Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

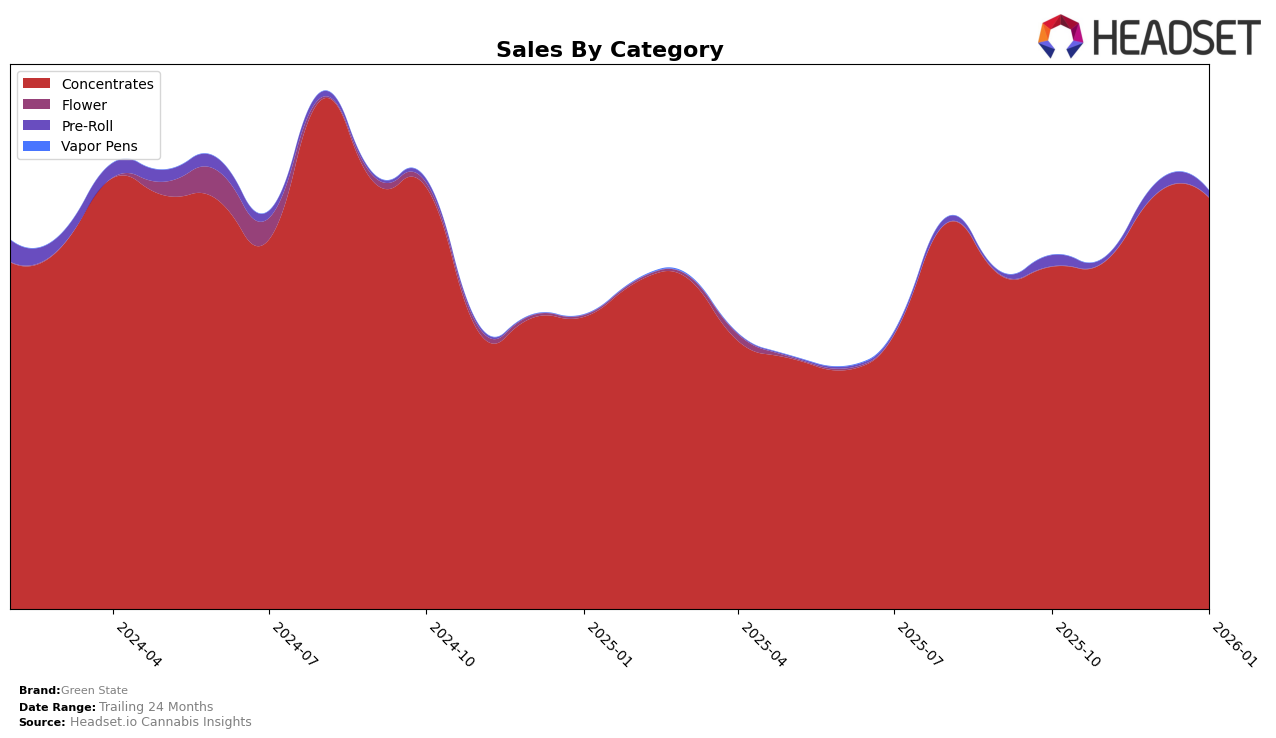

Green State's performance in the concentrates category within Washington has shown notable improvement over the past few months. While they were initially ranked 35th in October 2025, they climbed to the 27th position by December 2025, maintaining that rank into January 2026. This upward trajectory is indicative of a strengthening market presence, likely driven by strategic initiatives or product enhancements that resonated well with consumers. The increase in sales from $66,131 in October to $80,146 in December further underscores their growing appeal in this category.

Despite the progress in Washington, Green State's absence from the top 30 brands in other states or provinces suggests potential areas for growth and expansion. Being outside the top 30 can be seen as a challenge, highlighting opportunities for the brand to enhance its market strategies and product offerings in those regions. This disparity in performance across different markets could be influenced by varying consumer preferences or competitive pressures, offering Green State valuable insights into tailoring their approach to capture a more significant share in these areas.

Competitive Landscape

In the Washington concentrates market, Green State has shown a notable improvement in its rank from October 2025 to January 2026, moving from 35th to 27th position. This upward trend is indicative of a positive shift in sales performance, with sales peaking in December 2025. In contrast, Fire Bros. experienced fluctuations, dropping out of the top 20 in November and December before recovering to 25th in January. Similarly, Lifted Cannabis Co saw a decline in rank, reaching 29th in January, while Method showed a slight improvement, ending at 28th. Notably, Buddies re-entered the rankings in January at 26th, suggesting a resurgence. These dynamics highlight Green State's competitive edge and potential for continued growth in the concentrates category.

Notable Products

In January 2026, the top-performing product for Green State was Creamy Push Pop Rosin (1g) in the Concentrates category, achieving the highest sales rank at number 1 with a notable sales figure of 754 units. Jabba OG Hash Rosin (1g) rose to the second position from fourth in December 2025, showing a significant increase in popularity. Garlic Cookies Hash Rosin (1g) secured the third spot, entering the top rankings for the first time. Tangie Cookies Hash Rosin (1g), which was the leader in December, dropped to fourth place, indicating a shift in consumer preference. Apples & Bananas Hash Rosin (1g) maintained a steady presence, ranking fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.