Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

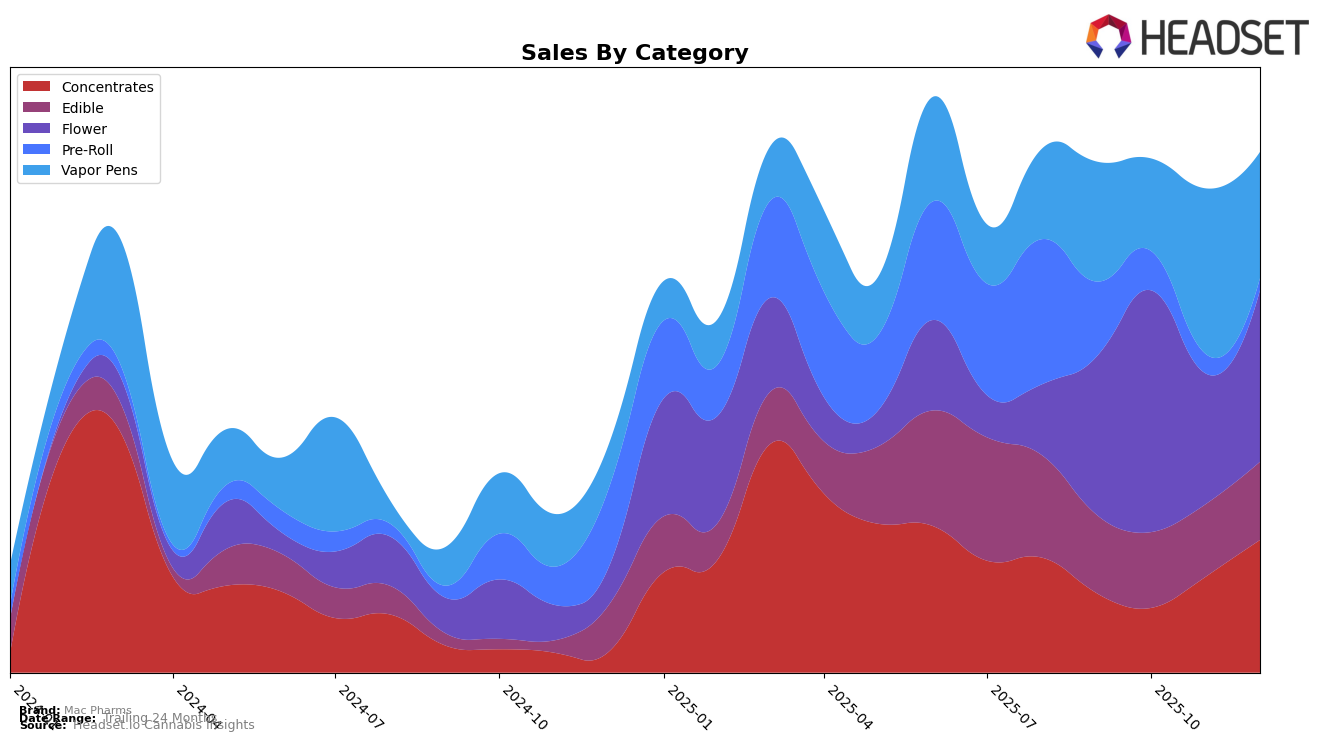

Mac Pharms has shown a notable performance trajectory in the Michigan market, particularly within the Concentrates category. After a dip in October 2025, where the brand fell to 34th place, Mac Pharms made a significant recovery by December 2025, climbing to the 20th position. This upward movement is supported by a steady increase in sales, which nearly doubled from October to December. In contrast, the brand's performance in the Edible category has been less dynamic, consistently hovering around the 46th to 49th positions, indicating a more stable but less competitive stance in this segment.

In other categories, Mac Pharms' presence has been more sporadic. For instance, while they were ranked 75th in the Flower category in October 2025, they fell out of the top 30 in other months, suggesting challenges in maintaining a competitive edge. Similarly, in the Pre-Roll category, their absence from the rankings after September 2025 highlights potential difficulties in sustaining market presence. However, the Vapor Pens category tells a different story, with Mac Pharms making a remarkable leap from 60th place in October to 36th in November, before settling at 46th in December. This fluctuation suggests a volatile yet promising potential for growth in this segment.

Competitive Landscape

In the competitive landscape of Michigan's flower category, Mac Pharms has experienced notable fluctuations in its market positioning. As of December 2025, Mac Pharms ranked 93rd, a decline from its 75th position in October 2025, indicating a downward trend in its market presence. This shift is significant when compared to competitors like Sapphire Farms, which showed a similar decline, moving from an unranked position to 37th in November and then dropping to 86th by December. Meanwhile, GreenCo Ventures entered the top 100 at 79th in December, suggesting a potential rise in competition. These dynamics highlight the competitive pressures Mac Pharms faces, emphasizing the need for strategic adjustments to regain its standing and drive sales growth in this evolving market.

Notable Products

In December 2025, Mac Pharms' top-performing product was Lush Pineapple Gummies 4-Pack (200mg), which reclaimed its number one position with a sales figure of 11,376 units. Berry Nana Gummies 4-Pack (200mg) closely followed, securing the second spot, having dropped from the top position in November. Orange Burst Gummies 4-Pack (200mg) consistently held the third rank, maintaining its presence in the top three since September. Sour Apple Gummies 5-Pack (200mg) remained steady at fourth place, despite fluctuations in its sales figures over the months. Notably, Snow Ballz Cured Resin (1g) emerged as a new entry in the top five, ranking fifth in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.