Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

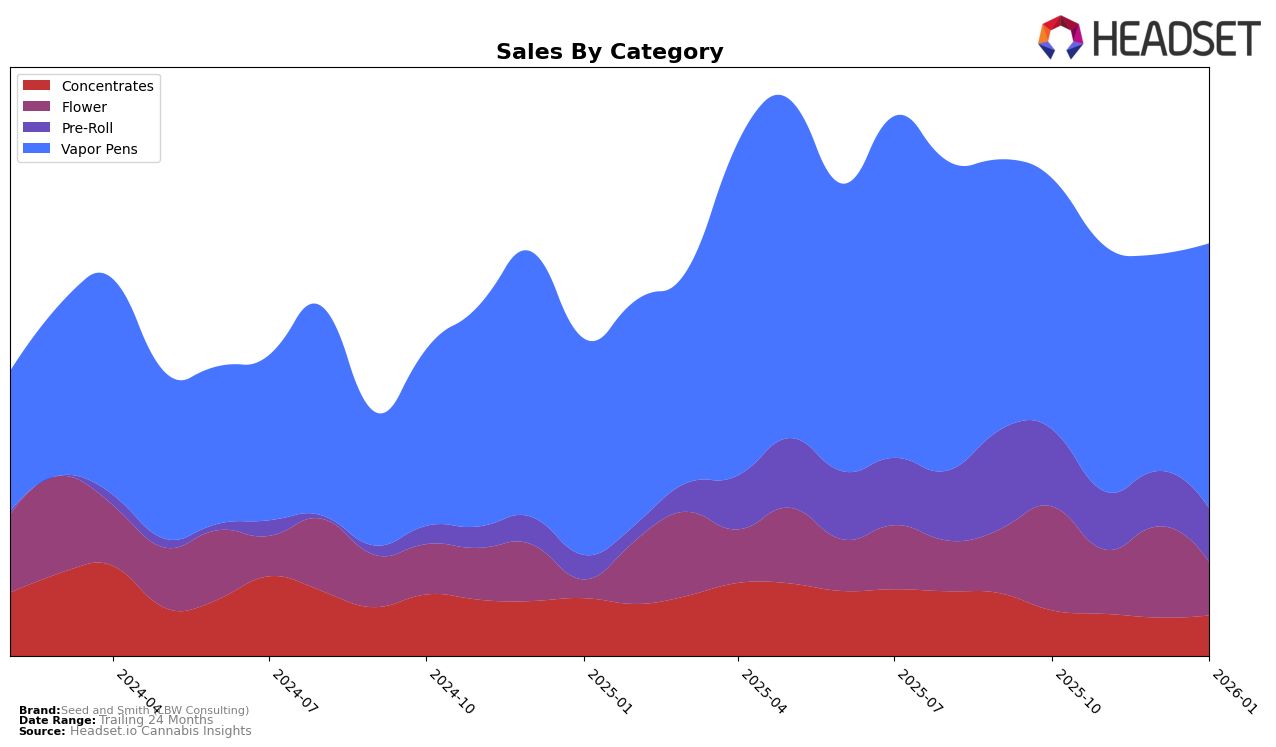

In the competitive cannabis market of Colorado, Seed and Smith (LBW Consulting) has shown varied performance across different product categories. In the Concentrates category, the brand maintained a steady presence, consistently ranking between 27th and 28th over the past four months, indicating a stable position within the top 30. However, the Flower category tells a different story, where the brand's ranking fluctuated significantly, dropping from 42nd to 55th in November and then returning to 54th in January. This variability suggests challenges in retaining a consistent market share in the Flower category, possibly due to shifting consumer preferences or increased competition.

On a more positive note, Seed and Smith (LBW Consulting) experienced notable success in the Vapor Pens category in Colorado. The brand improved its ranking from 20th in December to 14th in January, reflecting a strong upward trend. This improvement is underscored by a significant increase in sales in January, indicating growing consumer demand for their vapor pen products. In contrast, the Pre-Roll category saw a dip in rankings from 18th in October to 26th in December, before recovering slightly to 23rd in January. This fluctuation suggests that while there is potential in the Pre-Roll market, the brand may need to strategize to stabilize and improve its position further.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Seed and Smith (LBW Consulting) has demonstrated notable fluctuations in rank and sales over the past few months. As of January 2026, Seed and Smith climbed to 14th place, a significant improvement from its 20th position in December 2025. This upward trend suggests a recovery in sales, which reached $519,870 in January 2026, surpassing its December figures. In contrast, O.penVape experienced a consistent decline in rank, dropping from 8th in October 2025 to 16th in January 2026, indicating a downward sales trajectory. Meanwhile, Olio maintained a relatively stable position, consistently ranking around the 10th to 12th spots, which reflects steady sales performance. Sauce Essentials showed a volatile pattern, peaking at 11th in December 2025 but slightly declining to 13th by January 2026. These dynamics highlight the competitive pressures Seed and Smith faces, yet its recent rank improvement suggests effective strategies may be at play to capture market share in the Colorado vapor pen category.

Notable Products

In January 2026, Seed and Smith (LBW Consulting) saw Alien Octane (Bulk) from the Flower category take the top spot, moving up from its third position in December 2025, with notable sales of $3649. The Orange Spark Live Resin Cartridge (1g) in the Vapor Pens category secured the second rank, making its debut in the rankings. Mac Stax (14g) and Space Force (3.5g), both from the Flower category, ranked third and fourth respectively, with Mac Stax entering the rankings for the first time. Apricot Scone Live Resin Cartridge (1g) rounded out the top five, marking its first appearance in the rankings. This shift in rankings highlights a strong performance in both the Flower and Vapor Pens categories for Seed and Smith (LBW Consulting) in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.