Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

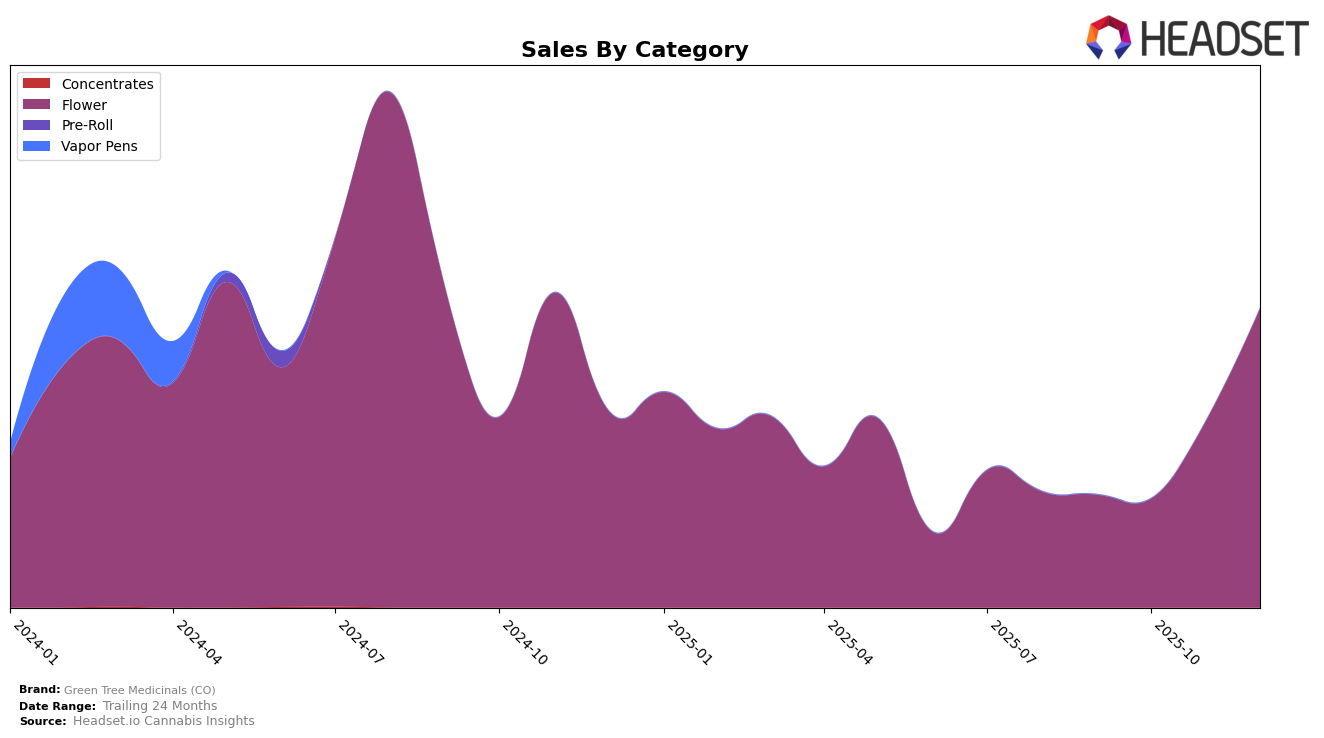

Green Tree Medicinals (CO) has shown a notable upward trajectory in the Flower category within the state of Colorado. Starting from a rank of 50 in September 2025, the brand has impressively climbed to 17 by December 2025. This significant movement indicates a strong market presence and growing consumer preference. The December sales figures, which are markedly higher than those in September, further underscore this growth. The brand's ability to break into the top 30 by November and then continue to ascend suggests effective market strategies and product appeal.

It's important to note that while Green Tree Medicinals (CO) has made substantial gains in Colorado, the absence of its ranking in other states or provinces in the top 30 list implies limited or less competitive performance outside Colorado. This could be interpreted as a potential area for growth and expansion. The brand's focused success in Colorado could serve as a model for entering other markets, but the current data suggests that its influence remains concentrated. Observers might find it worthwhile to watch how Green Tree Medicinals (CO) leverages its Colorado success to potentially enhance its presence in other regions.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Green Tree Medicinals (CO) has demonstrated a significant upward trajectory in its market position over the last few months of 2025. Starting from a rank of 50 in September, Green Tree Medicinals (CO) climbed to 17 by December, indicating a notable improvement in market presence. This ascent is particularly impressive when compared to competitors like LEIFFA, which, despite a strong showing in November with a rank of 16, fell to 19 in December. Meanwhile, The Original Jack Herer maintained a consistent performance, ranking at 16 in both October and December. Silver Lake, which started strong at rank 5 in September, experienced a decline to 15 by December, suggesting a potential shift in consumer preferences. Additionally, Host showed a positive trend, improving from rank 31 in October to 18 in December. These dynamics highlight Green Tree Medicinals (CO)'s ability to capture market share effectively, positioning it as a rising contender in the Colorado Flower market.

Notable Products

In December 2025, Green Tree Medicinals (CO) saw Peace Maker (Bulk) rise to the top position, achieving the highest sales figure of $1,849. A1 Stank Sauce (Bulk) maintained a strong second place with notable sales of $1,487, showcasing consistency from its previous second-place ranking in October. Durban Poison (Bulk) emerged in the third spot, marking its first appearance in the top ranks with sales of $1,348. Orange Chicken (Bulk) entered the rankings in fourth place, contributing $1,105 in sales. Starfire Cream (Bulk) experienced a drop to fifth place from its previous third-place ranking in October, indicating a slight decline in its market performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.