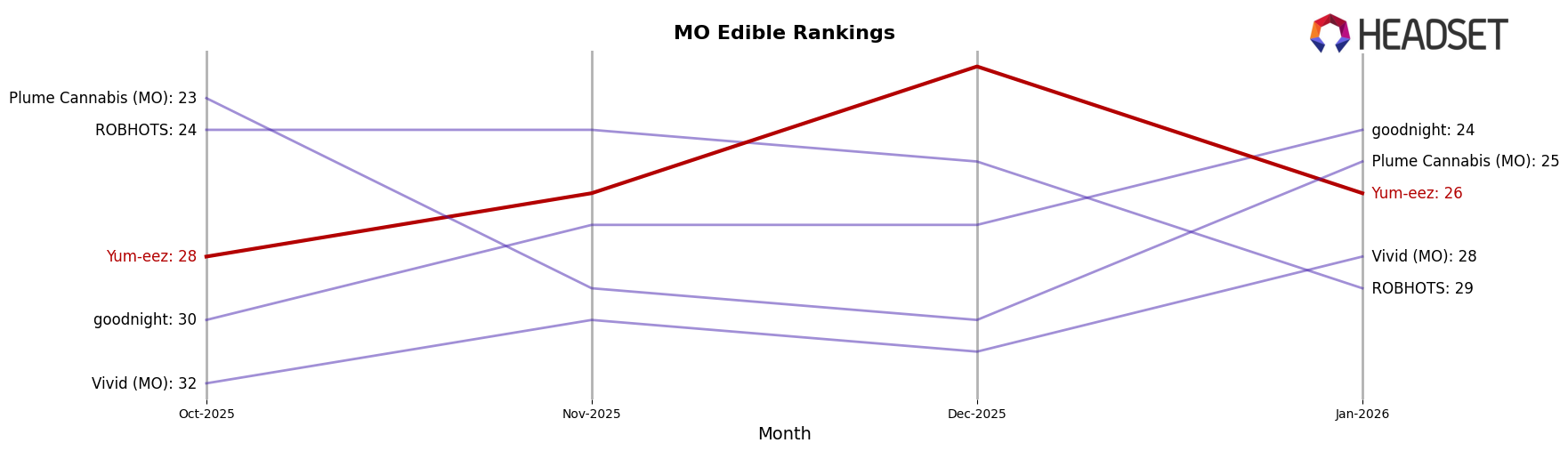

Yum-eez, a notable player in the cannabis edible market, has demonstrated fluctuating performance across different states and categories. In Missouri, the brand has seen a varied ranking in the edible category. Starting at the 28th position in October 2025, Yum-eez improved to 26th in November and further climbed to 22nd in December, before descending back to 26th in January 2026. This fluctuation indicates a competitive landscape in Missouri, where Yum-eez managed to make significant gains in December, likely due to increased consumer demand or successful marketing strategies during the holiday season. However, the drop in January suggests challenges in maintaining momentum, which could be due to increased competition or market saturation.

While Yum-eez has managed to maintain a presence in the top 30 edible brands in Missouri, their absence from the top 30 in other states or provinces could signal a need for strategic expansion or increased market penetration efforts outside of Missouri. The sales figures in Missouri reflect a peak in December 2025, with sales reaching nearly $200,000, before declining in January 2026. This trend could suggest a seasonal pattern or the impact of promotional activities, highlighting the importance of timing and consumer behavior in the cannabis market. Overall, Yum-eez's performance indicates both opportunities for growth and areas requiring strategic adjustments to enhance their market position across different regions.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Missouri, Yum-eez has demonstrated notable fluctuations in its rankings and sales over the past few months. From October 2025 to January 2026, Yum-eez improved its rank from 28th to 22nd in December, although it slipped back to 26th by January. This indicates a temporary surge in popularity, possibly due to seasonal promotions or product launches, but also highlights the volatility in consumer preferences. In comparison, ROBHOTS consistently maintained a higher rank than Yum-eez, although it experienced a downward trend, dropping from 24th to 29th, which suggests potential challenges in maintaining its market position. Meanwhile, goodnight showed a steady improvement, climbing from 30th to 24th, and Plume Cannabis (MO) also improved its rank from 30th to 25th, indicating a competitive edge over Yum-eez in the latest month. Despite these challenges, Yum-eez's sales peaked in December, surpassing its competitors, which may signal strong brand loyalty or successful marketing strategies during that period. This dynamic environment underscores the importance for Yum-eez to continually innovate and adapt to maintain and improve its market position.

Notable Products

In January 2026, the top-performing product for Yum-eez was Sativa Mango Gummies 10-Pack (300mg), maintaining its number one rank from December 2025 with sales of 1,094 units. Hybrid Blackberry Gummies 10-Pack (300mg) secured the second position, marking its debut in the rankings. Indica Pineapple Gummies 10-Pack (300mg) followed closely in third place, also appearing for the first time in the rankings. Hybrid Sour Cran Raspberry Gummies 10-Pack (250mg) and Indica Pineapple Gummies 10-Pack (120mg) ranked fourth and fifth, respectively, both entering the rankings in January. The consistent performance of Sativa Mango Gummies highlights its popularity, while other products have newly emerged as top contenders.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.