Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

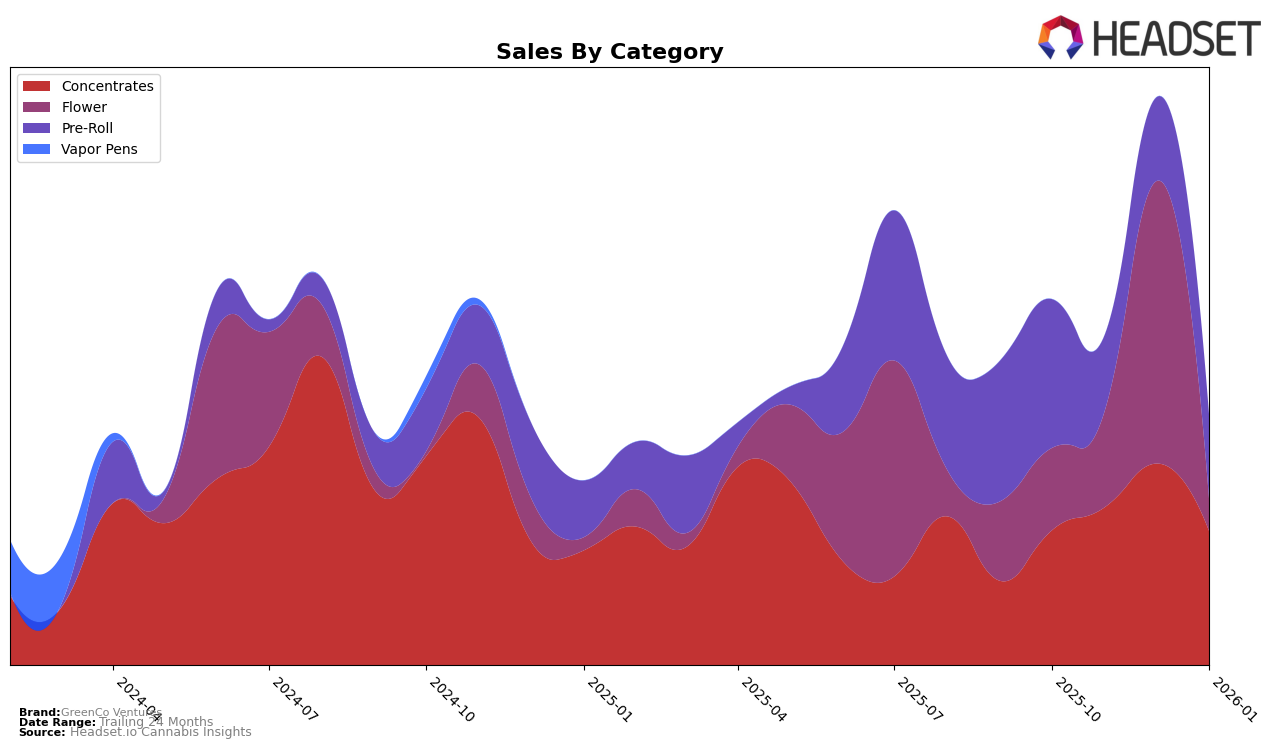

GreenCo Ventures has shown varied performance across different product categories in Michigan. In the Concentrates category, the brand exhibited a fluctuating rank, starting at 19th in October 2025 and peaking at 15th in December before dropping to 23rd by January 2026. This indicates that while there was a positive trend towards the end of 2025, the brand faced challenges maintaining its position in the new year. On the other hand, their presence in the Flower category was not as prominent, as they were not ranked in the top 30 until January 2026, when they appeared at 83rd place. This suggests a late entry or resurgence in this category, which could be a point of focus for potential growth in the future.

In the Pre-Roll category, GreenCo Ventures experienced a significant drop in their ranking from 59th in October 2025 to 92nd in November and December, before recovering slightly to 76th in January 2026. This decline and partial recovery highlight the competitive nature of the Pre-Roll market in Michigan, where maintaining a stable ranking can be challenging. Despite these fluctuations, the brand's sales figures in the Concentrates category saw a notable increase in December 2025, suggesting that while rankings shifted, there was still a strong consumer demand for their products. This complex performance pattern across categories and months provides insights into the areas where GreenCo Ventures may need to strategize for more consistent growth.

Competitive Landscape

In the competitive landscape of the Michigan concentrates market, GreenCo Ventures has experienced notable fluctuations in its ranking and sales over the past few months. Starting from October 2025, GreenCo Ventures was ranked 19th, climbing to 15th by December 2025, before dropping to 23rd in January 2026. Despite this recent dip, GreenCo Ventures demonstrated a strong sales performance, peaking in December 2025. This fluctuation in rank can be attributed to the dynamic movements of competitors such as Anarchy Extracts, which consistently maintained a close ranking, and Bowhouse, which showed a steady improvement, surpassing GreenCo Ventures in January 2026. Meanwhile, Peachy Hash & Co. also improved its position, indicating a competitive push in the market. The resurgence of LOCO in January 2026, jumping to 25th from a lower rank, further underscores the competitive pressures GreenCo Ventures faces. These dynamics highlight the importance for GreenCo Ventures to strategize effectively to regain its upward trajectory in this competitive market.

Notable Products

In January 2026, the top-performing product for GreenCo Ventures was the Durban Poison x Trop Cherry Pre-Roll (1g), which climbed to the number one rank with sales of 6,995 units. The Biscotti Pre-Roll (1g) followed closely, slipping from its previous month's top position to second place. The Pink Grapes Infused Pre-Roll (1g) debuted impressively at third place. Grape Cream Cake Infused Pre-Roll (1g) maintained a consistent presence, ranking fourth, while Blue Cherry Dream Pre-Roll (1g) held steady at fifth place. Notably, the Durban Poison x Trop Cherry Pre-Roll (1g) showed significant growth, ascending from the second position in December to lead the sales in January.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.